Dr Carole Nakhle

GIS’s new “Dossier” series aims to give readers a quick overview of the analysis of key topics, regions or conflicts. This edition looks at oil and gas – specifically, at the trends that are having an impact on this all-important sector, and at how these commodities affect the relations between global and regional players. It is based on a selection of reports by Dr Carole Nakhle and others.

Perhaps more than any other commodities, oil and gas play a crucial role in global geopolitics. Wars are fought over these resources, and their prices – a key determinant in the cost of energy – are an ever-present source of tension. Over the past decade, technological advances have led to a revolution in extracting oil and gas from shale, transforming the industry and turning importers into exporters.

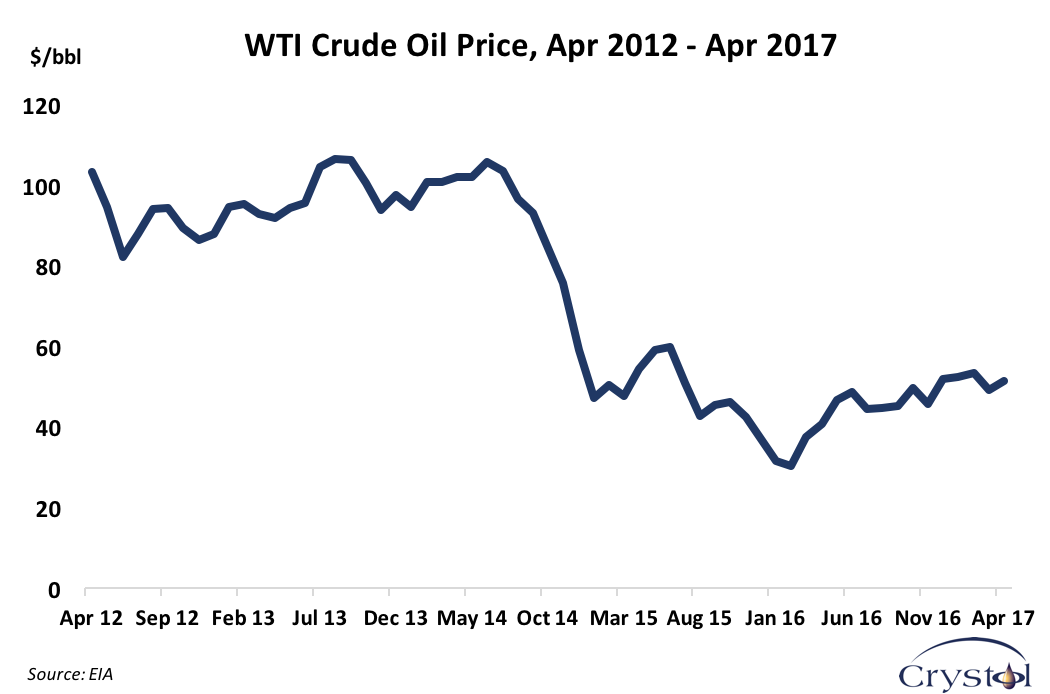

At the same time, the precipitous drop in oil prices that occurred in 2014 and has abated only somewhat since is reshaping the role of the Organization of the Petroleum Exporting Countries (OPEC) and its influence on geopolitics.

Threats presented by climate change have spurred many governments to act to reduce carbon emissions – and therefore the consumption of fossil fuels. But the alternatives are expensive and carry their own significant risks. Oil and gas are forecast to remain dominant parts of the world’s energy mix for decades to come.

1. Diminished OPEC

OPEC, which only a few decades ago seemed an all-powerful force in setting oil prices, is losing influence. GIS energy expert Dr. Carole Nakhle examined this trend back in 2011. At the time, prices hardly moved after the cartel decided to increase output, because many members had already been flouting production targets. Members’ diverging interests, both economic and political, make it difficult for OPEC to take concerted action.

Regional rivals Saudi Arabia and Iran, for example, frequently disagree on production quotas. This was on full display in 2012, when oil prices dropped to under $100 per barrel. Tehran, reeling from sanctions and limited access to the market, wanted to freeze output. Riyadh was worried about the impact of high prices on its customers and had signaled its willingness to increase production to make up for reduced Iranian supplies.

By 2016, after a steep drop in oil prices and a failed price war with shale oil producers in the U.S., Saudi Arabia was ready to agree to a production freeze. But with sanctions having been lifted earlier that year, Iran’s position had also reversed. At an informal meeting in Algiers, OPEC finally agreed to cut production. But keeping members in line remains a tall order. As Dr. Nakhle correctly predicted, Iran was exempted from the cuts. Iraq has since announced that it will boost output and Indonesia suspended its membership because it did not want to adhere to the deal.

2. American rise

Another reason the cartel’s impact is waning is the rise of non-OPEC producers, especially the United States and its shale oil companies. The surge in American oil production is transforming the global market, with the U.S. set to become the world’s biggest oil producer by 2020. Dr. Nakhle set out two scenarios in early 2013: either OPEC would cut production to neutralize the additional supply, or it would not, leading to a drop in prices to below $80 per barrel.

As it turned out, the latter came to pass, with oil prices falling sharply in late 2014. The collapse in oil prices was expected to push many American shale oil firms, with their costly drilling processes, out of the market. But as GIS expert Dr. Frank Umbach pointed out, increased efficiency and improving technology have kept them in the game.

3. The shale revolution

Shale extraction technologies have not only revolutionized the oil market, but have had a profound effect on the global natural gas market as well. The U.S. has gone from an importer to an exporter of natural gas, and the new supply has accelerated the delinking of oil and gas prices. As prices have dropped, power-generation companies in the U.S. have switched from coal to natural gas – a major contributing factor to declining demand for coal there. By 2020, the U.S. could be the world’s third-largest LNG exporter, and in a March 2017 report Dr. Stephen Blank showed how this would drive down prices in both Asia and Europe. In fact, the huge amount of American natural gas flooding global markets could even start a gas-price war in Europe, wrote Dr. Umbach.

Taking all this into account, Dr. Nakhle explained in a February 2017 report that it is shale extraction, not generation from renewable sources such as solar and wind, that is proving to be the real disruptive technology in the energy market. The effect of renewable energy, she said, will be felt in the longer term, while shale technology will alter the market in the short-to-medium term.

4. Iraq: the wild card

As mentioned above, Iraq recently decided to increase oil production, despite originally agreeing to adhere to OPEC’s deal late last year to limit output. The pendulum swing makes clear the difficult choice that Iraq has before it. The country sits on the world’s fifth-largest proven oil reserves. Its economy has been devastated by years of war, and it depends on oil for money to rebuild and pay for essential government services. Since the first Gulf War in 1990, it has not been subject to OPEC’s quota system, and has steadily increased output. In 2015, its oil production surged by 23 percent. However, output has not come close to reaching the 12 million barrels per day by 2017 that the government had aimed to achieve in 2011 – a goal Dr. Nakhle pointed out that few believed was realistic. It currently produces about 4.5 million barrels per day.

Yet low oil prices have given Baghdad reason to favor OPEC’s production cuts, and even to join them. “In the longer term, Iraq may face strong economic incentives to rejoin some form of OPEC quota arrangement”, predicted Dr. Nakhle in 2011. As always, though, the devil is in the details: Iraq insists on using its own production figures as a baseline for potential cuts, rather than those reported by third parties such as the International Energy Agency (IEA). Its own figures are far higher and using them would leave it with more oil to produce and sell after the cuts are implemented. For now, Iraq seems to have chosen maximizing production over maximizing prices.

5. The Iran factor

In terms of market share, Iraq’s gain has been Iran’s loss. Between 2011 and 2015, Iraq picked up most of the business Iran’s energy sector lost due to international sanctions. In fact, during this period, Iraq’s oil production exceeded Iran’s for the first time in almost two decades.

Dr. Nakhle predicted this state of affairs ahead of a wave of new sanctions on the country in 2012, saying “[Iran’s] position is threatened by the reemergence of Iraq as a potentially major OPEC oil producer”. She pointed out that Iran was taking some measures to lessen the effects, including threatening to close the Strait of Hormuz to create uncertainty and keep prices high. However, she said, “while Iran may seem to be thriving in the current situation where oil prices are high, in the longer term, its oil industry and economy will suffer most”.

The Iran nuclear deal that was agreed in the summer of 2015 to lift sanctions offered the possibility of tremendous investment opportunities – especially since Iran’s oil and gas industries are both underdeveloped. However, an immediate flood of Iranian oil and gas into the market did not materialize, nor was there a huge wave of investors clamoring to get into the country – as Dr. Nakhle had predicted a year before the deal was concluded, and again just after it was announced.

However, Iran has now managed to bring production back to above pre-sanction levels (about 3.8 million barrels per day), putting into question how long it will be exempt from OPEC production cuts.

6. Saudi reform

At the center of all these trends is Saudi Arabia, the world’s largest oil producer and the leading voice in OPEC. The Saudis have had to grapple with increasingly complex problems – from managing the interests of various OPEC members and fending off the rise of American shale-oil producers, to satisfying exploding demand for energy from its domestic market. In 2012, Dr. Nakhle pointed out that an inability to meet demand for natural gas had led Saudi Arabia to divert much of its oil to the power sector instead of selling it on global markets.

At the center of all these trends is Saudi Arabia, the world’s largest oil producer and the leading voice in OPEC. The Saudis have had to grapple with increasingly complex problems – from managing the interests of various OPEC members and fending off the rise of American shale-oil producers, to satisfying exploding demand for energy from its domestic market. In 2012, Dr. Nakhle pointed out that an inability to meet demand for natural gas had led Saudi Arabia to divert much of its oil to the power sector instead of selling it on global markets.

In April 2016, the kingdom launched an economic reform plan to meet goals such as balancing the budget, creating jobs, reducing subsidies, diversifying the economy and developing the private sector. The most striking proposal was for an initial public offering of Saudi Aramco, the national oil company. Estimates for its valuation have ranged from $400 billion to $2 trillion.

Analysts have long argued that the country needs to reduce its dependence on the oil industry. However, “[e]xperience shows that such reformist ambitions tend to resonate strongly during periods of low oil prices, before their urgency fades away when oil prices increase”, wrote Dr. Nakhle. “This time, however, Saudi Arabia seems more determined than ever to carry out a landmark transition, and the whole world is watching”.

7. Sovereign wealth funds

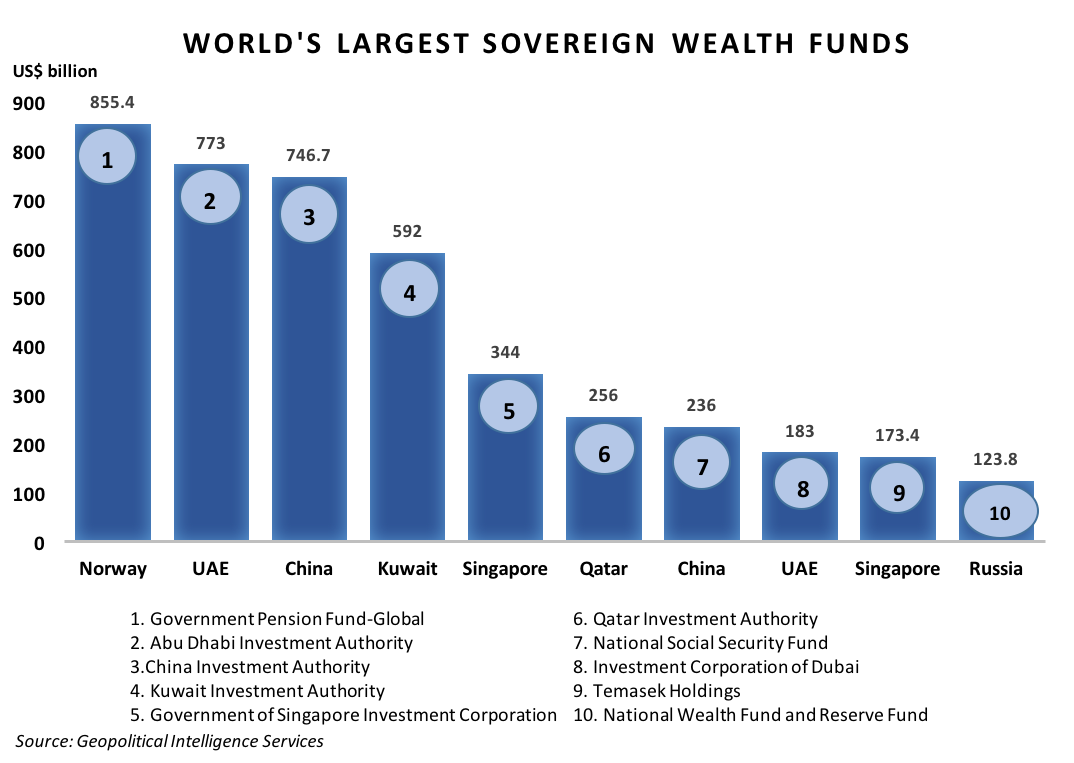

Another element of Riyadh’s economic reform plan was the transformation of the Saudi Public Investment Fund (PIF), which until recently had largely acted as a holding fund, into a more traditional sovereign wealth fund (SWF) that would invest oil income for future generations. The plan will increase PIF’s holdings to some $2 trillion, more than double those of Norway’s $922 billion Government Pension Fund Global (GPFG), currently the world’s largest.

With oil prices low and governments realizing the long-term threat to the cash cow from climate change mitigation policies, using such funds to save for the future has acquired new urgency. When SWFs are properly managed, they can create wealth that will remain with a country long after oil’s importance to its economy fades. “That may be the only way for these commodity exporters to preserve a future role in global affairs”, Dr. Nakhle predicted.

8. North Sea resilience

In the North Sea, oil and gas output has peaked and the remaining reserves are either smaller and/or more technically challenging than those developed in the past. But predictions of its demise have proven premature. After a decade of declining production, output for both commodities ticked up in 2015, despite low prices.

Dr. Nakhle predicted this phenomenon in two reports from 2012, in which she pointed out that the North Sea was still an attractive region for investors, due especially to favorable regulations. Fields holding significant amounts of oil and gas were discovered in 2010 and 2011, and there is still plenty left to pump: the UK’s section of the North Sea alone still contains resources equivalent to 22 billion barrels of oil. Technological advances have also played a factor, making technically challenging fields more profitable.

9. COP21’s hot air

In December 2015, the COP21 climate change conference produced a deal that was hailed by many politicians and media as a landmark accord. It aims to keep the average increase in global temperatures to below 2 degrees Celsius relative to levels from the pre-industrial era, but lacks binding CO2 emissions reductions targets and does not require countries to follow the action plans for fighting climate change that they submitted at the meeting.

While the agreement did reinforce the message that the march toward the post-fossil fuel era will continue, much will depend on the cost and reliability of alternatives, wrote Dr. Nakhle. Fossil fuels are still far cheaper sources of energy than renewables and nuclear, which require strong government backing and subsidies. They will continue to dominate the world’s energy mix until at least 2040.

10. Impact of low oil prices

While low oil prices are typically good news for consumers, many have warned of negative impacts: first on producers, whose margins will be squeezed, and second on investment, which could be curtailed due to lower returns. That could end up creating a spike in prices, as the downturn in investment leads to tighter supply.

But the cause-and-effect relationship is not so straightforward. In fact, lower prices could end up benefiting producers, who will have the upper hand in negotiating deals with host states. Low oil prices have pushed some governments to make investment more attractive, especially in countries already struggling to increase production. Moreover, equipment and labor costs fall when oil prices are low.

Long investment lead times are also a factor to consider. “Today’s conventional oil production is the result of exploration carried out more than a decade ago and investment decisions made more than five years ago”, wrote Dr. Nakhle. So even if investments slow down, a rise in prices would only occur in the longer term. The investment cycle for shale oil is much faster, however, and output in that sector will be more responsive. As soon as prices do start to rise, more shale oil will come online, increasing supply and reining in prices.

The article was first published by Geopolitical Intelligence Services