Lord Howell

Few would question that once again the global energy developments scene is in upheaval, with radical change pounding at the energy supply chain, governments finding their calculations upset, consumers benefitting, at least in the short term, from cheaper oil and gas, and yet general apprehension all round about the longer term impact of the recent halving of crude oil prices, and its inevitable knock-on effects.

The oil price drop is of course at the forefront of the minds not just of energy planners and companies, but of the financial and investment world, of policy-makers and of geo-political strategists. But all depends on how lower price pattern will last.

The immediate impact on the revenue budgets of major oil exporters and on all higher cost oil production is obvious. But behind this lies a deeper set of issues. Contrary to much talk about deliberate conspiracies to wipe out the American frackers, damage Russian ambitions or hurt Iran, the decision of the main ‘swing’ producers to hold oil production levels makes complete sense in rational economic terms. Substantial extra oil production has been added to world totals by the American shale boom, and in the short term that will continue. Indeed land-based storage for American oil is rapidly filling and ship storage is already under pressure.

Any production cut by the OPEC leaders would be immediately replaced by increased non-OPEC oil. There would be little or no impact on price. The Saudis and others would merely lose market share, and revenue. With world demand fairly flat, with Chinese oil demand easing and with rival energy sources in the wings (e.g. renewables and nuclear expansion) it makes no economic sense for the low-cost Gulf producers to move until fundamentals change on both the supply and demand sides –which will certainly take some time.

That’s the economics of the new scene. But what about the politics? best place to buy accutane online uk Cheaper or volatile crude prices interact directly with the Middle East turmoil and with the deep shadow of the so-called and atrocity-driven Islamic State now stretching out into the Maghreb and into sub-Saharan Africa. Iraq revenues, once so plentiful are now seriously depleted.

Current trends also put the European Union policy-makers and individual European Governments under pressure to react. The European ‘gamble’ on high cost energy opening the way in the lower carbon energy technologies is under increasing challenge, as the required subsidies for renewables swell ever further above world fossil fuel prices. Coal, far from being phased out, is attracting new investment in generating stations, as in Germany, directly contrary to the goal of reduced emissions. Britain faces lagging investment in new power generation, with the result that the electricity capacity safety margin is being worryingly eroded. The struggle to resolve the ‘trilemma’ of plentiful, reliable and affordable energy, delivered by the market, with costly low-carbon alternatives driven by Government intervention, continues.

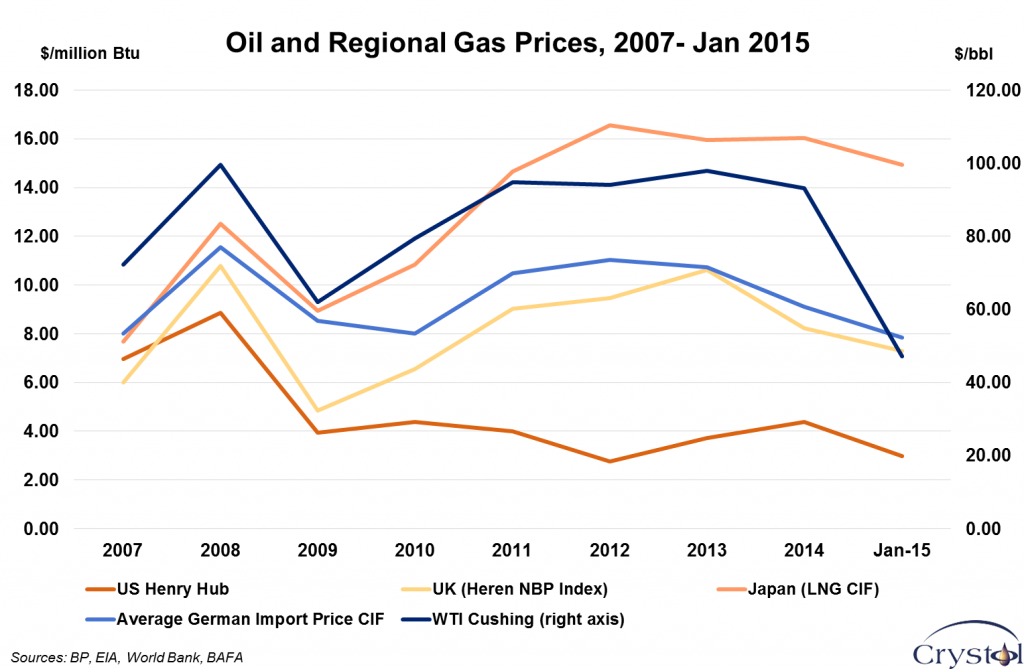

Cheaper oil means less ‘dash for gas’ and weaker gas prices as well. Mixed reports come from the American oil and gas sectors, with new drilling slowing but overall output still strong.

Those Central Asian oil-producing republics which, like Russia itself, are heavily dependent on oil and gas sales, face severe budgetary difficulties. Meanwhile the Ukrainian stand-off has already led to revised gas pipeline plans for Caspian region product transmitted through Turkey. Both China and Japan, the world’s second and third largest economies, remain poised to change their energy requirement trajectories as conditions evolve.

In an ever-faster changing and more volatile energy scene major political repercussions lie ahead. There will be new winners and new losers, as well as new weak points in the global energy supply chain. The 2014 oil price collapse surprised many, although not all. There will be more surprises to come.