Dr Carole Nakhle

It’s a combination of factors that drives technological changes in any industry. When it comes to the macro environment, market structure and government policies offer one explanation as to why technological developments have come fast in certain countries, but are absent in others.

Government policies can cover a wide spectrum. Some relate to direct financial support, such as subsidies; others are less financially burdensome and more effective. In conventional oil and gas, investment is a long-term proposition, as is investment in new technologies. It takes years, even decades, and significant capital commitment to convert below-ground oil and gas resources into sustainable production. It also takes huge efforts to convert innovative ideas into commercial applications.

Throughout this development period, external conditions can — and often do — change significantly (and these are often outside government control). Governments, however, can minimize important risks, mainly the regulatory and fiscal risks, by providing certainty and sending the right signals to investors, which in turn boosts investor’s confidence.

Case Studies: Carbon Capture and Shale Gas

The story of carbon capture and storage (CCS) is one example: According to the IEA, policy support for this important technology has fluctuated sharply — gaining momentum during the first decade of this century but waning after 2009 (i.e., after the failure of the Copenhagen meeting on climate change to reach a deal, and shortly after the global financial crisis).

As a result, “More than 20 advanced large-scale CCS projects were cancelled between 2010 and 2016, and the announced funding commitments were either scaled back or withdrawn across Europe, the United States and Australia.”

And it’s important to note that government support is unlikely to be enough on its own. Supplementing it with competitive market structures will count for at least as much. The shale technology in North America, which has fundamentally altered global energy markets even though it remains largely confined to that part of the world, is one such child of market forces. The application of a combination of horizontal drilling and hydraulic fracturing (also known as fracking) techniques has allowed oil and gas to be extracted from previously non-commercial deposits, in shale rock with low permeability.

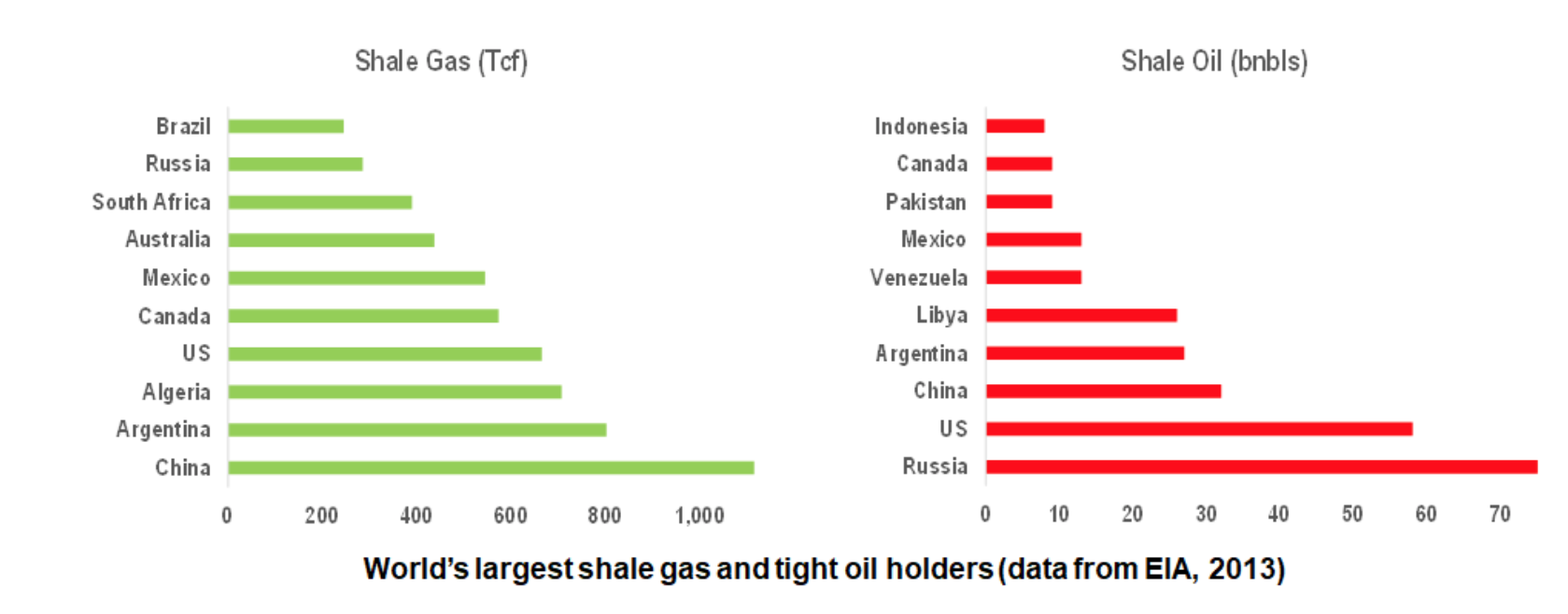

What is probably more impressive in the development of that technology itself is that the U.S. is not the largest holder of tight oil and shale gas resources. China sits on the world’s largest shale gas resources and Russia on the largest tight oil resources, according to the Energy Information Administration.

But the U.S. has many above-ground ingredients, usually of the market-friendly kind, that have driven the shale revolution, and which are largely missing elsewhere. It will therefore be difficult for many shale resource-rich countries, to replicate the U.S. experience, even though the technology has been tested and proven.

The Power of Markets

Christof Rühl, advisory board member of Crystol Energy and former chief economist of BP, describes the shale revolution as a perfect example for market driven-processes. He explains that in a classical innovation cycle, small and mid-sized companies experiment and at the end may trigger new and innovative ways of accessing and exploiting old and well-known resources.

That is because they use the space the market gives them to take risks. Typically, many of them will lose their shirts in trying to innovate, and only few of those trying can eventually succeed, and will be rewarded accordingly. This is what happened with U.S. shale: larger and more risk-averse companies came in only after the smaller, independent pioneers had shown the way, to perfect and consolidate the new technology.

Whether in the run-up to shale hydrocarbon production or in the large scale and capital-intensive deployment of seismic or digital technology, it is the basic incentive provided by competition which moves the technological frontiers of an industry.

If competition drives innovation, then one needs markets and their trial-and-error signals and incentives to support competition. Any system which tries to reduce the scope for error to zero will lose the capacity to innovate.

In energy, this is a lesson aptly confirmed by the track record of national oil companies, which are not exposed to competitive forces. And it is a lesson worth keeping in mind, in support of today’s energy transition. To succeed, the transition from fossil fuels to “clean” industries needs to harness market forces. Experience and history have long shown that technologies that rely on markets tend to develop much faster than those relying solely on government support, because they have to be economically viable to survive.

The article was first published in the AspenTech Blog

Related Analysis

“New Technological Frontiers in the Oil and Gas Industry”, Dr Carole Nakhle, Oct 2018

“Oil and gas pins its hopes on new technologies”, Dr Carole Nakhle, Nov 2018