Dr Carole Nakhle

Shell’s decision to suspend its Alaskan Arctic drilling activities in September 2015 confirms what many experts have long argued: the day for extracting hydrocarbons in the region has not yet come. In fact, given today’s oil prices and increasing competition from more accessible sources, large-scale extraction of oil and gas in the Arctic could be decades away.

In the United States, oil companies have set their eyes on Arctic hydrocarbon extraction for nearly a century. However, excitement over the region’s potential riches tends to come and go in cycles. Investor enthusiasm is usually curbed by the emergence of cheaper and more easily accessible alternatives, which in turn has translated into lower oil and gas prices. At the beginning of the 20th century, the discovery of oil in the Middle East lured companies’ focus away from the Arctic. Today, new technologies allowing for the extraction of shale oil and gas provide the alternative.

The Arctic has large potential for hydrocarbon extraction. The United States Geological Survey (USGS) estimated in 2008 that approximately 13 per cent of the world’s undiscovered oil and 30 per cent of the world’s undiscovered gas deposits lie north of the Arctic Circle. But today, it is difficult to make the case for investing in operations there. Oil prices are hovering below US$50, and companies are cutting costs and shelving low-yielding projects. Unless the oil price climbs back to above US$80 per barrel, global oil firms are unlikely to make extracting the Arctic’s resources a priority.

That said, these firms typically take a long-term view when it comes to restocking their portfolios, so the Arctic will not disappear from their radar screens. But market conditions will continue to dictate the extent of any future activity.

Arctic challenges

In its National Strategy for the Arctic Region, the Obama administration stated in 2013 that ‘the Arctic region is peaceful, stable and free of conflict.’ But that is hardly an accurate description when it comes to exploring for the region’s potential oil and gas riches. The hurdles and fierce opposition that faced Royal Dutch Shell’s offshore Alaska drilling plans are just one example.

Until September 28, 2015, when Shell announced it was halting its drilling activities in the Chukchi Sea off the north-west coast of Alaska, many questioned Shell’s determination to pursue its venture there. The company had expressed its will to see the investment through for several months, and some wondered whether there was something that the company knew that others, including its peers, did not. The risk-reward balance that investors typically seek did not seem to be there, especially considering today’s oil prices and increasing competition from shale oil and gas extraction operations.

In August 2015, shortly before Shell’s U-turn, the media was awash with news that the company had obtained the final permit required to proceed with drilling. That the US government had issued the permit sparked an outcry from environmentalists. Just a day after the permit was granted, US presidential candidate Hillary Clinton wrote on Twitter that the Arctic offshore oil should not be exploited. ‘Given what we know, it’s not worth the risk of drilling,’ she wrote, sending a clear message to investors about her plans if she wins the presidential campaign. Following Shell’s announcement, the Obama administration put a halt on drilling in Alaska’s Arctic Ocean over the next two years, cancelling auctions for drilling rights in the Chukchi and Beaufort seas.

Shell’s history in Alaska dates back to 1918, when the company’s geologists first examined the potential for oil extraction in the US territory. It engaged in onshore and offshore drilling in southern Alaska in the 1950s and 1960s, but BP’s (then called British Petroleum) discovery of the giant Prudhoe Bay oil field in 1968 was the major milestone that revived interest in Alaska’s far north. Still, extraction has largely been limited to activity that is onshore and either below or on the circumference of the Arctic Circle.

Aside from Shell’s recently aborted plans for drilling in the Chukchi Sea, there remain only two other extraction operations in Arctic waters – both off the coast of northern Norway. One is Statoil’s Snohvit, the first offshore development in the Barents Sea and the first liquefied natural gas production plant in Europe. The other is Eni’s Goliat oil field, also located in the Barents Sea. It is due for its first pilot production before the end of 2015.

Substantial resources

According to the above-mentioned USGS study, most of the undiscovered oil and gas resources the Arctic holds lie offshore. More than 70 per cent of the exploration potential is believed to be gas, largely in Russian waters.

But these estimates, while indicating substantial resources, should be treated with caution. Geological resource estimates are inherently uncertain – they do not specify what can be commercially recoverable. That is largely determined by market conditions, mainly the price of oil. There buy accutane usa could be a lot of oil in the ground under the ice cap that may be ‘technically recoverable,’ but we do not know how much of it can be recovered in a cost-effective manner.

At the same time, other sources of supply are appearing in the market. Apart from new extraction opportunities from shale, Mexico opened up its oil and gas fields to foreign investment in 2014. Iran’s deal with global powers to end sanctions will bring even more hydrocarbons onto the market. All of this should continue to put pressure on oil prices, in turn making expensive ventures in the Arctic unprofitable.

An early victim of the lower prices caused by the shale revolution was the giant Shtokman gas field in the Barents Sea. In August 2012, Russia’s Gazprom announced it would postpone development of the field indefinitely.

Shell’s current setback echoes its disappointing experience in the Arctic in the 1980s. Then, after drilling exploration wells in the Chukchi Sea and Beaufort Sea, the company had to abandon its plans after the oil price plummeted to nearly US$10 in 1986, or US$21.50 today. That was too low to justify developing fields in such remote – and risky – locations.

As put by Norwegian consultancy firm DNV GL, risk in the Arctic is as diverse as the region itself. The main risks are technical, weather-related, operational, environmental, reputational and personnel-related. All these risks result in high costs for oil and gas investors. According to the US Energy Information Administration (EIA), studies have shown that developing onshore oil and natural gas reserves in Arctic Alaska can cost 50-100 per cent more than conducting similar projects in Texas.

Costly venture

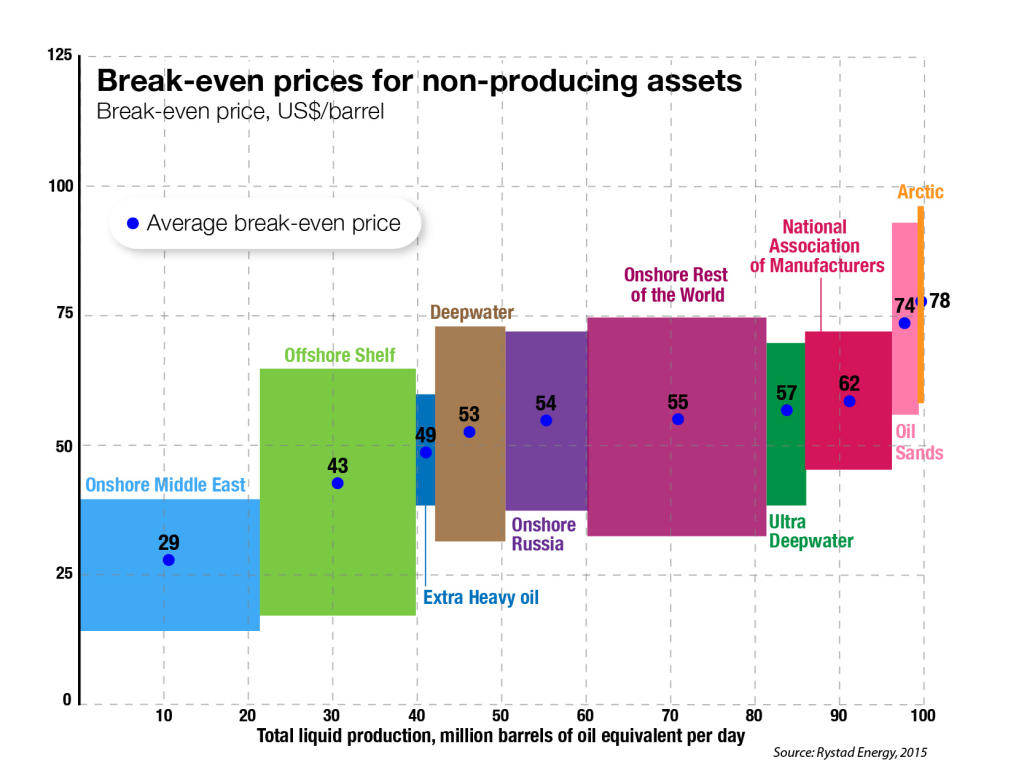

The consensus today among experts is that the Arctic has become the most expensive region for resource exploration and development. It requires the highest break-even price to make commercial sense. With oil prices as they are today, it is difficult to make the case for investing in hydrocarbon extraction in the Arctic.

Two characteristics set the Arctic apart from other areas where oil and gas firms normally operate: its climate (low temperatures, large temperature variations and sensitive environment) and remoteness. While ice in the Arctic is melting and recedes significantly in the summer, conditions in the winter are still harsh. The presence of ice impacts production, offloading and export activities, and requires robust facilities. The infrastructure is simply not yet available.

Furthermore, following the Deep Water Horizon oil spill in the Gulf of Mexico in 2010, regulations on offshore drilling in the US have been tightened, thereby limiting access and increasing costs further. BP’s response to the spill was remarkably fast, with their ability to mobilise oil tankers, drilling rigs, vessels and people. This would not have been possible in the Arctic. If such an accident were to occur there in the autumn, nothing could be done before spring at the earliest – a major concern expressed by environmentalists.

Overlapping and disputed claims of economic sovereignty between neighbouring jurisdictions also presents an obstacle to developing Arctic resources.

In May 2015, Shell CEO Ben van Beurden justified his company’s determination to explore Arctic waters, saying that by the time oil comes into production, the global balance of supply and demand could look quite different. He may well be right – especially if he was referring to the very long term.

Since launching its annual World Energy Outlook five years ago, BP has not foreseen a major role for the Arctic before 2035. Along similar lines, the EIA expects Alaskan oil production to continue to decline through 2040, and therefore discounts the potential of major developments in the region. The International Energy Agency also confirms that Arctic oil is a long-term eventuality.

Arctic energy facts

- In August 2012, Gazprom postponed indefinitely the development of its giant Shtokman gas field, which was discovered in 1988 in the Russian waters of the Barents Sea

- The territory north of the Arctic Circle is divided up

- among eight countries: Canada, Denmark (Greenland), Finland, Iceland, Norway, Russia, Sweden, and the United States

- Shell operated in Alaska continuously from the mid- 1960s until 1998, and drilled many exploratory wells in the Beaufort and Chukchi seas in the 1980s and 1990s. In 2005, the company re-entered Alaska, acquiring leases in the Beaufort Sea

- It has been reported that Shell has spent US$7 billion on plans to explore the Arctic

- Alaska’s crude oil production has declined from 1.8 million barrels per day in 1991 to 0.5 million barrels in 2014. Almost 75 per cent of Alaska’s crude oil production from 1990 to 2012 was from the Prudhoe Bay and Kuparuk River fields in the central North Slope

- Statoil’s Snohvit operation is located at 70 degrees north, at the same latitude as the frozen seas north of Alaska

Article reproduced with the kind permission of Geopolitical Intelligence Services