Christof Rühl, member of the Advisory Board of Crystol Energy and a Senior Fellow at the Center on Global Energy Policy at Columbia University, discusses the latest global macroeconomic developments and energy markets in this weekly interview to the Gulf Intelligence.

Christof talks about oil prices, where the recent increase seems to have a name written all over it – OPEC+. There’s no systematic shortage of capacity – we have almost five million barrels a day of it. The only shortage is political willingness to release that capacity. We also need to be wary on how to judge the strength in current demand because we may have well published OECD and US inventories figures, but we don’t really see what’s happening in China or Asia and some other regions, where the actual growth comes from.

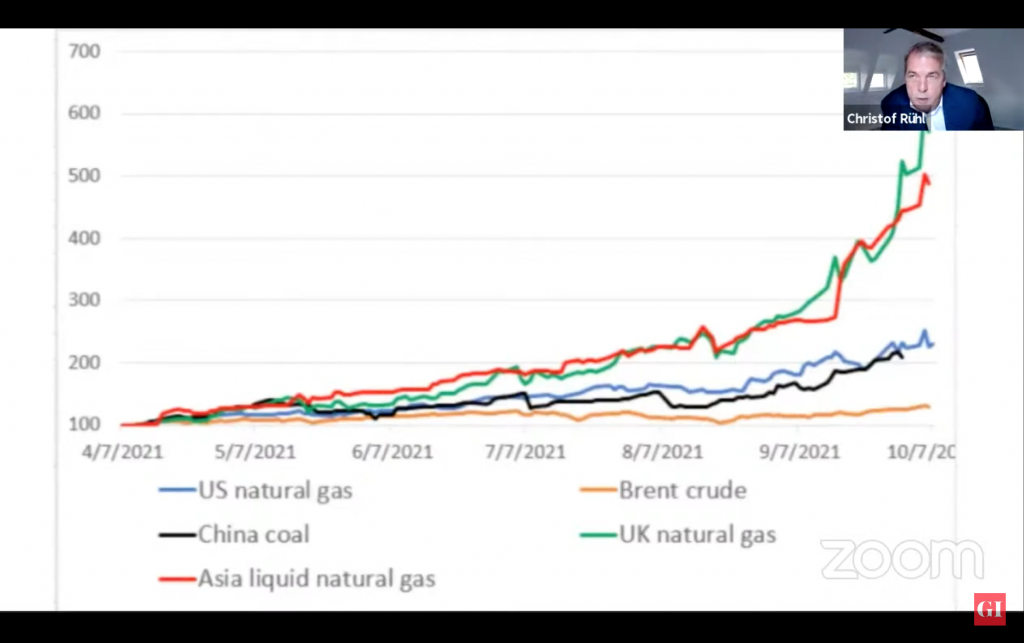

He further comments on whether natural gas prices are driving oil’s strength, explaining that there’s a systematic difference between the situation in natural gas and coal, and oil. The strong crude price is nothing compared to what’s happened with other fuels. Natural gas prices have increased five or six-fold since March and coal has doubled. These are fuels where we have seen an investment gap which has led to a capacity shortage. That’s a very different game from what has happened to Brent. Even US shale is coming back; by April next year, we could have substantial changes in US oil production. US natural gas is also plentiful. The only bottleneck for now is transport. A year from now, we may all be lamenting low prices. China doesn’t look good, Europe doesn’t look good, and the US looks good only if Biden gets his way with implementing his stimulus and infrastructure program.

On the macroeconomic outlook through 1H 2022, Christof states that we need to look at the big picture; the economic performance triangle between Europe, China and the US on one hand, and what happens with this energy and inflation situation on the other. The Biden administration will be slow on clamping down on inflation for pollical reasons and Western governments and central banks deep down know that they have no chance of getting rid of the substantial debt which has been piled up, other than by gradually inflating it away. We will continue to see a conflict between the need for interest rate rises and the desire not to increase them.

Christof is joined by Jorge Montepeque, President and Founder of Global Markets. Dyala Sabbagh from the Gulf Intelligence moderates the discussion.

Watch the full discussion:

Related Comments

“OPEC+ sticks to its July output plan“, Dr Carole Nakhle, Oct 2021

“US Fed’s policy and Bank of England’s performance“, Christof Rühl, Sep 2021

“Oil demand recovery and gas price spikes“, Christof Rühl, Sep 2021

“Gas crisis hits the European Union“, Dr Carole Nakhle, Sep 2021