Christof Rühl, Global Advisor at Crystol Energy, was quoted in Nucleonics Week (S&P Global Commodity Insights, Volume 66 / Issue 43, October 22, 2025), where he discussed the economics of nuclear power and cautioned that cost comparisons often overlook key financial and risk-related factors.

Rühl noted that the apparent cost savings of nuclear energy are “erroneous” because they exclude both full capital costs and the implicit insurance governments provide against accidents. “Since private insurance would be prohibitively expensive, taking on this risk through public guarantees effectively constitutes a subsidy,” he explained.

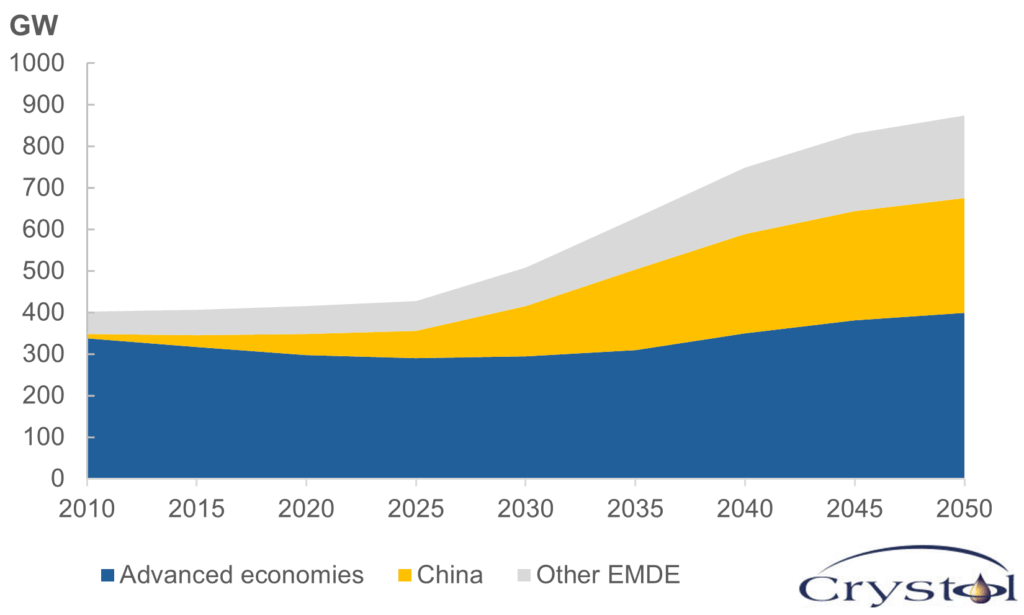

Nuclear power capacity by region in the Announced Pledges Scenario

He emphasized that when these hidden costs are included, nuclear energy is not cost-competitive with natural gas or renewables. “It must be subsidized — which may be the right decision, but it is a political choice, not an economic advantage,” Rühl said.

Looking ahead, he pointed to small modular reactors (SMRs) as a potential game-changer for nuclear economics, though he noted that “these technologies are not yet operating at scale.”

Related Comments

“Podcast Feature: Dr Carole Nakhle on the Middle East’s Untapped Gas Potential“, Dr Carole Nakhle, Aug 2025

“Dr Carole Nakhle Discusses OPEC+ Strategy on BBC World News“, Dr Carole Nakhle, Aug 2025