In September 2025, crude futures came under renewed pressure, recording back-to-back losses as investors refocused on supply and demand fundamentals. In a recent Welligence Energy Analytics webcast, cited by the Wall Street Journal, Dr. Carole Nakhle , CEO of Crystol Energy, shared her perspective on the drivers behind current oil price dynamics.

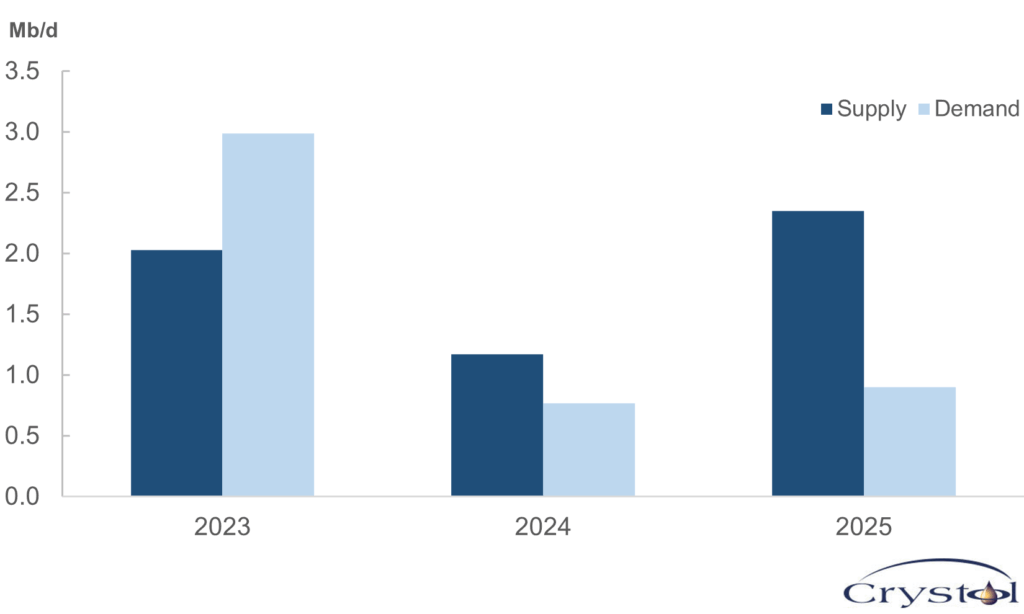

Dr. Nakhle noted that while global demand persists, it has not expanded at the same pace as supply. Despite this imbalance, prices have not collapsed, reflecting the market’s capacity to absorb additional barrels from OPEC+ and other producers.

Oil supply and demand growth

She also highlighted China’s continued strategy of buying crude for storage. Although economic data suggests modest demand growth, these stockpiling efforts have helped balance the market. The key uncertainty is how long this approach can continue, and how much further China can expand its inventories.

Together, these factors underscore the fragile equilibrium in oil markets, where resilient supply, slower demand, and strategic stockpiling intersect to shape price trends.

Related Comments

“Podcast Feature: Dr Carole Nakhle on the Middle East’s Untapped Gas Potential“, Dr Carole Nakhle, Aug 2025

“Dr Carole Nakhle Discusses OPEC+ Strategy on BBC World News“, Dr Carole Nakhle, Aug 2025