Crystol Energy CEO, Dr. Carole Nakhle, was quoted in Al Jazeera English on Venezuela’s oil outlook and why global markets have not reacted sharply despite a major political shock.

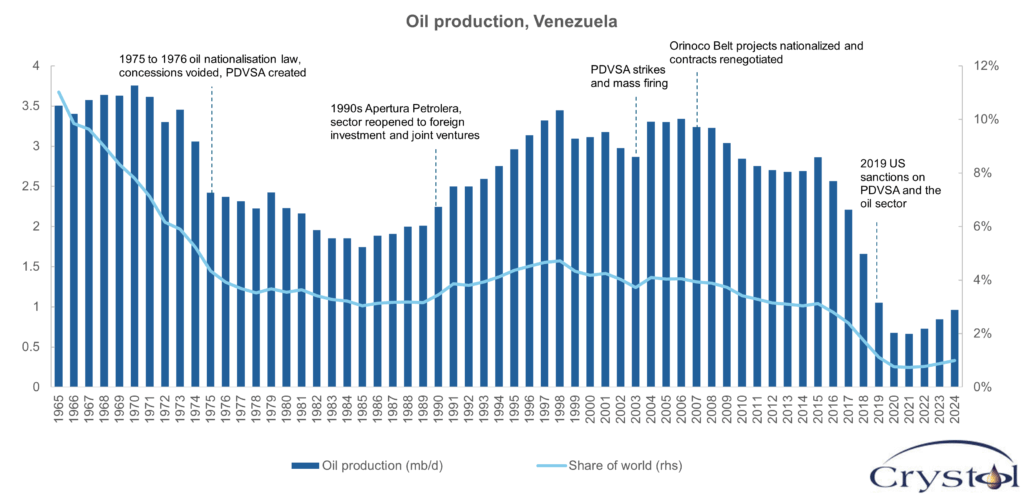

She explained that the decline in Venezuela’s oil sector began well before US sanctions. Years of mismanagement, politicisation, and underinvestment weakened the industry first. Sanctions then accelerated the downturn by restricting finance, operations, and access to markets.

She also noted that a rapid rebound in output is unlikely in the short term. Current efforts focus on stabilising existing production. Any meaningful growth would require sustained capital, technology transfer, and institutional reform, which take time to deliver.

Dr. Nakhle further underlined that the deeper risk is prolonged political disorder rather than immediate supply disruption. Markets can absorb additional Venezuelan barrels, but they struggle to price sustained instability.

Related Comments

“Venezuela, geopolitics, and what moves oil prices in 2026“, Dr Carole Nakhle, Jan 2025