Dr Carole Nakhle

Predicting the various factors that shape oil markets is always uncertain. This is particularly true today with the major changes in global policy dynamics following the biggest election year in history in 2024. Among the most noteworthy changes is the new administration in the United States – the world’s largest economy and the biggest producer and consumer of oil.

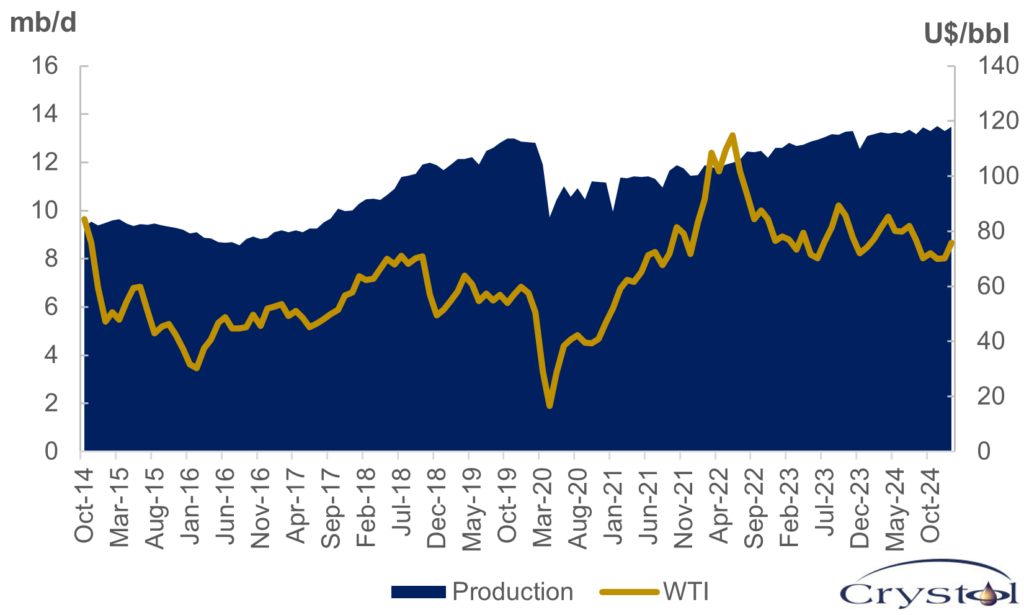

Since taking office in January of this year, U.S. President Donald Trump has announced several policies and initiatives that can steer international oil markets in different directions. Domestically, his “drill, baby, drill” approach promises levels of U.S. oil production “not seen before,” which would require oil prices to remain high enough to spur the necessary level of activity. Yet, he also wants lower prices to ease the financial burden on American consumers.

In addition to focusing on domestic production, he wants to use oil as a tool to achieve his broader political agenda, including intensifying pressure on Russia to force it to the negotiating table and end the war in Ukraine. “If the price (of oil) came down, the Russia-Ukraine war would end immediately. Right now, the price is high enough that that war will continue,” President Trump said in his address to delegates at Davos during the World Economic Forum. He went on to blame the Organization of the Petroleum Exporting Countries (OPEC) for keeping prices at current levels: “[T]hey should have done it long ago. They’re very responsible, actually, to a certain extent, for what’s taking place.” At present, the price of Brent crude oil is around $70 per barrel.

Mr. Trump’s other policies, some of which are still in the making, will also affect oil markets. Chief among them are those related to economic warfare and tariffs, which may provoke different responses from affected countries, ranging from cooperation to retaliation. These reactions will have differing implications for international trade, the global economy and oil markets.

Such consequential policy changes and related ambiguities could lead to greater volatility in global oil markets. But it is also possible that, amid the ongoing uncertainty, a sense of stability could ultimately emerge.

U.S. monthly crude oil production and oil price

Data source: US Energy Information Administration

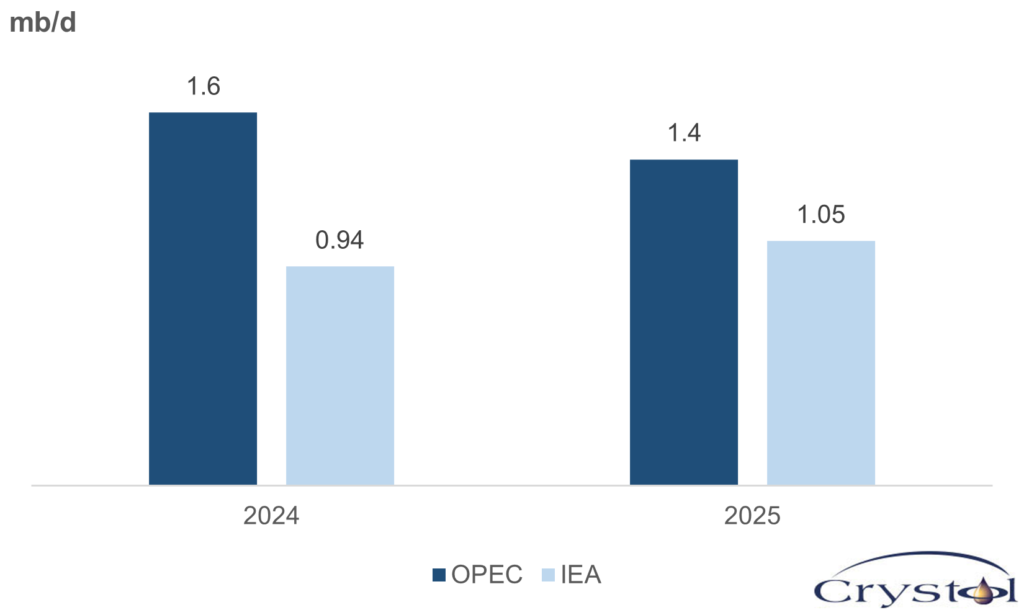

Divergent market expectations: OPEC vs IEA

The year 2024 was characterized by confusion regarding oil demand forecasting, highlighting the different assumptions surrounding key markets. Discrepancies in forecasts are common, but last year the differences between OPEC and the International Energy Agency (IEA), the most-commonly cited oil demand forecasts, were especially notable. For most of the year, OPEC projected that demand would grow at least twice as fast as the IEA anticipated: over 2.2 million barrels a day (mb/d) compared to just above 900,000 barrels per day from the IEA.

In a market where oil demand surpasses 100 mb/d, this difference represents barely 1 percent. Nonetheless, it is far from negligible, as it can determine whether the market will be in surplus (with supply growth exceeding demand), which would put downward pressure on prices, or in deficit, leading to the opposite effect. In August 2024, OPEC began gradually lowering its demand estimates, and by the end of the year, it cut these estimates by nearly 600,000 barrels per day. While this adjustment helped narrow the gap with the IEA figures, a significant difference still remained.

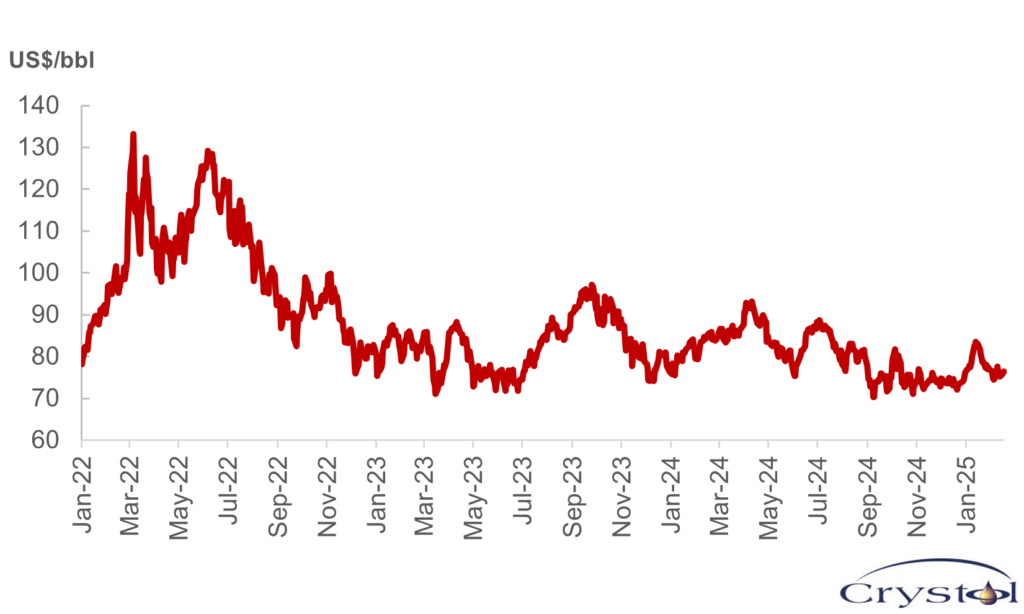

Overall, the market appears to have vindicated the IEA. Yet, geopolitical tensions, especially in Europe and the Middle East, have added a fear premium to prices. Furthermore, the ongoing production cuts implemented by OPEC+ since 2022, despite pressure from the U.S., helped maintain prices at an average of $81 per barrel that year.

Oil demand forecasts

Data source: IEA, OPEC

For 2025, the difference in oil demand forecasts seems less dramatic, with OPEC anticipating demand growth of 1.4 mb/d, compared to the IEA’s estimates of just over 1 mb/d. Both organizations agree that overall growth will be fueled mainly by non-OECD countries, especially in Asia, with China being the primary driver. This growth will also receive support from other countries in the region, along with the Middle East and Latin America.

OPEC describes the increase in demand as healthy and “comfortably above the pre-pandemic rate.” Yet, last year’s experience is not reassuring. There are new and lingering risks to economic activity with spillover effects on oil demand.

Trade tensions

The outlook remains underwhelming despite stable global economic growth, according to the International Monetary Fund (IMF). It noted that the overall picture “hides divergent paths across economies and a precarious global growth profile.” Specifically, the IMF projects that the Chinese economy, the world’s second-largest and top importer of crude oil, will grow at 4.5 percent this year (compared to 4.8 percent in 2024). However, it warns of several downsides. The Asian powerhouse continues to face excessive debt, deflation, a real estate crisis and subdued consumer confidence; moreover, tariffs imposed by the new Trump administration could jeopardize its economic outlook further.

President Trump, the self-proclaimed “tariff man,” has threatened to impose levies on Chinese-made products that could reach as high as 60 percent, although he is approaching this gradually. On February 1, 2025, a 10 percent tariff on goods from China became effective. Mexico and Canada were also targeted for 25 percent tariffs (implementation was set for March 1), and the list of potential targets is getting longer. Evidence shows that trade tariff increases lead to “economically and statistically significant declines in domestic output and productivity,” especially when they result in tit-for-tat actions.

A major economy like China, which relies heavily on international markets for its growth, will be especially vulnerable to the harmful effects of trade tariffs, both on its own exports and those imposed on its trade partners. This situation could, in turn, drag down global economic growth and limit the potential increase in oil demand. Furthermore, retaliatory tariffs imposed by its trade partners would likely worsen the negative effect on global trade, warned American bank JPMorgan Chase & Co.

Spot Brent oil price

Data source: US Energy Information Administration

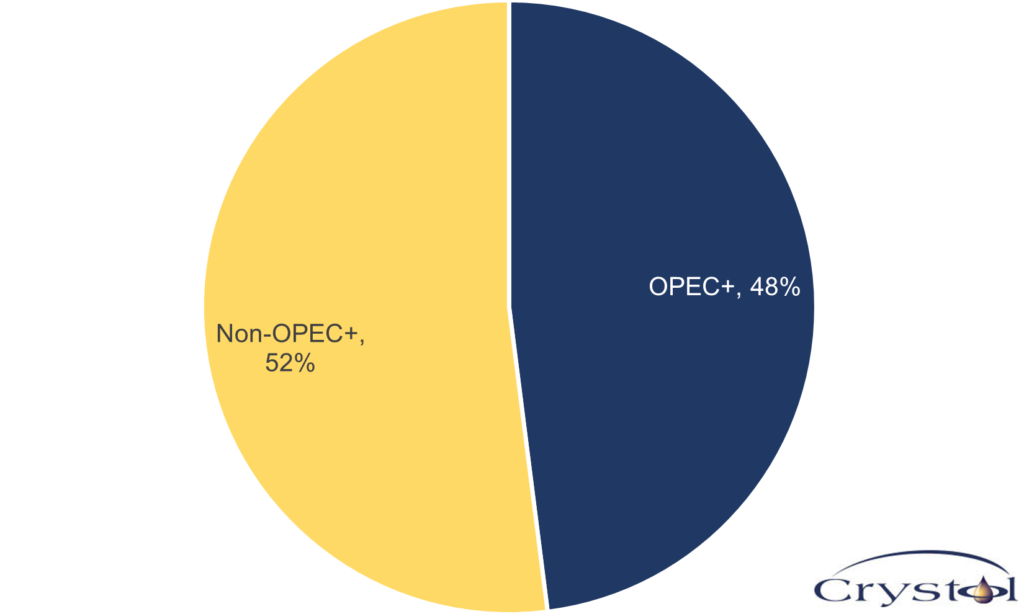

Balancing oil supply

The world’s oil supply is almost evenly divided between OPEC+ and non-OPEC+ producers. Growth from OPEC+ has been limited due to output cuts that the group began implementing in 2022. Last year, there were three attempts to reintroduce some of the voluntarily curtailed barrels back into the market. However, OPEC+ determined that the market conditions were unfavorable enough to justify such a move, postponing the decision to April 2025. Additionally, the timeline was extended to avoid any unintended effects on prices.

The IEA indicates that even if OPEC+ chooses to delay unwinding some of its output cuts, the market is still likely to face a surplus, underscoring potential challenges for both producers and customers. If those barrels are released, the surplus would increase, particularly given the strong growth outside OPEC+ countries, the agency added.

In recent years, the growth of non-OPEC+ oil supply has been primarily driven by the U.S., as well as by Brazil, Guyana, Canada, Norway and Argentina. This trend is expected to continue this year, with an additional increase of 1.8 mb/d projected for global oil supply. According to the U.S. Energy Information Administration, after reaching an annual record of 13.2 mb/d in 2024, U.S. crude oil production is expected to reach another peak of 13.5 mb/d this year. President Trump’s promise of oil production levels “not seen before” may well be within reach.

World oil supply in 2025

Data source: IEA

Oil activity boost

The arrival of a pro-oil administration in the White House has created a more optimistic outlook for the industry in 2025 compared to last year. According to the Dallas Fed Energy Survey, this optimism is reflected in the expectations of industry executives regarding their capital spending this year. Nearly 43 percent of respondents anticipate an increase in capital expenditures, while only 19 percent expect a decrease and the remainder foresee no change.

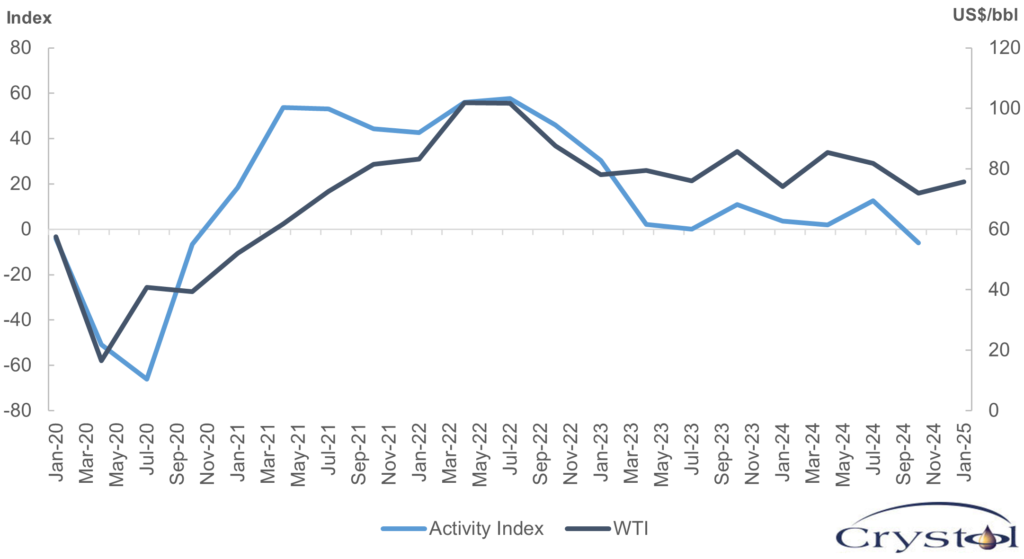

However, attributing the oil industry’s activities solely to political changes can be misleading. While there is no doubt that the U.S. oil industry feels “supported” by the Trump administration, the real driver behind the increased investment – leading to higher production – remains tied to market prices. A look at the Dallas Fed Energy Survey’s Activity Index illustrates this connection well: When oil prices increase, it encourages greater spending in the industry. In contrast, falling prices lead to a reduction in activity.

It can be argued that the increase in U.S. oil production is due to OPEC+ production cuts that have kept prices favorable for American producers, allowing for profitable expansion. Therefore, urging OPEC to release more barrels into the market may not be the best outcome for U.S. producers, unless it aligns with a growing gap in the market.

U.S. Oil Activity Index and WTI oil price

Data source: Dallas Fed Energy Survey, St. Louis Fed

Sanctions on oil producers

President Trump has threatened to target key oil producers with severe sanctions. “Settle now, and STOP this ridiculous War! IT’S ONLY GOING TO GET WORSE. If we don’t make a ‘deal’, and soon, I have no other choice but to put high levels of Taxes, Tariffs, and Sanctions on anything being sold by Russia to the United States, and various other participating countries,” President Trump told Russian President Vladimir Putin in a post on his Truth Social platform.

This would be in addition to the last round of tough sanctions that former U.S. President Joe Biden implemented just before leaving office. Although Western sanctions have failed to limit Russian supplies, which has helped keep oil prices stable, imposing even tougher sanctions with more stringent enforcement will inevitably increase the pressure on Russia.

Many expect Mr. Trump to reinstate his “maximum pressure” strategy on Iran. During his first term, this approach succeeded in bringing Iranian oil exports down to as low as 500,000 b/d, although it never completely halted them. In fact, on February 4, President Trump issued a directive aimed at intensifying economic pressure on Iran. The directive calls on Treasury Secretary Scott Bessent to use sanctions and tighten the enforcement of existing measures to ramp up the pressure on Tehran.

On February 14, Mr. Bessent stated that the U.S. is working to reduce Iran’s oil exports to less than 10 percent of their current levels. “We are committed to bringing the Iranians back to the 100,000 barrels-a-day of oil exports, figures we saw during Trump’s first term,” he said. Currently, Iran exports approximately 1.5 to 1.6 million barrels daily, he added.

Scenarios

Unlikely: Oil demand to surge, leading to a notable rise in prices

Many moving parts, primarily related to geopolitics, can drive oil markets in various directions. It seems unlikely that oil demand will soar this year, pushing prices significantly higher, particularly when combined with supply losses from Russia and Iran.

More likely: Trade tensions could limit growth in oil demand

When it comes to demand, the downside risks are prominent. Trade wars will limit the potential for demand growth. They might even lower oil prices, provided there are no notable changes on the supply side – an undesirable outcome for American oil producers. However, if President Trump follows through on his threats and successfully restricts exports from Russia and Iran, oil prices will rise – an unwelcome scenario for American consumers.

In this case, if OPEC steps in and seizes the opportunity to release some of the oil barrels it has long been stockpiling and does so under its often-trumpeted slogan of “restoring market balance,” any resulting increase in prices is likely to be moderate and short-lived. This outcome would be favorable for both American producers and consumers. Should Russia agree to a deal, it will probably demand an easing of sanctions on its energy exports in return. Consequently, oil prices will then come under pressure. Considering that negotiations are unlikely to be completed overnight, at some point, OPEC+ will have to reassess when and how it would release its barrels.

Amid all this ambiguity, it appears that when one policy or decision creates a gap, alternative actions can bridge that gap and help restore equilibrium. While volatility should always be expected in the complex global oil markets, one can still see how stability may ensue. President Trump might just find a way to balance the seemingly conflicting interests of his important stakeholders: the American consumer on one hand, and American oil producers on the other.

Related Analysis

“Trump should call on Opec in his bid to negotiate with Putin“, Christof Rühl, Jan 2025

Related Comments

“Oil rises after Trump announces tariffs on Canada“, Dr Carole Nakhle, Feb 2025

“President Trump Energy Policy, Tariffs and Oil Markets“, Dr Carole Nakhle, Jan2025