Crystol Energy CEO Dr Carole Nakhle shared her insights with Norwegian business magazine Kapital on how China large scale oil stockpiling is influencing global energy markets. She drew on independent satellite data and analytical agencies. She said that China strategic and commercial crude reserves are a little above half full. Exact figures remain unclear because the country does not publish transparent inventory statistics.

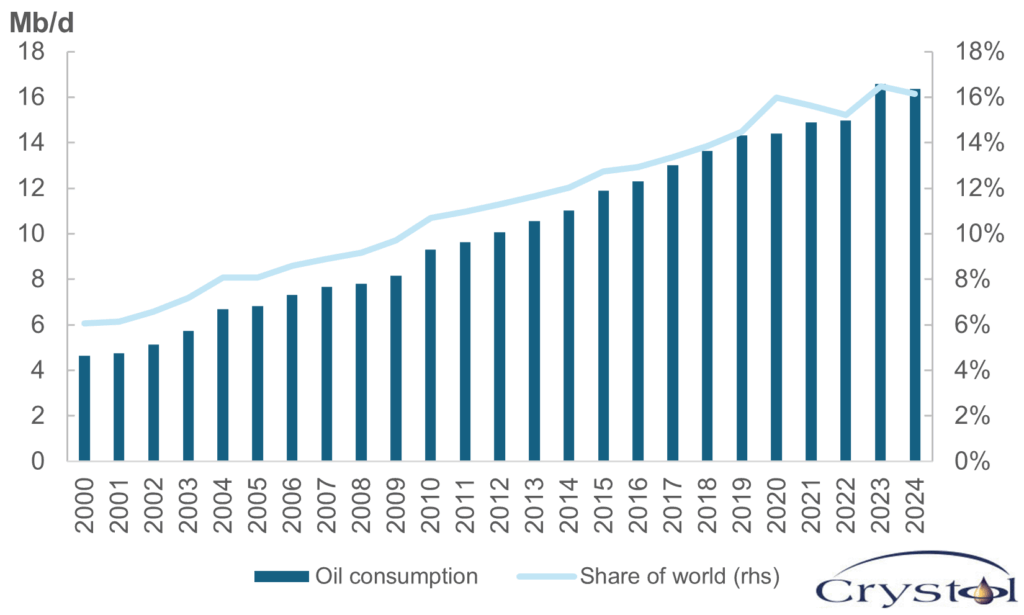

Chinese oil demand

Data source: Energy Institute

Key takeaways:

China crude oil reserves are estimated to be a little above half of total capacity, but limited transparency makes precise figures difficult to confirm.

China remains a key driver of global oil demand through its large needs in petrochemicals, industry and transport, even as parts of the economy electrify.

Oil stockpiling serves several aims at once, including stronger energy security, the use of available storage capacity and the chance to buy more crude when prices are relatively low.

Strategic and commercial inventories grow together, with state decisions on reserves complemented by refineries that expand their own stocks under clear policy guidance.

Import quotas and permits allow the authorities to shape crude oil import volumes and keep refinery activity in line with national objectives.

This coordinated approach seeks to protect China from market volatility and geopolitical shocks, with clear implications for oil balances and prices worldwide.

Related Comments

“Trump tariffs: Concern grows over falling oil prices“, Dr Carole Nakhle, Apr 2025

“Experts warn of trade tensions on oil demand“, Dr Carole Nakhle, Apr 2025