Dr. Carole Nakhle, CEO of Crystol Energy was quoted in this article published by Arab News commenting on the impact of geopolitics on investment at the BMG Economic Forum.

According to Dr. Nakhle, the Kingdom of Saudi Arabia has a “powerful” energy sector that has proved resilient to major geopolitical developments.

She added that in the Western world, concerns about the volatility and reliability of oil and gas are often voiced. However, what is frequently overlooked is the necessity of volatility in a well-functioning market. The crucial issue is how effectively this volatility is managed.

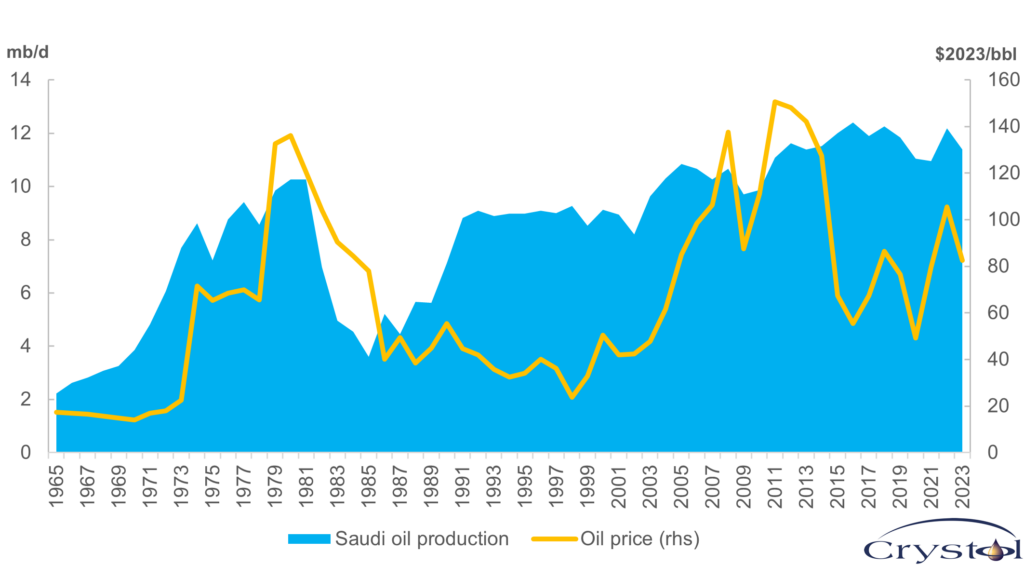

Recent years have been marked by significant geopolitical developments. The Ukraine conflict, energy crises, and numerous macroeconomic challenges have characterized this period. Sanctions have been imposed on Russia, Iran, Venezuela, with ongoing issues in places like Libya, Syria, and Yemen. Despite these disruptions, prices have spiked but quickly reverted to their pre-crisis levels – unlike previous crises in the past decades, where prices would have soared.

Saudi Arabia's oil production and oil price

Data source: Energy Institute

According to Dr. Nakhle, Saudi Arabia is able to take “proactive policies and measures” that compensate for the geopolitical risk. The “commitment and clarity” of Vision 2030 means the Kingdom can take on “reduced” geopolitical risk premiums.

On the oil supply outlook of the Kingdom, Dr. Nakhle pushed back against the “overwhelming thinking” predicting the end of the oil sector in Saudi Arabia as part of the larger “peak oil” debate. She pointed out that relying on oil revenues to finance ambitious projects could pose significant risks for an economy. Dr. Nakhle argued that this common belief oversimplifies a complex reality, cautioning against comparing all oil producers, including leaders within OPEC like Saudi Arabia, as each presents a unique situation.

Regarding the Gulf Cooperation Council (GCC) and Saudi Arabia specifically, she expressed confidence due to their substantial reserves and low production costs, dismissing any concerns about their economic stability.

Related Analysis

“Equatorial Guinea’s oil and gas industry continues to shrink“, Dr Carole Nakhle, May 2024

“Why Angola left OPEC“, Dr Carole Nakhle, Apr 2024

Related Comments

“Africa’s energy resources: a blessing or a curse?“, Dr Carole Nakhle, Aug 2023

“European gas crunch, African supply and the energy transition“, Dr Carole Nakhle and Dr Theo Acheampong, Sep 2022