Dr Carole Nakhle, CEO of Crystol Energy, is quoted in this article written by Dina Kadri from Attaqa where she assesses the fundamentals of global oil prices.

According to Dr. Nakhle, oil prices are falling globally despite tensions in the Middle East due to an oversupply of oil and relatively weak demand. Economic uncertainty and fears of slowdowns in major economies are dampening oil demand, while supply growth outside of OPEC+ remains robust. Additionally, the large spare capacity from OPEC+ production cuts has added further pressure. Considering all these factors, it’s clear why prices are where they are today.

She added that while there may be short-term spikes due to the initial shock, the overall impact on prices depends on the nature and duration of the attack (as seen in the markets’ muted reaction to the last attacks), any subsequent escalation, and, most importantly, whether there are significant disruptions to supply.

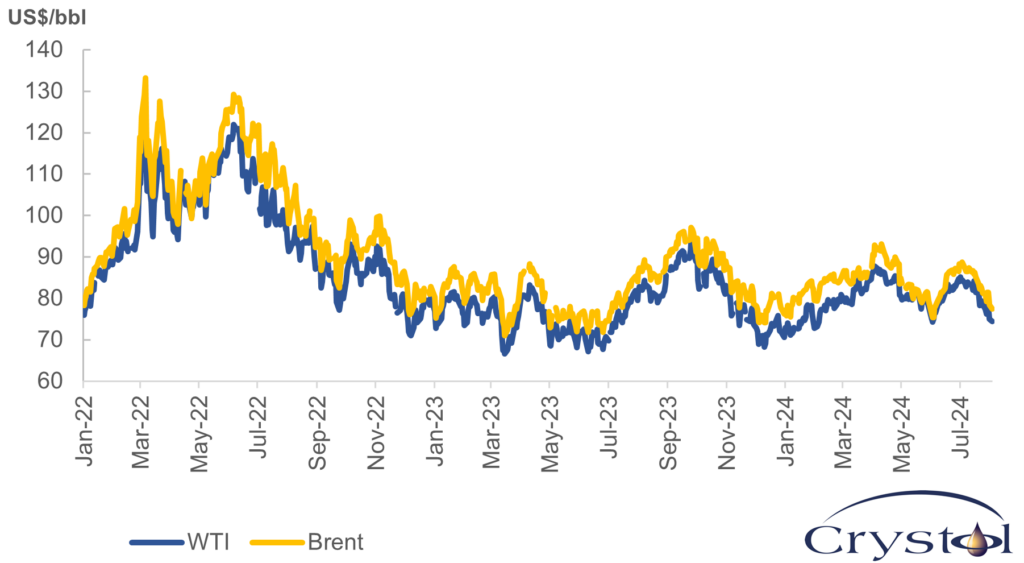

Daily oil prices since 2022

Source: EIA

As for OPEC+’s possible decisions in their next meeting in October, Dr. Nakhle hightlighted that OPEC+’s decisions are not set in stone; they can be revised depending on unpredictable market developments. So far, OPEC+ has remained committed to its most ambitious demand forecasts for this year, but reversing these decisions could in0dicate that the forecasts were overly optimistic.

Related Analysis

“Oil markets: Relative stability amid geopolitical strife“, Dr Carole Nakhle, Feb 2024

Related Comments

“Middle East faces heightened risk of conflict“, Dr Carole Nakhle, Jul 2024

“Growth outside OPEC+ robust“, Dr Carole Nakhle, Jul 2024