Dr Carole Nakhle

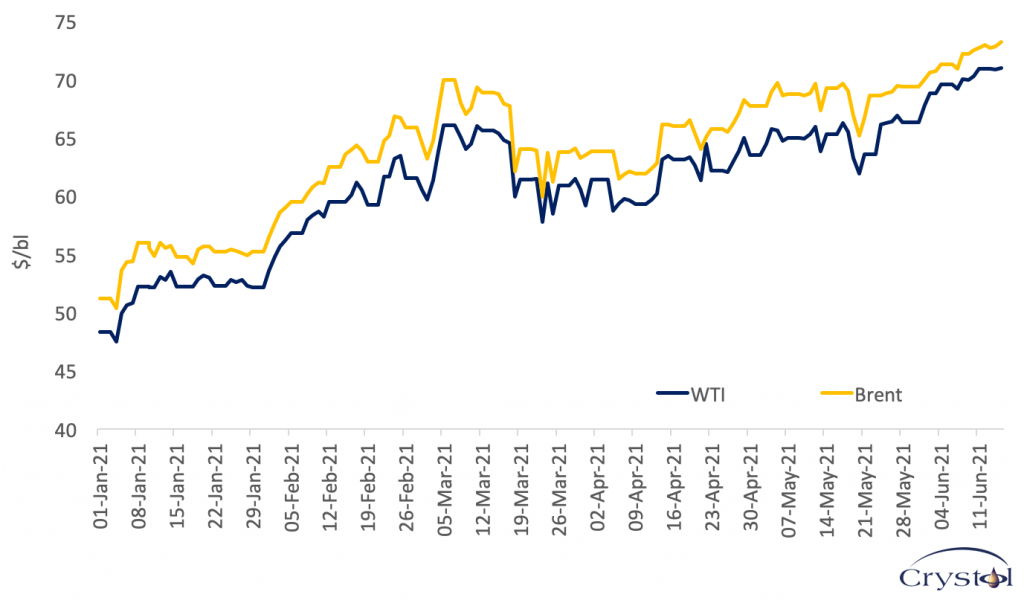

Oil prices have come a long way since reaching their lows of April 2020. The rebound has been rapid and impressive; prices are currently similar to those of early 2020, before the outbreak of the Covid-19 pandemic. The trend has pushed some market observers, particularly financial institutions, to significantly upgrade their forecasts, with some even predicting three-digit prices.

Goldman Sachs expects oil prices to hit $75/bl during the second quarter of 2021, then $80 during the third quarter. JP Morgan even mentioned prices hitting three digits once the global economy fully recovers from the pandemic. Such a rally would be part of a “commodities super cycle,” a current buzzword in the financial community, whereby commodities from iron ore to oil and staple crops trade above their long-term average prices for several years.

Others remain more cautious. The United States Energy Information Administration (EIA), for instance, expects oil prices to average $65/bl in the second quarter of 2021, $61/bl during the second half of 2021, and $61/bl in 2022. The CEO of French oil major Total has suggested that prices between $50-60/bl were more likely.

Daily Spot Oil Price, Jan - Jun 2021

Data Sources: Bloomberg; EIA, 2021

There are sound reasons to be optimistic. However, if history is any indicator, oil-price predictions are often less accurate than weather forecasts. Covid-19, the mother of all market threats, is still alive and kicking, and even mutating. All oil market and economic projections now feature a disclaimer warning about the continued uncertainty caused by the coronavirus, and rightly so. Still, one development appears unlikely even when the pandemic is brought under control: a steep upward trajectory in prices.

The article was first published by the Geopolitical Intelligence Services

To request a copy, contact us on [email protected]

Related Analysis

“New Opportunities 2021: Some optimism for oil markets“, Dr Carole Nakhle, Feb 2021