Dr Carole Nakhle

Oil markets remain impressively stable despite enormous uncertainty around how the Covid-19 pandemic will develop and how fast the global economy (and therefore oil demand) will recover. A lot of the credit goes to OPEC+. The group – consisting of OPEC, Russia and several other oil-producing countries – has not managed to bring prices back to their pre-Covid levels, but it has succeeded in stabilizing them in the range of $40-45 (for Brent crude).

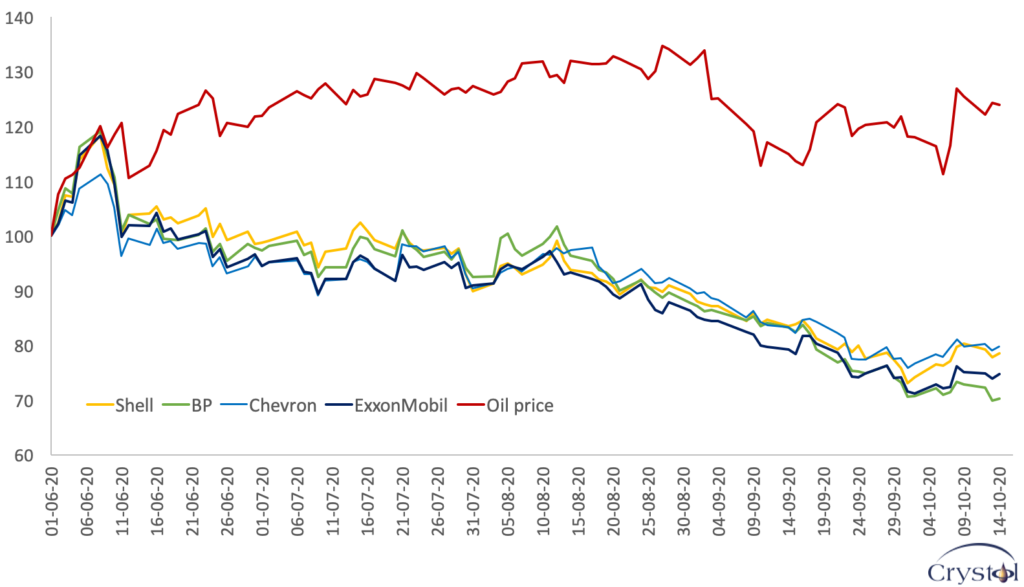

The slight increase in oil prices in August brought some optimism, leading commentators to predict a tightening market – and therefore much higher prices – by the end of the year. Such predictions soon proved premature, as oil prices fell back to their June levels, where they seem to have settled for now.

Oil majors’ share price and Brent oil price (June 2020 = 100)

Source: US EIA

Nevertheless, most forecasting agencies expect prices to rise next year. Banks like Goldman Sachs are the most bullish, predicting that prices will hit $65 per barrel by the third quarter. Those expectations are in line with most economic forecasts, which predict rapid growth starting in 2021, though a return to pre-Covid levels is not expected for a few years.

Only time will tell how accurate such projections are. Energy analysts are no strangers to changing forecasts. This time they may be overlooking some brewing forces that could discredit their analyses. The oil companies’ recent share price performance shows the disconnect between energy analysts’ expectations and those of investors.

Related Analysis

“Oil market outlook: sailing in the dark”, Dr Carole Nakhle, Sep 2020

“Oil market outlook: A cautious global recovery”, Dr Carole Nakhle, Jul 2020