Dr Carole Nakhle

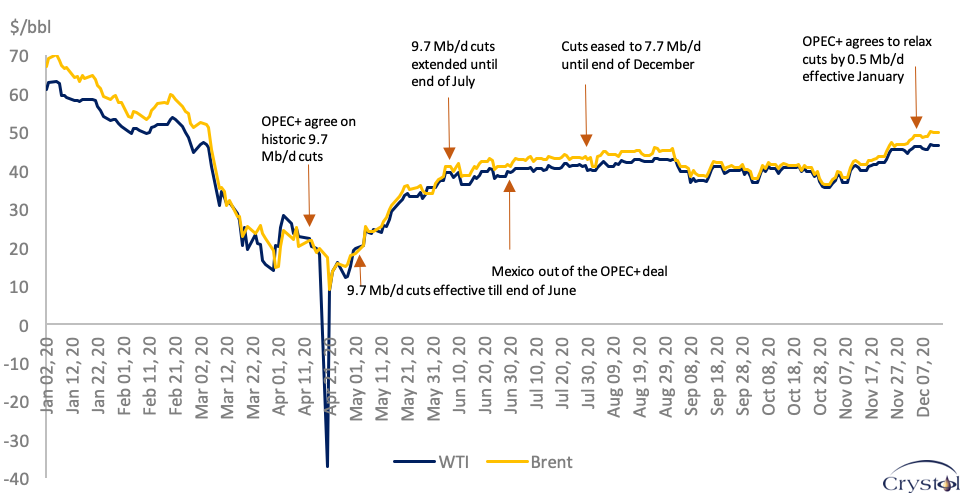

Oil prices have ended the year on a relative high, compared to levels since March. Prices are still lower than at the beginning of the year. But they have picked up after six months of inertia and seem to be heading in the right direction from the point of view of major oil producers like OPEC+, which is taking credit for the uptick.

Several questions remain. First, it is unclear whether oil prices can maintain their momentum into the immediate future and throughout 2021. Many factors are hazy, particularly on the demand side. A second set of issues, this time on the supply side, revolve around the prices that OPEC+ will deem satisfactory. The organization may aim for price levels that would get the major producing countries closer to balancing their budgets. But this will also depend on the price growth needed to revive production outside the group, particularly with shale oil in the United States.

Daily oil prices in 2020

Source: US EIA, Bloomberg

Most commentators agree that U.S. shale oil has had its heyday and will never return to this year’s peak of nearly 13 million barrels a day (13 mb/d). There is no doubt that the U.S. shale industry is deeply bruised – but so is the global oil industry, whether state or privately owned.

Should shale output defy expectations, as it has done on several occasions in the past, OPEC+ would face, once again, tougher competition – offsetting the benefits of higher revenues brought on by market recovery.

Related Analysis

“Oil market outlook: A quandary for OPEC+“, Dr Carole Nakhle, Sep 2020