Dr Carole Nakhle

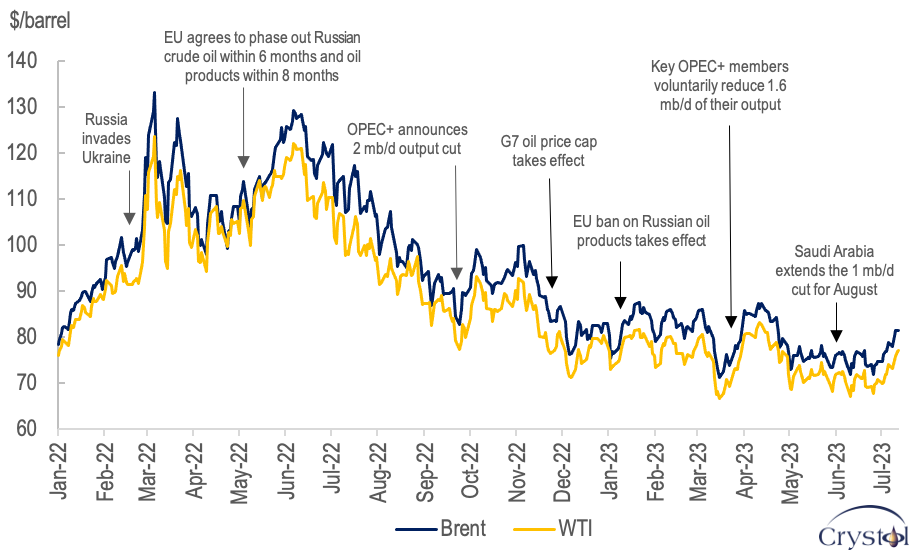

When Russia invaded Ukraine in February 2022, oil prices spiked to nearly $130 per barrel (/bl) in the following month. Back then, the International Energy Agency (IEA) predicted a loss of 3 million barrels a day (mb/d) – that is about a third of Russia’s total production and almost 3 percent of the global output – and warned that this could produce “the biggest supply crisis in decades.”

Those fears persisted until at least the summer. In July 2022, JP Morgan warned that Russia could cut up to 5 mb/d of production, driving global oil prices to a “stratospheric” $380/bl. Although such gloomy forecasts did not materialize, most forecasting agencies and financial institutions continued to expect a tight market in the second half of this year. Goldman Sachs anticipated oil prices would hit nearly $100/bl in that period. In April 2023, the IEA concluded, “our oil market balances were already set to tighten in the second half of 2023, with the potential for a substantial supply deficit to emerge.”

However, oil prices did not move according to those projections. On the contrary, for a year now since June 2022, they have been on a downward trend, despite the ongoing war in Ukraine and the multimillion-barrel cuts OPEC+ has announced since October 2022. By June 2023, oil was trading at least $50/bl less than exactly a year earlier.

What pushed prices down?

Market expectations have shifted from fears of supply scarcity in the face of a rapidly growing demand to concerns about trailing demand and too much supply. In June this year, Goldman Sachs reduced its 2023 price forecast to $86/bl.

A bearish macroeconomic outlook, especially in major consuming nations, and resilient Russian production are often cited as the main reasons behind the shift. It is also basic economics: both supply and demand react to prices, though with a time lag. Furthermore, while spikes can still be expected and volatility – a key feature of global oil markets – will not be gone, one key difference with 2022, which tends to be overlooked in today’s oil market analysis, is the larger safety cushion built up in the system. For that, OPEC takes credit, even if it was an unintended consequence of the producer group’s recent actions.

Oil prices, January 2022 – July 2023

Data Sources: EIA, Bloomberg

Divergent oil demand forecasts

The IEA and OPEC continue to estimate that oil demand will grow by 2.2 and 2.4 mb/d respectively this year to hit a record 102 mb/d. However, OPEC acknowledges that its forecast is subject to many uncertainties, including global economic developments and ongoing geopolitical tensions. Interestingly, the United States Energy Information Administration (EIA), which traditionally was the most bullish regarding oil demand growth (with OPEC the most conservative and IEA in the middle), has taken a more cautious stance. It forecasts a growth of 1.76 mb/d, or ca 500,000 barrel per day less than its two counterparts. That difference largely stems from its more subdued outlook for non-OECD demand.

Oil demand is affected by several factors, primarily the economic outlook – the so-called income effect, where stronger economic growth fuels oil demand, and weak growth reduces it. In its June 2023 Global Economic Prospects report, the World Bank drew a gloomy outlook: the world economy will remain “frail” and in a “precarious state,” at risk of a deeper downturn this year and in 2024, amid the protracted effects of the overlapping negative shocks of the Covid-19 pandemic, Russia’s invasion of Ukraine and the sharp tightening of monetary policy to contain high inflation. The bank expects global growth to slow significantly in the second half of this year, with weakness continuing in 2024. Such a forecast does not support a strong oil demand growth scenario.

Enter the China factor

Various institutions have pinned their hope on restored economic growth in China and firming oil demand globally. In its July 2023 oil market report, the IEA expected China to account for 70 percent of demand growth this year. Earlier in the year, Goldman Sachs stated that oil demand growth from China – the world’s second-largest oil consumer after the U.S. – would boost the price of Brent) by at least $15/bl.

However, as the World Bank has found, “the optimism that arose with the end of China’s Covid-19 shutdown earlier this year proved to be fleeting.” Here two main factors come into play. First, the Chinese economy is export-oriented and is therefore exposed to the economic health of its markets. Second, domestic demand has not rebounded as many had hoped. One reason is the fact that the Chinese government did not give generous cash handouts that would have boosted spending, unlike the U.S. government’s fiscal response to the pandemic shock. China’s industrial output and retail sales growth in May 2023 were below expectations, which led some major banks, such as HSBC, to downgrade their forecasts for the country’s gross domestic product (GDP).

In June, the National Bureau of Statistics of China warned that “the international environment is still complicated and severe, the domestic structural adjustment has mounting pressure, and the foundation for the economic recovery is not yet solid.” Indeed, July data showed slowing momentum as China’s gross domestic product (GDP) grew 0.8 percent in the second quarter of 2023 compared to 2.2 percent in the first quarter. The political tensions between the U.S. and China only add to the pressure.

The role of the U.S. and other non-OPEC producers

Meanwhile, the oil supply continues to grow. This year, however, it will be largely driven by non-OPEC+ producers, namely the U.S., Brazil, Norway, Canada and Guyana. Even though growth in U.S. shale production is not as strong as witnessed in the pre-pandemic years, the U.S., currently the largest oil producer in the world, is expected to account for half of the non-OPEC growth this year, exceeding previous forecasts.

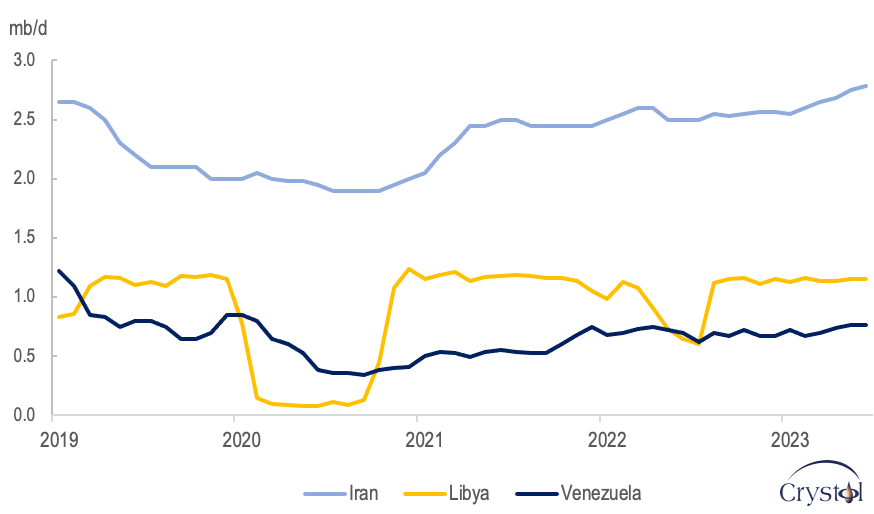

Within OPEC+, Russian oil production’s resilience and its exports continue to capture media attention. A decrease in Russian oil deliveries is now expected, partly because of Russia’s pledges earlier this year to reduce its exports by 500,000 b/d, and its recent pledge to cut an additional 500,000 b/d in August. It remains to be seen if all those cuts will be delivered , especially as accurate data on Russian output is getting more difficult to obtain. Meanwhile, OPEC quota-exempt countries – Iran, Libya and Venezuela – have ramped up production a bit. Iran has surpassed its 2019 figures, with its crude oil exports exceeding 1.5 mb/d in May, the highest monthly level since 2018.

Oil production in OPEC quota-exempt countries

Data Source: EIA

The production cuts

OPEC+ announced several cuts: 2 mb/d in October 2022, then 1.6 mb/d in April 2023, and the unilateral cuts Saudi Arabia communicated in June 2023. Then, with Russia showing support, extended them to August, and Russia announced additional cuts in the same month. Although the producers’ group described those cuts as “precautionary,” “preemptive” and “proactive” measures, they attracted criticism from various quarters. The White House responded to the October cuts with, “there will be consequences,” then the IEA warned that the April cuts risked exacerbating strains in oil markets, pushing prices higher. No publicly known “consequences” were seen, and the damaging risks of higher prices did not materialize.

Some have argued that because OPEC+ cuts have failed to put notable upward pressure on prices, the producer group’s influence over the market has diminished significantly. That, however, is only one aspect of the relationship between OPEC and oil markets.

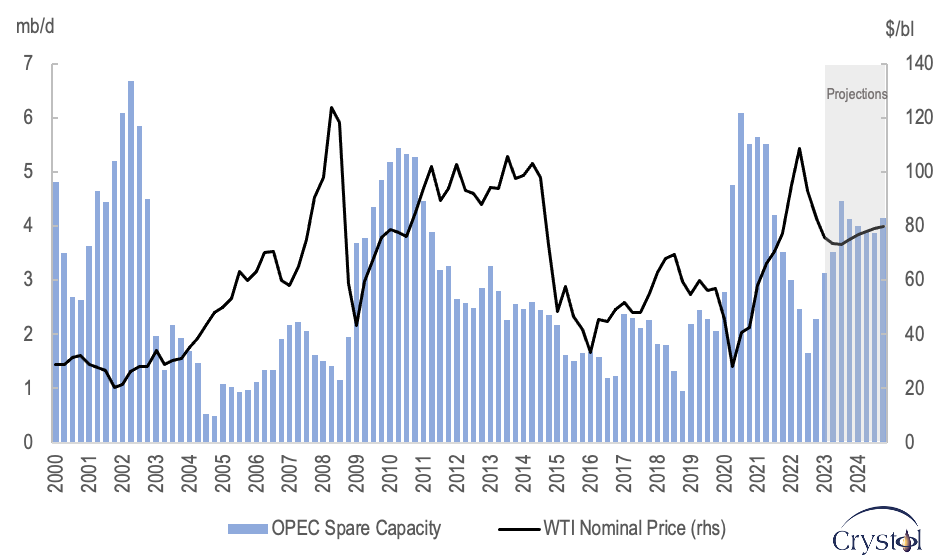

The role of OPEC’s spare capacity

Data Source: EIA

Another critical factor that has shaped oil markets for decades and will continue to do so for the foreseeable future is OPEC’s spare capacity, defined as the volume of production that can be brought on within 30 days and sustained for at least 90 days. It is that spare capacity that primarily gives OPEC and, particularly, the countries where it is concentrated – namely Saudi Arabia, which holds the lion’s share, Kuwait and the UAE – the important influence on global oil markets.

OPEC’s spare capacity indicates the world oil market’s ability to respond to potential crises that threaten oil supplies. As a result, oil prices tend to incorporate a higher risk premium when OPEC spare capacity is running low, and vice-versa.

Scenarios

In 2022, many warned of the heightened dangers of the low spare capacity that OPEC held then. Barclays, for instance, concluded that dwindling spare capacity would be a key driver for heightened volatility in the oil market and raised its price forecasts accordingly.

However, due to the production cuts announced between October 2022 and June 2023, OPEC’s spare capacity is being replenished, rendering support to current price levels despite the prevailing geopolitical uncertainties.

OPEC+ members have repeatedly announced that their core mission is to achieve market stability. Market stability remains a subjective matter without a stated reference price against which to benchmark. However, if one translates market stability into a lower likelihood of price spikes, then replenishing spare capacity does indeed help OPEC+ in its mission.

The current situation is far from the tight market many had feared earlier this year. And while those warnings have now been “rolled over” for 2024 – “this could leave the market in deficit in 2024, with the second half looking particularly tight,” as the IEA (referring to OPEC+ cuts) recently put it. OPEC’s spare capacity gives the market a significant safety cushion. That alone should call for caution when it comes to forecasting future prices. In the longer term, economic growth will decide how tight the market will become.

Facts & Figures

Projections for 2023 and 2024

- OPEC expects non-OECD oil demand to grow by 2.37 mb/d in 2023, accounting for nearly all the growth in oil demand compared to the IEA’s 2.16 mb/d (or 90% of total growth and China accounting for 70%) versus the EIA’s 1.64 mb/d.

- The World Bank’s baseline scenario calls for global growth to slow from 3.1% in 2022 to 2.1% in 2023 – before inching up to 2.4% in 2024.

- HSBC forecasts China’s GDP to grow 5.3% in 2023, down from the 6.3% expected earlier.

- The EIA projects U.S. crude oil production to climb by 670,000 b/d to 12.56 mb/d in 2023.

- The share of Russian oil exports heading to India increased from 1% in 2021 to 28% in March 2023.

Related Analysis

“Increasing pressure on Russia’s oil industry“, Dr Carole Nakhle, Apr 2023

Related Comments

“Saudi Arabia Voluntary Output Cut“, Dr Carole Nakhle, Jun 2023

“OPEC+ makes shock million barrel cut“, Dr Carole Nakhle, Apr 2023