Dr Carole Nakhle

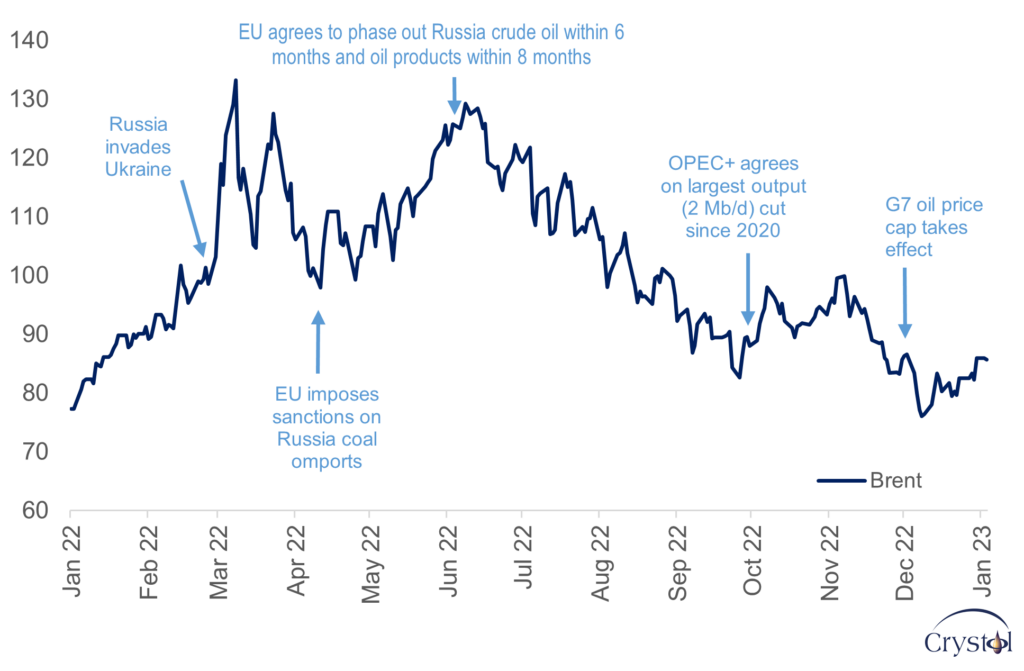

Although oil markets are no strangers to volatility, oil prices exhibited notable swings in 2022. Russia’s invasion of Ukraine on February 24 created significant uncertainty, and prices spiked accordingly. On March 8, Brent, the industry’s main global benchmark, exceeded $133 per barrel – jumping more than $50 compared to the beginning of the year and reaching a level last seen in June 2008, just ahead of the global financial meltdown.

No one knew the geopolitical consequences, and many feared a substantial loss of Russian oil supplies. For example, the International Energy Agency (IEA), predicted that “from April, 3 million barrels per day of Russian oil output could be shut in” – about a third of Russia’s total production and almost 3 percent of the global output. The agency warned that this could produce “the biggest supply crisis in decades.”

Looking through frosted glass

However, those fears gradually dissipated. Russian oil exports proved more resilient, thanks to the basic functioning of a liquid, global market, which allowed a redirection of trade flow with more Russian crude diverted from Europe to Asia, and more Middle Eastern and other non-Russian oil sent to Europe. Prices eased accordingly and ended the year around the same levels they started. Still, on a yearly basis, they were 43 percent higher compared to 2021.

Many wonder whether the upward march will accelerate in 2023, as largely predicted by the bulls of Wall Street. Although most published oil price forecasts for this year have been revised downward compared to previous estimates, they currently fall within the $90 to $100 per barrel range.

Oil price in 2022, $/barrel

Data Sources: EIA, Bloomberg

However, the industry’s track record of predicting oil prices is poor, and any assumption is likely to prove wrong. That is even more so today, given the high level of uncertainty surrounding fundamental dynamics that directly influence oil markets but are acting in opposite directions, with geopolitics and economic warfare, China and the global economic outlook being the most unpredictable factors for this year and beyond.

Putting a squeeze on a giant

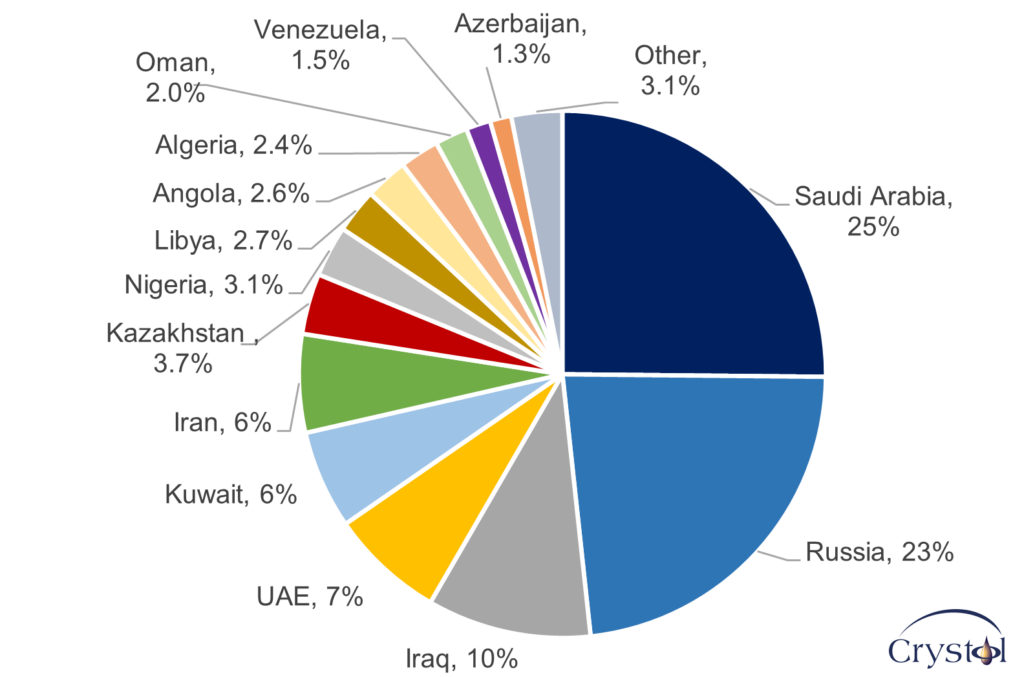

Russia’s role in global oil markets cannot be underestimated. It is the world’s third-largest producer after the United States and Saudi Arabia and the second-largest exporter after Saudi Arabia. It is also a key member of the OPEC+ group, where it stands as the second-largest producer after the Saudi kingdom, with production more than twice the level of OPEC’s second-largest producer, Iraq.

OPEC+ share of production by country (Dec. 2022)

Source: SPGlobal

Russia is also the world’s most sanctioned country. In less than a year, the European Union alone adopted nine sanctions packages, targeting various sectors, businesses and individuals in the country. Of most relevance are the sanctions imposed on Russian oil. In its sixth package announced in June 2022, the EU announced it would ban imports from Russia of crude oil and refined petroleum products, effective from December 2022 and February 2023, respectively. A temporary exemption was given for imports of crude oil by pipeline into those EU member states that, due to their geographic situation, have no viable alternatives.

Then in the eighth package announced in October, the EU stated it would impose a price cap on the maritime transport of Russian oil for third countries, in line with the G7 recommendation. The cap would allow non-EU countries to continue to trade Russian oil, using EU services such as insurance and tankers, as long as that oil is not paid for above the level set by the cap. The cap was set at $60 per barrel on December 3, 2022.

Interestingly, following that announcement, oil prices decreased. Although the Russian government responded that it would not supply oil to any country abiding by the cap, the statement was thin on the details and the specifics leaving room for potential flexibility. Furthermore, the cap is close to (or in some transactions, well above) what Russian crude oil has been selling for, meaning it has not made any difference to existing purchasers who are de facto abiding by the cap. Concerns about the supply outlook eased “amid signs of a well-supplied crude market and transpiring details about the G7 price cap on Russian crude,” OPEC said in its December oil market report.

So far, Russia’s oil production has remained essentially unchanged. According to the latest IEA estimates, Russian oil output is just 200,000 barrels per day below pre-invasion levels. However, things might be different this year as the sanctions bite harder.

For instance, some argue that while Russia has been able to redirect its crude oil from Europe to Asia, with China and India being the biggest buyers, the same may not apply to its refined oil products. Countries like China and India already have large refining capacities and prefer to take cheap crude oil and process it domestically rather than buying refined oil. However, it all boils down to economics, and the G7 is yet to reveal the cap on Russian oil products.

On balance, there seems to be a consensus that oil markets will experience a more significant loss of Russian oil this year than in 2022 but estimates still vary. While OPEC, for instance, expects the loss to be around 850,000 barrels per day, the IEA set that figure to nearly 1.5 million barrels a day (mb/d). The larger the loss, the higher the upward pressure on oil prices. JP Morgan warned that Russia could cut up to 5 mb/d of production, driving global oil prices to a “stratospheric” $380 per barrel – an unrealistic scenario in our view.

Enter the Chinese dragon

On the demand side, China’s sudden abandonment of the zero-Covid-19 policy announced in early December 2022 is the big story. Since the announcement, Covid-19-related restrictions and requirements have been dismantled. A “reopening” of the Chinese economy will be felt everywhere, particularly in oil markets. China is the world’s largest importer of crude oil, the second-largest oil consumer after the U.S. and the second-largest economy after the U.S.

According to the World Bank, nearly half of the growth in oil consumption in 2023 is expected to come from China. Bank of America argued that as the country reopens, more than a billion people will start traveling and spending, increasing demand for energy and other commodities. Goldman Sachs estimates that China’s reopening will add 1 mb/d to global demand (or around 1 percent of world consumption), putting an extra $5 a barrel to oil prices.

However, some, like UBS, wisely argue that the oil demand recovery in China is unlikely to be a one-way street – but rather a bumpy road with renewed setbacks, driven by possible temporary reimposed restrictions. Indeed, the rapid spread of Covid-19 among the widely unvaccinated population may well mean that the situation in China will worsen before it improves.

No one knows when the better phase will start and how the state of the rest of the world will be, including whether it will coincide with a slowdown in other major economies. International Monetary Fund (IMF) Managing Director Kristalina Georgieva has noted that for the first time in 40 years, China’s annual growth is likely to be at or below global growth, which could drag down worldwide economic activity rather than propel it.

Scenarios

Widely expected deceleration

According to the IMF, a third of world economies will enter a recession this year, including China, the EU and the U.S., which together account for nearly half of world oil consumption. “The worst is yet to come,” the fund has warned. The World Bank issued a similar warning in its latest Global Economic Prospects report. “Global growth is slowing sharply in the face of elevated inflation, higher interest rates, reduced investment, and disruptions caused by Russia’s invasion of Ukraine,” the report stated.

To fight inflation, central banks in major economies are raising interest rates. However, the recent deceleration in inflation rates has given market observers some optimism that inflation has peaked in countries such as the U.S., which could lead central banks to soften their stances. A slower rise in interest rates would ease the negative consequences on economic growth. However, inflation rates are still at decade highs and central banks still have a long way to go to reach what they perceive as acceptable inflation levels.

Former U.S. Treasury Secretary Lawrence Summers recently cautioned against “false dawns,” while the IMF’s chief economist, Gita Gopinath, urged central banks to stay the course. She said of the U.S. economy, “it’s clear that we haven’t turned the corner yet on inflation.”

However, a recession is unlikely to be evenly distributed; it can be more severe and long-lasting in some countries than others. At this stage, it is difficult to predict who the lucky ones will be.

Economic growth affects oil markets primarily through its impact on oil demand. A deceleration of economic activity dampens oil demand as it reduces income levels, putting downward pressure on prices, and the opposite is true. But OPEC+ will remain on guard, ready to introduce cuts to stop prices from sliding below a certain level. The decision to cut 2 million barrels a day in October 2022 illustrated the group’s determination.

Given the fluidity of the situation and the interaction of geopolitics and economics, it would be premature to formulate a firm judgment about the direction of oil markets this year. Meanwhile, many will continue to engage in guesswork about prices, and we should expect price forecasts to continue to be revised. As one study cleverly put it, “even if we understand the determinants of the price of oil, predicting these determinants can be very difficult in practice.”

Facts & Figures: 2022 oil factbox

- In 2022, West Texas Intermediate (WTI) and Brent crudes averaged $94 and $101 per barrel – an increase of about 39% and 43% compared to 2021 levels, respectively.

- In December 2022, Russian oil exports to India reached a new high of 1.3 mb/d.

- Most tankers transporting Russian crude oil in 2022 were Greek-owned.

- London is the world’s leading center for marine insurance.

- The IMF predicts global growth will slow to 2.7% next year, 0.2 percentage points lower than its July forecast. Half of the EU will be in a recession in 2023.

- China’s economy grew by 3% in 2022, well below Beijing’s official growth target of 5.5%, which was already the lowest in decades.

- Non-OPEC supply is forecast to expand by 1.5 million barrels a day. The U.S. is expected to lead the way with a share of about 75% of total growth.

- OPEC+ is a group of 23 OPEC and non-OPEC producers that entered cooperation in December 2016.

Related Analysis

“Russia’s oil is in long-term decline – and the war has only added to the problem“, Dr Carole Nakhle, Jul 2022

Related Comments

“The role of China in oil markets“, Dr Carole Nakhle, Jan 2023

“What is the Outlook for Commodities in the Wake of Peak Inflation & Peak Rate Tightening Cycle in 2023?“, Dr Carole Nakhle, Jan 2023

“Outlook for oil and gas markets for 2023“, Dr Carole Nakhle, Jan 2023