Dr Carole Nakhle

The momentum toward electrifying the transport sector continues to accelerate, forcing major oil producers to adjust their long-term strategic focus. Following record-breaking electric vehicle (EV) sales in 2024, projections for 2025 point to yet another historic year, reinforcing the global shift toward low-emission mobility.

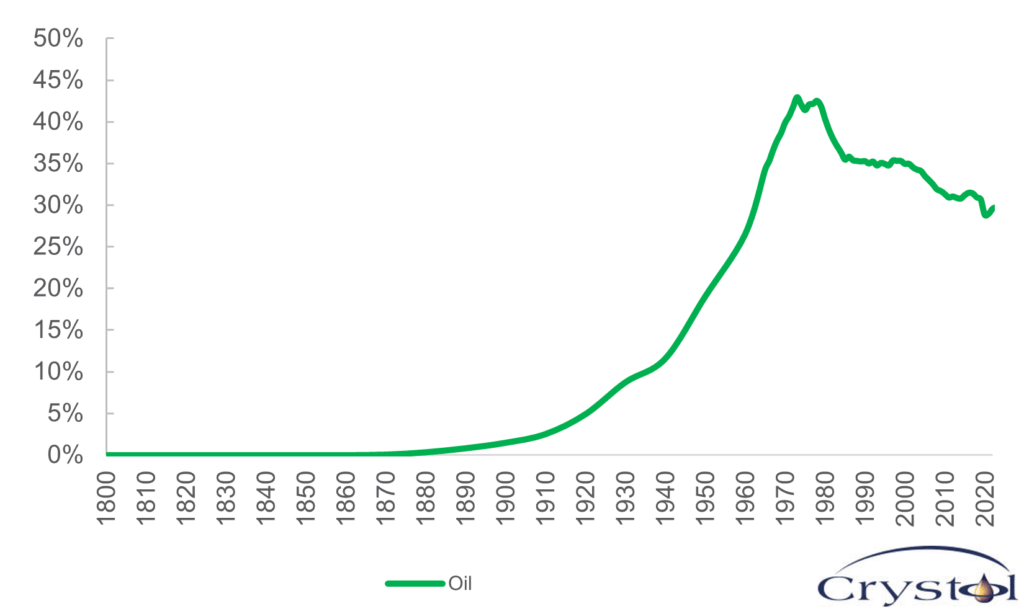

For oil market observers – and producers in particular – this evolving landscape signals a transformative shift. Although oil’s share in the global primary energy mix peaked in 1973 following the first oil shock and has since declined across most sectors, transport remained the one domain where oil preserved its dominance. This is due to what can be described as oil’s unique specialization: unmatched suitability for fueling the internal combustion engine thanks to high energy density, ease of transport and an established global supply chain.

But this was not the result of deliberate design. In fact, oil was nearly written off in the late 19th century, as electricity and the incandescent light bulb rendered its primary use – kerosene for oil lamps – obsolete. Its resurgence came from a historical coincidence: the development of the internal combustion engine. This technology gave oil a second life and placed it at the heart of the modern industrial economy, particularly in transport, securing its centrality in modern economies for more than a century. Today, that preeminence is being challenged.

With the rapid rise of EVs and improvements in battery technology and charging infrastructure, the foundations of oil’s specialization are beginning to erode. Unlike other fuels, such as natural gas – which faces substitutes in each of its applications – oil has long enjoyed an exclusive, irreplaceable role in transport. If that is undone, it will mark a turning point for the oil market.

Share of oil in global energy mix

Source: Our world in data

The critical role of the transport sector

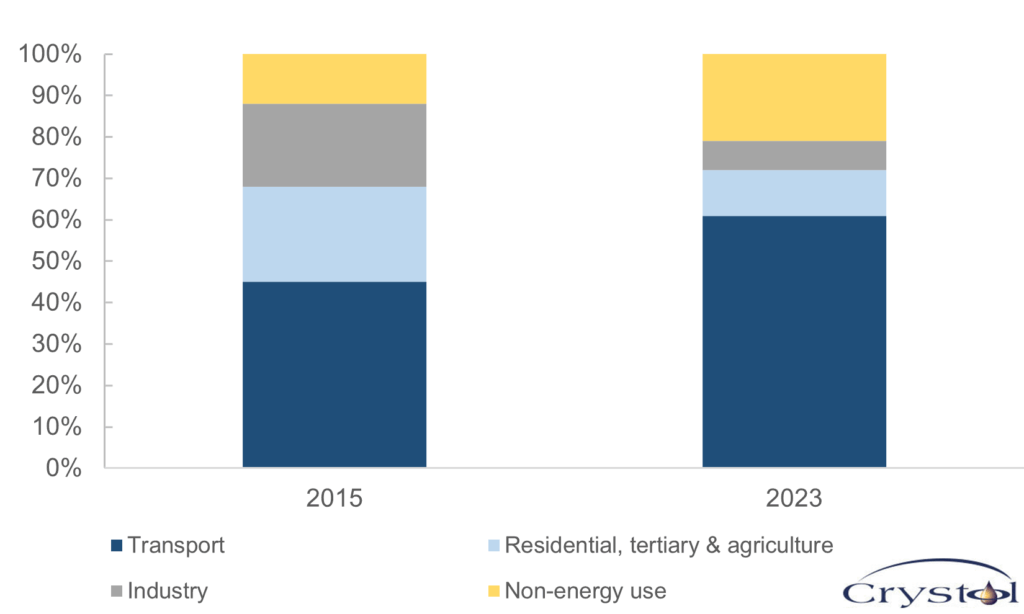

To understand the enduring connection between oil demand and transport, it is important to examine how oil products – such as diesel, gasoline, kerosene, jet fuel, and other fuel oils – are consumed.

Historically, transport has been the largest single consumer of oil. Although oil was initially shared across major sectors like industry or non-energy use like petrochemicals and residential heating, a clear divergence began after the 1973 oil shock, which led to an era of high oil prices and energy insecurity.

In response, many sectors sought alternatives. Industry and residential heating gradually shifted toward natural gas, coal and electricity – enabled by technological advances, infrastructure development and supportive policies. However, because of the widespread use of internal combustion engine vehicles, the lack of scalable alternatives, and the high energy density and convenience of liquid fuels, oil’s dominance in transport not only persisted but grew. Today, transport – including road, aviation and marine shipping – accounts for more than 61 percent of global oil consumption, with road transport alone making up nearly half. Oil still supplies nearly all the energy consumed in the sector.

Oil use by sector

Source: Enerdata; IEA

To grasp the importance of the transport sector to global oil demand, consider the events of 2020: The Covid-19 pandemic nearly brought road and air travel to a standstill, leading to a 10 percent drop in global oil demand. Prices plummeted so dramatically that the North American WTI benchmark briefly turned negative. In response, the Organization of the Petroleum Exporting Countries (OPEC+) was forced to intervene, cutting nearly 10 percent of global oil supply to stabilize the market and prevent a collapse.

EV’s expansion

From an environmental standpoint, the transport sector is a major contributor to global greenhouse gas emissions, accounting for roughly one-fifth of total carbon dioxide emissions – mostly from road vehicles. As a result, decarbonizing transport has become a central pillar in efforts to meet climate goals and achieve net-zero emissions by mid-century. Leading this transition in road transport are EVs, driven by rapid advancements in battery technology, falling production costs and supportive government policies worldwide.

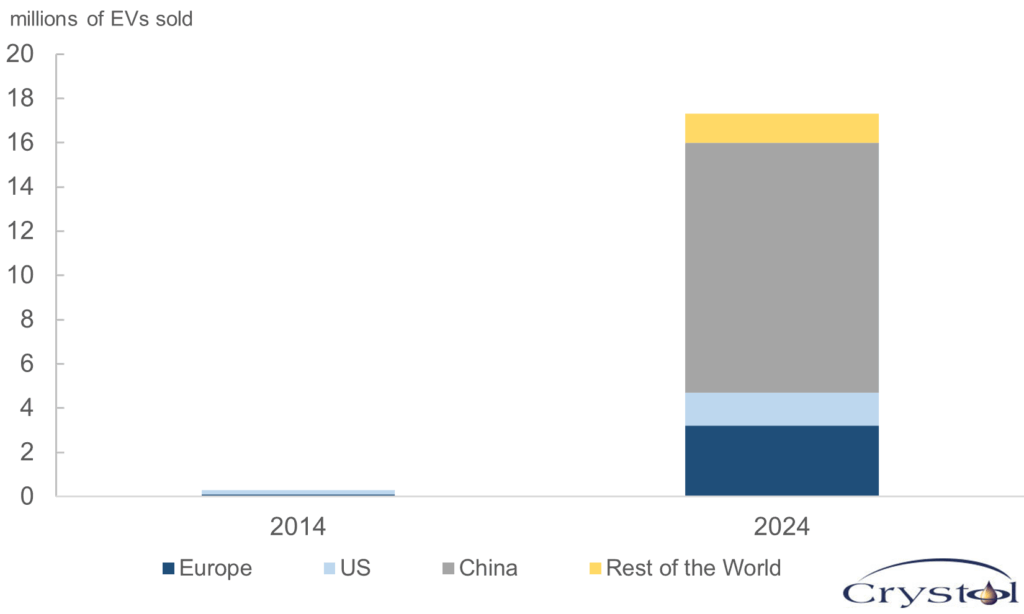

The EV revolution is gaining significant momentum. According to BloombergNEF’s Electric Vehicles Outlook, global passenger EV sales are projected to reach nearly 22 million units in 2025 – a 25 percent increase from 2024. The International Energy Agency (IEA) estimates that the total global EV fleet could reach 250 million by 2030.

Global EV sales

Source: IEA

In Norway, EVs make up 92 percent of new car sales and one in four EVs is Chinese-made. However, in absolute terms, the global impact of Norway’s transition to electrified transport is modest due to the country’s small vehicle fleet – fewer than 3 million cars nationwide. By contrast, China, with a fleet of around 340 million vehicles, dominates both EV sales and production. In 2024, nearly half of all new cars sold in China were electric, and the country accounted for almost two-thirds of global EV sales. Europe and the United States followed with 17 percent and 7 percent of global EV sales, respectively.

China also led global EV production in 2024, manufacturing more than 70 percent of all EVs worldwide. BYD, a Chinese automaker, became the world’s top EV producer, claiming over 22 percent of global sales – more than double Tesla’s share of around 10 percent. The third-largest EV manufacturer was also a Chinese company, with a 4 percent global market share.

This dominance has been no accident. The Chinese government has played a decisive role, supporting supply and demand through industrial and economic policies, generous subsidies, tax incentives, state procurement programs and long-term planning. As a result, a host of competitive homegrown EV brands have emerged, many of which are now expanding globally.

Long road ahead for EVs

Despite the rapid growth of EVs, they still have a long way to go before they can transform and decarbonize the global transport sector. Today, there are approximately 1.6 billion vehicles on the road worldwide, but only around 1 percent of them are electric. Projections suggest the global vehicle fleet will grow to about 2 billion by 2030. Unless the current momentum accelerates dramatically, the IEA’s estimate of 250 million EVs may hold true, translating to roughly 13 percent of the total fleet – an impressive increase, yet still a modest share.

Moreover, EV adoption remains highly uneven across regions. Outside of China, EVs are often seen as luxury products, largely confined to wealthier nations. In many low- and middle-income countries, even conventional vehicle ownership is limited due to affordability constraints. As a result, electrification may be concentrated in a few advanced economies.

Infrastructure remains another major challenge. Many countries, even those with high EV sales, face shortfalls in public charging networks, especially fast chargers. This contributes to “range anxiety,” particularly for consumers in remote areas. Furthermore, the environmental and social footprint of battery production, including the mining and processing of raw materials, raises sustainability concerns. Electric grids also need to adapt to rising EV demand. In some regions, increased EV charging loads (together with data centers) are already stressing local power infrastructure, particularly during peak hours.

Policy uncertainty also clouds the EV transition. Several governments that pledged to phase out conventional vehicle sales have revised or delayed those goals: The United Kingdom postponed its internal combustion engine ban from 2030 to 2035; in Europe, fiscal support for EVs has been scaled back; and in the U.S., President Donald Trump has introduced a series of policy reversals creating headwinds for EV adoption – from repealing the national target for EV uptake to eliminating the federal tax credit for new EV purchases.

A growing concern is the supply chain for critical raw materials – especially lithium, cobalt, nickel and rare earth elements – needed to manufacture EV batteries. These resources are not only geographically concentrated in a few countries (such as the Democratic Republic of the Congo for cobalt and Chile for lithium), but the processing and refining of most of these minerals is dominated by China.

Implications for oil demand

EV adoption is beginning to leave a measurable dent in global oil demand. According to the IEA, EVs displaced over 1.3 million barrels per day (mb/d) of oil consumption in 2024 – an increase of 30 percent from the previous year and roughly equivalent to Japan’s entire demand for transport oil. By 2030, this displacement is projected to exceed 5 mb/d, with China alone accounting for nearly half of the oil offset through its expanding EV fleet.

Skeptics point out that even 5 mb/d represents less than 5 percent of global oil demand – about half the volume lost during the Covid-19 pandemic. But this comparison overlooks two critical distinctions. First, the demand loss during Covid was temporary and cyclical; it rebounded once economies reopened. By contrast, the displacement from EVs is structural, driven by lasting changes in technology, consumer behavior and policy, and therefore unlikely to reverse. Second, structural demand loss does not need to be dramatic to be disruptive. Even modest declines, when sustained over time, can significantly reshape market dynamics, particularly when supply is no longer constrained.

Adding to this trend is the long-standing decline in oil intensity – the volume of oil consumed per unit of global gross domestic product (GDP). Since the first oil shock of the 1970s, oil intensity has been falling steadily, with a 56 percent reduction recorded by 2019. This trend has persisted through booms and busts, wars, revolutions and market disruptions. As one study notes, such consistency is exceedingly rare in long-run economic or energy data.

The combined effect of rising EV adoption and declining oil intensity points to a structural shift in oil demand dynamics. While the absolute volume of displaced oil may still seem modest in the context of a 100+ mb/d global market, its implications are far-reaching. In a rapidly growing demand environment, producers compete to increase output, and prices rise as supply tries to catch up. But in a stagnating – or even declining – demand landscape, competition intensifies in a different way: Prices come under downward pressure and only the lowest-cost producers can remain profitable. Marginal producers, particularly those with higher breakeven costs or limited fiscal flexibility, will find it increasingly difficult to sustain their positions.

In this new reality, the question is not simply how much oil EVs displace, but how that displacement, combined with broader efficiency gains, reshapes the competitive landscape. The high-rent era of easy profits for many oil exporters may be drawing to a close, not because oil is disappearing, but because its dominance is steadily and irreversibly fading.

Scenarios

Likely: Gradual disruption to oil markets, falling demand and intensifying competition

It is likely that the global EV transition continues its current trajectory, steadily expanding though falling short of fully displacing internal combustion engine vehicles in the global automotive fleet. Even so, the structural shift in oil demand will become increasingly apparent. The continued rise in EV sales, combined with other efficiency trends, will lead to a permanent loss of oil demand.

For oil producers, this means competition will no longer be about expanding supply to meet rising demand but about maintaining market share in a stagnating or slowly shrinking market. Prices will face downward pressure, and the global oil market will increasingly behave like a zero-sum game. High-cost producers will struggle to maintain revenues, and will face fiscal strain, declining geopolitical influence and mounting pressure on domestic budgets. Low-cost exporters – such as those in the Gulf – may be able to preserve their market share while having to accept lower returns. The oil market of the future will not vanish, but it will be more competitive.

Unlikely: EVs fall out of fashion and oil surges

If the momentum behind EV adoption falters due to an unlikely constellation of economic headwinds, reduced policy support, infrastructure bottlenecks and consumer resistance, global oil demand may resume an upward trajectory. Some factors augur for this outcome: Transport remains heavily dependent on oil, petrochemical demand continues to rise and the effects of energy efficiency gains are more than offset by increased consumption. The world could find itself in a high-demand, supply-constrained environment, reminiscent of the early 2000s.

In this scenario, oil producers with untapped reserves and low extraction costs will find themselves in an advantageous position. Nevertheless, the outlook here is mixed. Years of underinvestment in upstream capacity mean supply cannot ramp up quickly, leading to elevated oil prices benefiting exporters but placing inflationary pressures on oil-importing nations. Ultimately, this may offer short-term relief to oil producers, but it merely defers the inevitable adjustments they will need to make in a carbon-constrained world.

Related Analysis

“U.S. shale oil and gas: From independence to dominance“, Dr Carole Nakhle, Aug 2024

“The UK attempts to become a ‘clean energy superpower’”, Dr Carole Nakhle, Nov 2024

“Energy security: Perceptions versus realities“, Dr Carole Nakhle, Jul 2024

Related Comments

“Experts warn of trade tensions on oil demand“, Dr Carole Nakhle, Apr 2025

“Why London is a great place for energy transition“, Dr Carole Nakhle, Feb 2025