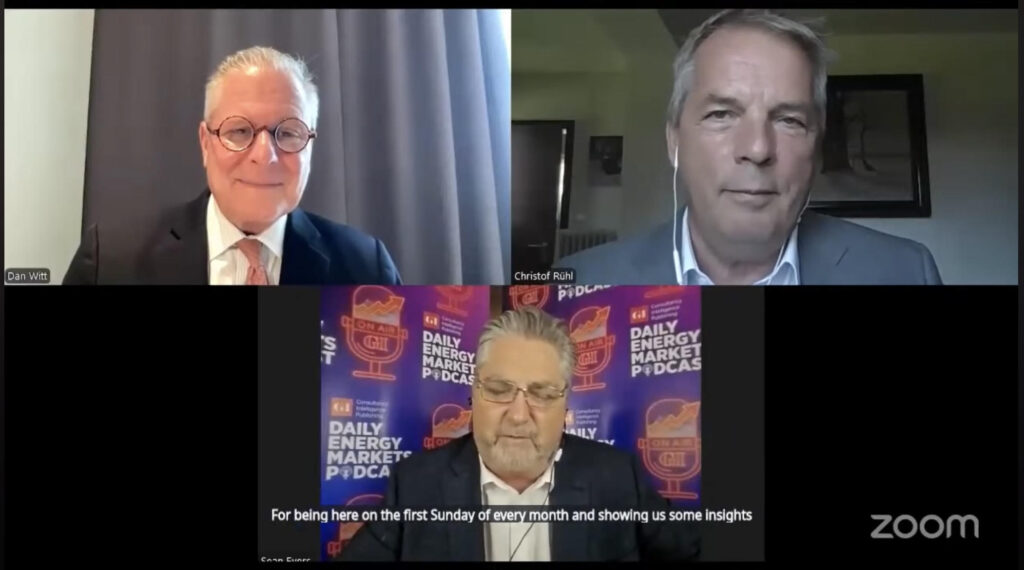

In this commentary to the Gulf Intelligence, two prominent members of our Advisory Board — Christof Rühl, Senior Research Scholar at Columbia University’s Center on Global Energy Policy, and Dan Witt, President of the International Tax and Investment Center — provided sharp analysis on global oil markets, OPEC+ strategy, and U.S. economic risks.

Christof Rühl: OPEC+ Market Share Strategy and U.S. Fiscal Risks

Rühl warned that the OPEC+ decision to raise oil output could lead to lasting price pressure by mid-2025. Saudi Arabia’s strategy appears focused on defending market share rather than price stability, risking a slow-motion price war amid growing rifts within the alliance — with Kazakhstan rejecting quotas and Russia favoring tighter supply.

He also highlighted the resilience of U.S. shale oil, noting its ability to bounce back within 12–15 months due to its flexible cost structure and infrastructure. Offshore projects remain unaffected due to their long-term nature.

On a macro level, Rühl cautioned that the greatest threat to oil demand is not from supply dynamics, but from U.S. fiscal and trade policy. Trump-era tariffs, erratic policymaking, and escalating fiscal deficits — combined with rising interest rates — risk undermining U.S. financial stability and shaking global investor confidence, especially if interest rates rise to 6–7%.

Dan Witt: U.S. Tariffs, Budget Realities, and Global Trade Alternatives

Dan Witt described the current U.S. trade environment as experiencing “tariff whiplash”, referencing the back-and-forth court rulings on the Liberation Day tariffs. He emphasized that Trump’s negotiation style—tariffs as leverage—creates global economic uncertainty, pushing trade partners to seek alternatives like the Middle Corridor trade route between China and Europe.

On the U.S. budget, Witt stressed that while maintaining the corporate tax rate at 21% supports competitiveness, the more urgent issue is overspending. With U.S. interest payments on debt soon exceeding defense spending, fiscal sustainability is at risk. He noted that reforms to entitlement programs, while politically contentious, won’t solve the broader challenge without addressing borrowing levels.

Sean Evers, Managing Partner from the Gulf Intelligence moderated the discussion.

Related Analysis

“Oil markets face uncertainty amid changing geopolitics” Dr Carole Nakhle, Feb 2025

Related Comments

“Oil rises after Trump announces tariffs on Canada“, Dr Carole Nakhle, Feb 2025