Dr Carole Nakhle, CEO of Crystol Energy, is quoted in this article written by Gaurav Sharma from Forbes where she assesses the stablity of the United Kingdom’s oil and gas fiscal regime.

Dr. Nakhle stated that politically motivated changes have reinforced the perception that the UK North Sea fiscal regime is among the most unstable in the world. Historically, the instability was balanced by a lower fiscal take from the U.K. government and fewer concerns about geopolitical risks. Today, however, the region faces high marginal tax rates. These rates are uncommon for similar jurisdictions but are typical in countries with larger fields and a sector dominated by major companies, including state-owned enterprises.

Despite this, the fiscal framework remains profit-based and progressive. This is unlike other regimes that rely on revenue-based mechanisms, such as royalties. Royalties are regressive because the government’s take increases when profitability falls.

Dr. Nakhle also noted that the government has offered some clarity for the next few years, helping to ease the impact of higher taxes. While the new proposal from Reeves is far from ideal for a shrinking sector, it still has some advantages compared to other global alternatives.

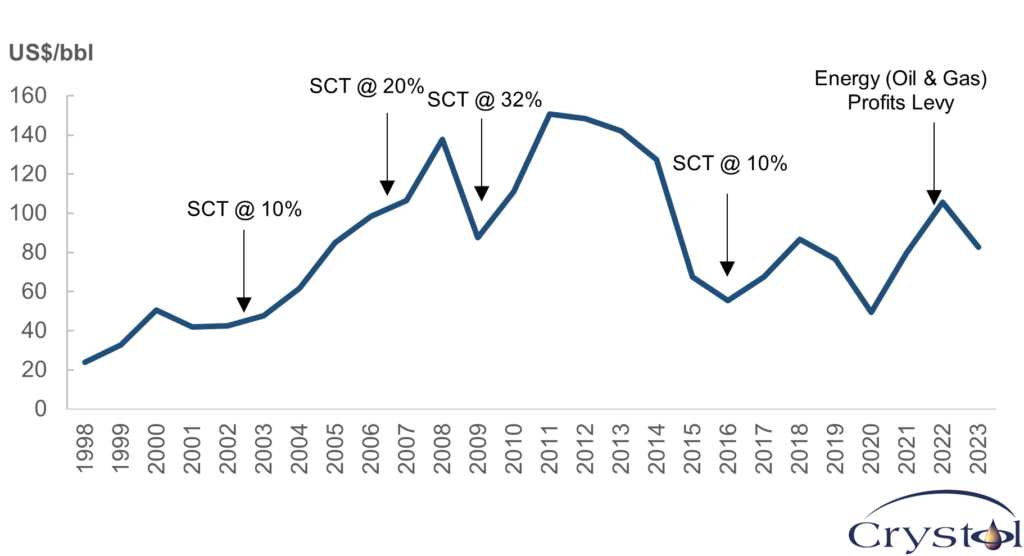

Oil price and UK government fiscal actions

The problem for the U.K. North Sea is that major players are almost gone. Independents are leaving, and those remaining are cutting investments. At this rate, the sector may not have much left in a few years. Many did not expect that politicized taxation, rather than economic factors and declining production, would speed up the North Sea’s decline. Yet, that seems to be happening now.

Related Analysis

“North Sea energy: The UK’s valuable national asset“, Dr Carole Nakhle, Jun 2022

Related Comments

“UK politics: The Labour Government’s agenda“, Dr Carole Nakhle, Jul 2024

“‘Complex and unstable’ UK tax regime for oil and gas is deterring investors“, Dr Carole Nakhle, Sep 2023