Dr Carole Nakhle, CEO of Crystol Energy, is quoted in this article by Davide Ghilotti from Upstream Online commenting on the United Kingdom (UK)’s upstream oil and gas fiscal regime.

According to Dr. Nakhle, the UK tax regime for oil and gas is complex and unstable, and therefore, deters investment. Countries’ tax systems can be built to capture windfall profits without jeopardising the stability of the system.

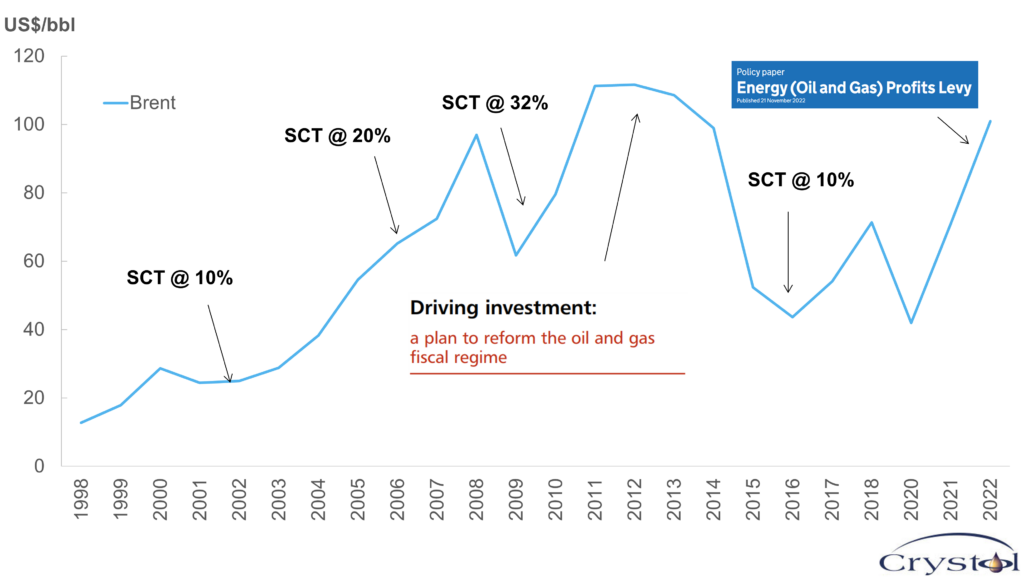

Oil price and UK government fiscal actions

Data source: EIA Note: “SCT” stands for the Supplementary Charge Tax

Dr. Nakhle added that the windfall tax was the government response to a combination of “economic and political pressure”. The main weaknesses of the UK tax regime are its instability and complexity due to regular tinkering and an attempt to chase volatile oil prices.

According to Dr. Nakhle, jurisdictions that offer a stable taxation regime can impose a higher government take. A well-designed tax regime should be able to adapt automatically to capture the windfall when there are higher than usual profits. For example, Norway, the UK’s North Sea neighbour, did not need to introduce a windfall tax, as the UK did, because it had it embedded in its original system and places significant importance to the stability of the regime.

Related Analysis

“Oil market: Shifting expectations“, Dr Carole Nakhle, Jul 2023

“The race to tax fossil fuel profits“, Dr Carole Nakhle, Jun 2023

Related Comments

“Energy Markets and Investment in Times of War and Transition“, Access for Women in Energy, Jul 2023

“Windfall taxes“, Dr Carole Nakhle, Feb 2023

“UK expands windfall tax to 35% for oil and gas companies“, Dr Carole Nakhle, Nov 2022