In this interview given to Alaa Joudi and Mohammed Al Selty from Asharq Business, Dr. Carole Nakhle, CEO of Crystol Energy, discusses the dynamics of global oil markets amid rising geopolitical tensions in the Middle East.

Key takeaways:

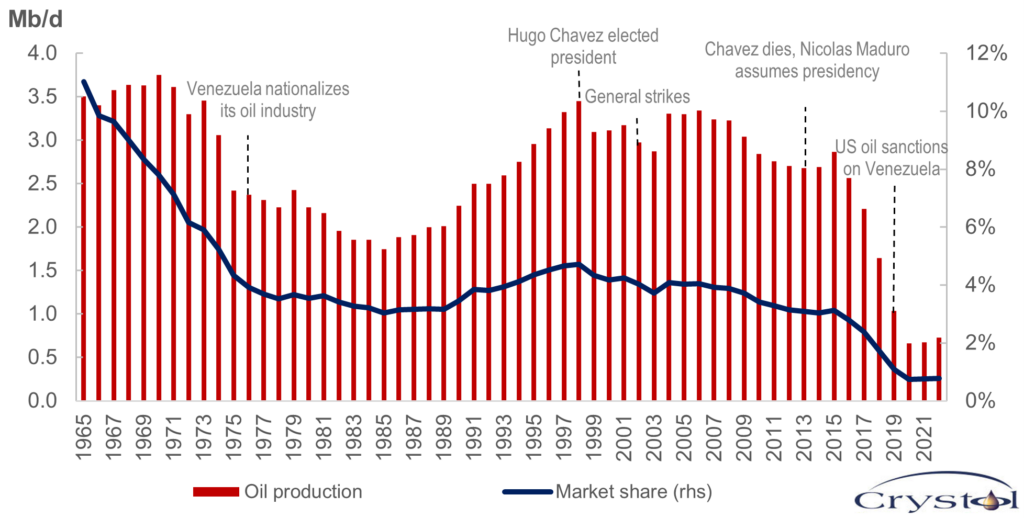

– Before the imposition of American sanctions, Venezuela was a key player in global oil markets, particularly as it sits on the largest proven oil reserves in the world. The sanctions have negatively affected investment in the Venezuelan energy sector and subsequently the country’s output. However, the sector was already suffering from adverse government policies after the late President Chavez came to power. An removal/alleviation of the sanctions can boost the country’s production and exercise certain downward pressure on prices, everything else being the same, but on its own it is unlikely to significantly alter global market dynamics.

Oil production in Venezuela and key milestones

Source: Energy Institute

– The outlook of the war between Israel and Hamas remains unclear. If it escalates and involves other players in the region, we should expect a notable impact on energy prices.

– OPEC+ cuts have helped to replenish the spare capacity which in turn provides an additional safety cushion to global markets.

– Oil markets have evolved in recent years. Had the war happened say 10 years ago, we would have seen serious spikes in prices.

– In a high interest rate environment, the purchasing power of individuals and firms is restricted which in terms affects economic growth and thus the demand on oil.

– High interest rates also dictate the level of investment. However, not all players are equally affected, whereby companies that rely on loans are more exposed to companies that have a more robust financial position.

Related Analysis

“Oil market: Shifting expectations“, Dr Carole Nakhle, Jul 2023

Related Comments

“US SPR faces existential crisis“, Dr Carole Nakhle, Aug 2023

“Energy transition and price outlook“, Dr Carole Nakhle, Jul 2023