Dr Carole Nakhle, CEO of Crystol Energy, is quoted in this article written by Andreas Exarheas from RigZone commenting on the possibility of an oil embargo by OPEC+ on Israel.

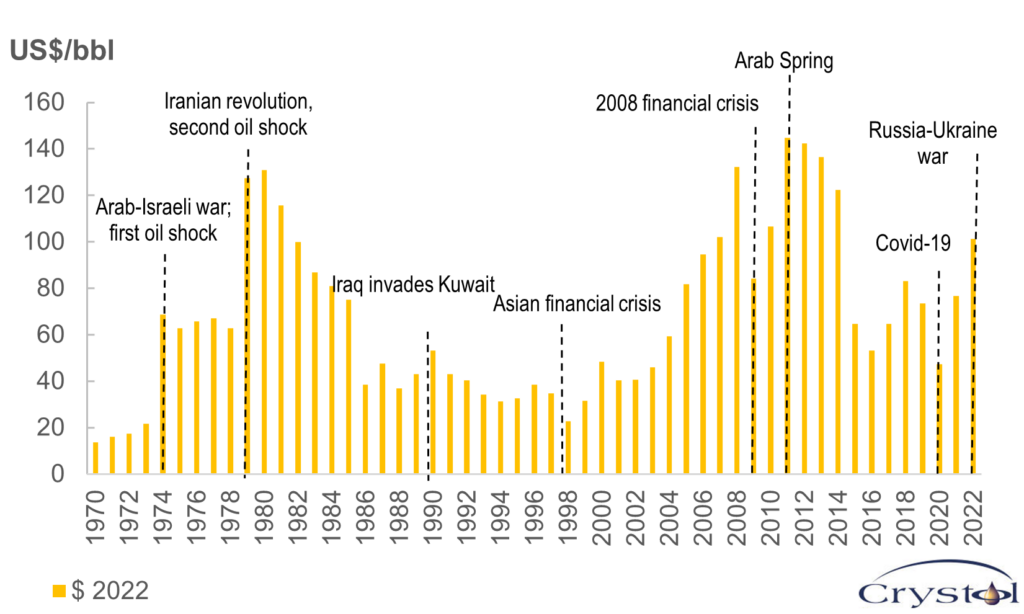

Annual oil prices and key milestones (1970-2022)

Source: Energy Institute

According to Dr. Nakhle, using oil as a political weapon is of course a card OPEC+ can play and one of its members, Iran, has openly called for it. However, for a global oil embargo this is not the 1970s anymore. Not only market conditions have changed drastically but the circumstances of its individual countries and their alliances have changed. For a targeted boycott of Israel, the latter will find alternatives.

She added that in the past, the immediate effect of oil embargoes was higher oil prices. With time, however, importing nations seek to diversify their sources of supplies, thereby reducing their vulnerability to such embargoes.

Related Analysis

“Oil market: Shifting expectations“, Dr Carole Nakhle, Jul 2023

“Oil and gas: The investment gap dilemma“, Dr Carole Nakhle, Feb 2023

Related Comments

“Energy Markets and Investment in Times of War and Transition“, Access for Women in Energy, Jul 2023

“What is the Outlook for Commodities in the Wake of Peak Inflation & Peak Rate Tightening Cycle in 2023?“, Dr Carole Nakhle, Jan 2023

“Higher oil and gas investment to be expected on the back of new support from policymakers“, Dr Carole Nakhle, Oct 2022