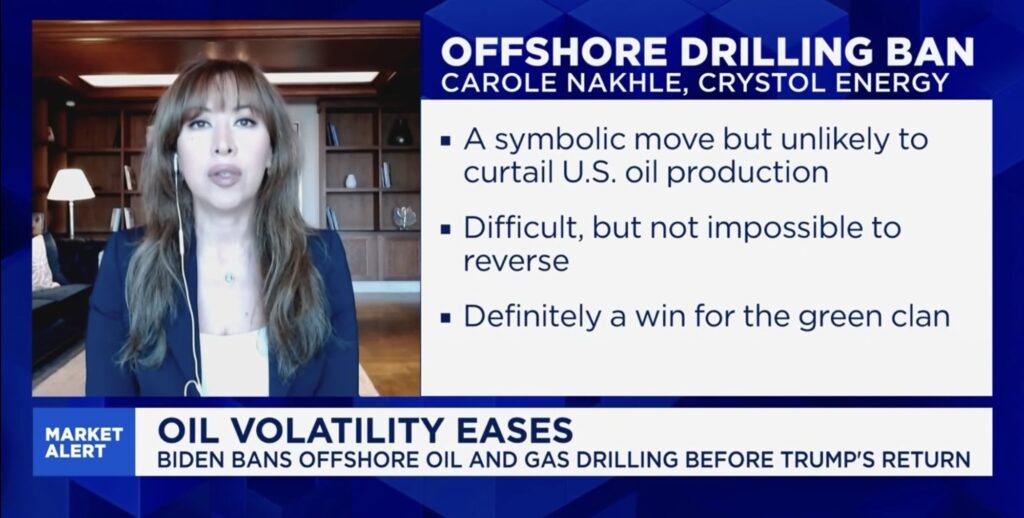

In this interview given to Dan Murphy from CNBC, Dr. Carole Nakhle, CEO of Crystol Energy, discusses the implications of Biden’s ban on offshore oil drilling in the U.S. as well as the outlook of global oil markets.

Key takeaways:

Biden’s Offshore Drilling Ban

– Biden’s offshore drilling ban, the largest in U.S. history, is a symbolic move that raises concerns for the oil and gas industry but is unlikely to significantly impact U.S. production.

– Major producing areas in the Gulf of Mexico (GoM) are expected to be largely unaffected. The developments of offshore fields have long lead times, taking around seven years to convert investments into production making the effect of the ban intangible in the short term.

– Although GoM is a notable producing area, the majority of U.S. oil and gas production comes from shale formations, which have been the primary driver of growth since the shale revolution. The ban has no impact on shale production, further limiting its effect on overall U.S. output.

– The ban is considered a win for renewable energy advocates and could pave the way for stricter anti-fossil fuel measures.

– It also reinforces President Biden’s legacy as the most environmentally/climate friendly American President.

Oil Market Outlook

– Oil prices started the year with notable gains driven by China’s economic stimulus measures and speculation about potential return of President Trump’s maximum pressure on Iran.

– However, the sustainability of these gains is uncertain as OPEC+ plans to release more barrels in the second quarter, which could lead to a market surplus.

– Despite expectations of oversupply, geopolitical factors could still create surprises in the market.

Related Analysis

“Oil markets: Relative stability amid geopolitical strife“, Dr Carole Nakhle, Feb 2024

Related Comments

“Reasons for the decline in oil prices“, Dr Carole Nakhle, Aug 2024

“Growth outside OPEC+ robust“, Dr Carole Nakhle, Jul 2024