Christof Rühl

Abstract

The world is witnessing an unprecedented episode of ‘economic warfare’, with more than 30% of global GDP (the G7’s share) pitched against 11% of global energy production (Russia’s share). This paper analyzes oil sanctions against Russia. It shows that the risk of tighter sanctions backfiring, and harming the economies of the sanctioning countries, is manageable. In terms of sanction design, sanctions and embargo announcements have so far been decentralized and voluntary. In previous episodes, sanctions have been enforced, and breaching them was punished. The paper asks whether the unilateral or the mandated model will be more successful in maximizing damage to Russia’s energy revenues, while minimizing economic damage to the sanctioning alliance. Given the scale of Russia’s supplies, a gradual approach is called for. The optimal strategy uses unilateral sanction picking as long as Russian energy exports are large enough to pose a systemic threat; and sanction enforcement thereafter.

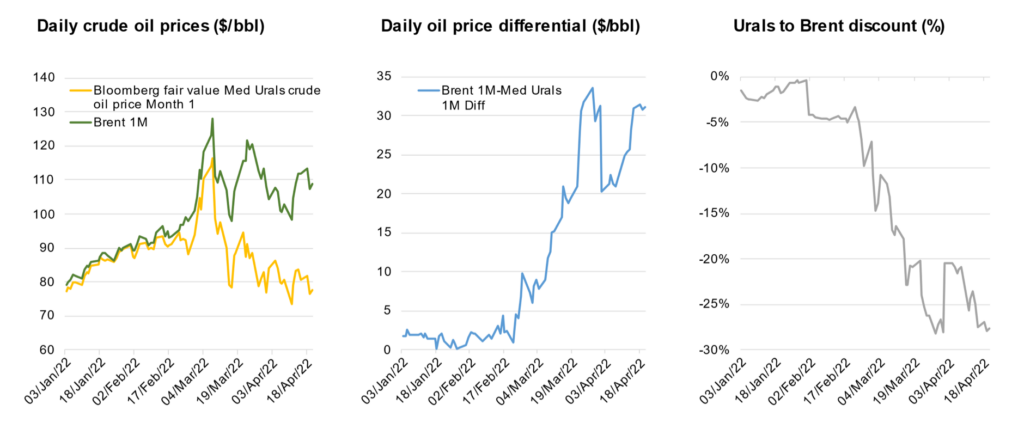

The dual price effect of oil sanctions on Russia

Data Source: Bloomberg

Forthcoming in International Economics and Economic Policy, Volume 19, Issue 2, April 2022

Related Analysis

“Sanctions and the Economic Consequences of Higher Oil Prices“, Christof Rühl, Apr 2022

“Energy Markets and the Design of Sanctions on Russia“, Christof Rühl, Mar 2022