Dr Carole Nakhle

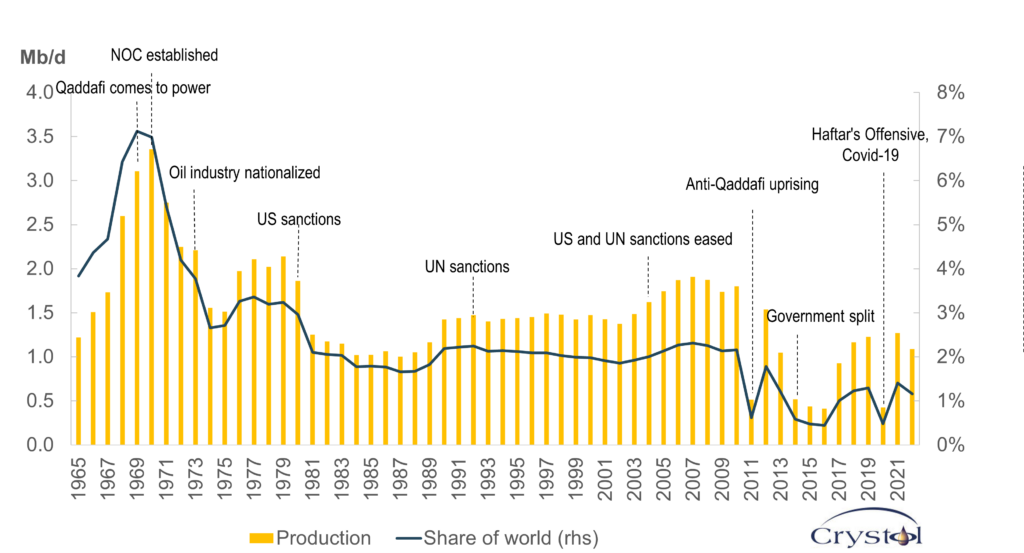

Libya was once a very significant player in global oil markets. In 1970, at its zenith, its production reached nearly 3.4 million barrels a day (mb/d), making it the second-largest Arab oil producer after Saudi Arabia, which was then producing 3.8 million barrels per day. However, over half a century later, Libya’s current production stands at only 32 percent of its peak, ranking it 18th in the world. The country now aspires to achieve an output of 2 million barrels per day by 2030.

In 2017, Libya announced a more ambitious target of 2.2 million barrels per day by 2023, but this goal fell short – not due to a scarcity of oil. On the contrary, Libya’s proven oil reserves have more than doubled in the last 40 years, making it Africa’s largest holder of such reserves, constituting nearly 40 percent of the continent’s total. Above-ground factors, primarily politics and poor governance, have hindered Libya from fully capitalizing on its oil wealth. The country’s economy, in which oil accounts for 98 percent of its government revenues and 60 percent of gross domestic product (GDP), has been struggling as a result.

Following the 1969 coup d’etat led by Libyan army officer Muammar Qaddafi, Libya experienced prolonged international isolation and sanctions. Just as these measures were lifted, a major popular uprising inspired by the Arab Spring revolutions in Tunisia and Egypt began in 2011. It resulted in the death of Qaddafi, the fall of his decades-long regime and a drastic overhaul of the political system. A civil war started in 2014, and although it officially concluded in 2020, the IMF continues to describe Libya as a “fragile and conflict-affected state” suffering from social and institutional frailty.

This volatile history has had detrimental effects on the sentiment of oil-sector investors. While some hope has arisen recently, oil majors have yet to commit the capital needed to enable a significant increase in output. At current production levels, Libya’s oil reserves can last nearly 340 years – the longest in the world. Unless the investment climate radically improves, Libya is bound to lose the most on the energy transition, with its potential oil riches at a high risk of becoming valueless.

A volatile history

In 1958, seven years after gaining independence from France and the United Kingdom, Libya made its first oil discovery, with production commencing a year later. By 1961, it inaugurated its oil exports and became a member of OPEC (Organization of the Petroleum Exporting Countries) in 1962. Between 1965 and 1969, Libyan oil production experienced remarkable growth, peaking in 1970.

However, this success sowed trouble in the North African nation and shaped its history for decades to come. After ousting King Idris on September 1, 1969, Qaddafi set up the country’s National Oil Corporation (NOC) in 1970 and three years later he nationalized the industry, which had been run primarily by foreign companies.

Qaddafi’s hostility toward Western governments and Libya’s association with terrorist groups prompted the United States to impose its initial set of sanctions on the country in 1978. However, it was the December 1988 bombing of a Pan Am airliner over Lockerbie, Scotland, that led to Libya’s most severe isolation. In November 1991, two Libyan intelligence operatives were indicted by Scottish and U.S. courts for their involvement in the attack. Despite the charges, Qaddafi’s government refused to extradite them, resulting in the imposition of United Nations sanctions on Libya. This additional layer of international censure mainly affected investment in its oil sector.

Until the sanctions were eased in 2004 – following Qaddafi’s offers of counterterrorism cooperation after the 9/11 terror attacks on the U.S., coupled with his decision to dismantle Libya’s weapons of mass destruction and long-range missile development programs – oil production struggled to exceed 1.5 million barrels per day. The relaxation of sanctions supported the return of international oil companies, which, in turn, boosted production.

Just as things began to look better, Libya entered another period of instability following the spread of the Arab Spring from nearby countries. The overthrow of Qaddafi in 2011 left the country with a political vacuum. Warring factions attacked domestic oil production facilities, and Libya’s production hit a low of 500,000 barrels per day that year.

The country continues to be politically divided with two rival governments – one in Tripoli and the other in eastern Libya, each backed by different powers influential in the region.

Libya’s oil production, milestones

Source: Energy Institute

Divided nation

The Government of National Stability (GNS), established by the Sirte-based House of Representatives (HoR), is predominantly backed by Egypt, Russia and the United Arab Emirates (UAE). It holds sway over the eastern and southwestern regions, encompassing most of Libya’s oil fields, and is aligned with the self-styled Libyan National Army led by Field Marshal Khalifa Haftar.

Meanwhile, the Government of National Unity (GNU), predominantly supported by Turkey and Western nations, and endorsed by the UN, exercises control over the capital, Tripoli, and its surrounding areas. Despite reconciliation attempts led by France, a political settlement between the two factions proved elusive. As a result, the east-west divide is likely to persist, as neither side can exert full military or political control over the country.

The geographical distribution of oil production and export facilities accentuates this divide, with key terminals like Es Sider and Ras Lanuf comprising 42 percent of Libya’s oil export capacity being located in the eastern part of the country under the GNS control. In the western part, under the influence of the GNU, two export facilities, Zawiya and Mellitah, account for 28 percent of the nation’s oil exports.

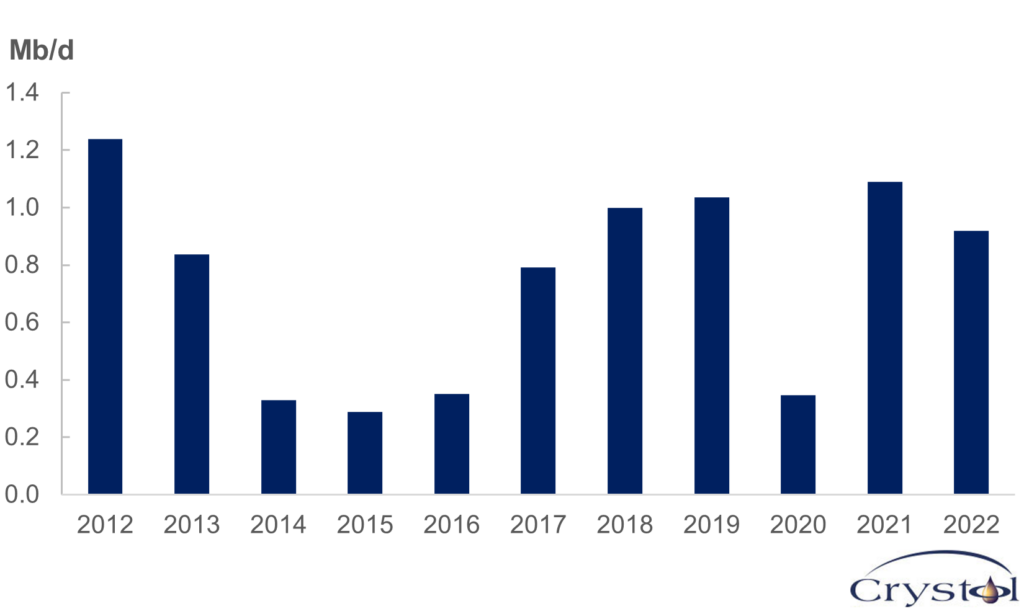

Amid this divide, both sides have staged oil blockades or production shutdowns as a tactic to demand a larger share of the oil proceeds or to achieve political gains. One such incident was the 10-month blockade in 2020 led by the eastern government, which severely curtailed the country’s output. While there has been a degree of stability since then, in the absence of a unified government the prospect of such events happening again remains. The most recent occurrence took place in early January 2024, following a brief closure in July 2023; both impacted fields in the southwestern parts of the country.

Recognizing the fragility of the situation, OPEC has exempted Libya from abiding by any quotas. The country’s political troubles have exacted a high cost. In addition to the economic and human toll, Libya’s influence on global oil markets has eroded, with the loss of market share from 7 percent in 1970 to a mere 1.2 percent in 2022. Other players have taken its place. Iraq, for instance, an OPEC peer and a country also classified by the IMF as fragile, in 1965 had nearly the same market share within OPEC as Libya (around 10 percent) but had managed to increase its share it to about 13 percent by 2022. Libya’s share within OPEC has plunged to just 3 percent.

Export directions

Despite its diminished role, Libya continues to be an oil exporter that matters, particularly to Europe. The domestic market is small (about 200,000 barrels a day), allowing most Libyan production to be exported. Europe continues to be its largest market, given geographic proximity and historical ties, accounting for 71.5 percent of Libyan oil exports in 2022, while nearly 20 percent headed to Asia-Pacific and most of the remainder to North America. In that year, Libya was the sixth-biggest supplier of crude oil to the European Union after Russia, the U.S., Norway, Kazakhstan and Iraq.

Taking advantage of Brussels’ continuous search for alternative energy sources to Russia, Libya has increased its footprint in the EU, expanding its market share to nearly 8 percent and ranking as the fifth supplier of oil after Norway, the U.S., Kazakhstan and Saudi Arabia in the second quarter of 2023. Further increases, however, are contingent on Libya’s ability to ramp up production.

Libyan crude oil export volumes

Source: OPEC

Investment badly needed

Libya is keen on doing just that. Its national oil company plans to launch an oil and gas licensing round this year, the first such round in the last 17 years. Only the exploration licenses would be aimed at international oil companies. Libya’s Minister of Oil and Gas Mohamed Oun explained: “We are not against international companies coming back, but they should come to conduct exploration activities, not into already discovered fields.”

Before the civil war, Libya attracted a diverse group of investors, including European oil majors (Italy’s Eni, Spanish Repsol, France’s TotalEnergies), U.S. majors (such as ConocoPhillips and ExxonMobil), and other players (Algeria’s Sonatrach, the Russian Gazprom and Tatneft) – with Eni being the most prominent player.

While companies like Shell and ExxonMobil withdrew from the country after the start of the civil war (in 2012 and 2013 respectively), others have continued to play important roles. For instance, Eni has been operating in Libya since 1959 and relies on the country for approximately 10 percent of its production portfolio. Most of its stakes are in the fields in the western part of the country.

Scenarios

In 2023, the Libyan NOC reported that Eni, along with British BP and Algerian Sonatrach, were planning to resume exploration and contractual activities in the country, now that the security situation has improved. Austria’s OMV also announced its intention to resume its operations by February 2024. That is undoubtedly good news.

Above-ground risks

However, the risk of doing business in Libya continues to be high. In addition to the notable political and security risks, Libya suffers from poor governance, especially in its oil and gas sector. According to the Natural Resource Governance Institute index, Libya is the worst-governed among the 13 OPEC countries and other global oil producers assessed. Also, Libya’s performance on the World Bank’s governance indicators has worsened in the last decade.

As a result, Libya will have to offer attractive terms to investors to compensate them for the significant risks they would be taking. The return of international oil companies will support production growth from Libya but hitting 2 million barrels per day of output looks rather ambitious. The International Energy Agency (IEA) expects a modest growth in Libya’s oil production capacity, reaching only 1.2 million barrels per day by 2028, while under the more optimistic IMF scenario, Libya’s daily production gradually raises to some 1.5 million barrels per day by 2026. However, even then, the country is unlikely to be seen as a reliable supplier as long as its political divisions persist, reducing its ability to capitalize on its oil reserves – especially as the energy transition accelerates.

Facts & Figures

- The Gulf of Sirte in Libya hosts about 16 giant oilfields, containing approximately 89% of Libya’s proven oil reserves.

- Libya has a population of about 7 million and accounts for 3% of global proven oil reserves.

- It is the 19th-largest holder of proven natural gas reserves globally (0.74% of the world) and the fourth-largest in Africa (10.6% share) after Nigeria, Algeria and Egypt, and delivers 0.4% and nearly 6% of global and African gas production, respectively.

- In December 2019, Turkey and the GNU signed a memorandum of understanding defining their maritime borders bilaterally. The agreement allows the two countries to carry out joint exploration operations in the Eastern Mediterranean. Egypt was quick to condemn the deal, calling it “illegal,” whereas Greece and Cyprus subsequently submitted formal objections to this delineation to the UN in February and April 2020, respectively.

- In early January 2024, according to S&P Global report, Libya’s major oil fields, El Sharara (the country’s largest) and El-Feel, were disrupted by protesters from the southern region of Ubari. The turmoil was over high fuel prices and general economic distress.

Related Analysis

“A rising China is reshaping global energy markets“, Dr Carole Nakhle, Nov 2023

“Australia’s LNG success may be at risk“, Dr Carole Nakhle, Aug 2023

Related Comments

“Why the Middle East won’t quit oil“, Dr Carole Nakhle, Jan 2024