Dr Carole Nakhle, CEO of Crystol Energy, is quoted in this article written by Andreas Exarheas from RigZone where she assesses whether the geopolitical tensions are translating into higher oil prices.

According to Dr. Nakhle, we all know that geopolitics affect oil markets but no one knows how to quantify the risk premium which depends on one’s own perception of the risk to supply disruptions. But the geopolitical risk should not be taken in isolation from other important market conditions, including – how tight supplies are to start with? how rapidly demand is growing? Is there sufficient spare capacity in the system? The answer to these questions will determine the magnitude of the geopolitical risk premium.

She added that, today, we haven’t seen supply disruptions. Demand is not booming. Non-OPEC+ supply is healthy, so is the spare capacity largely thanks to OPEC+ cuts.

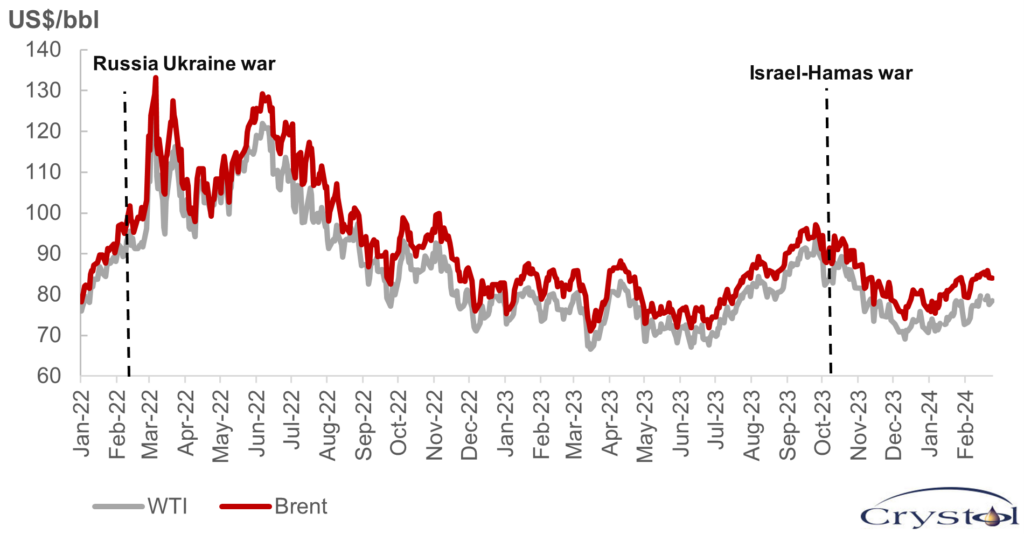

Daily spot oil prices

Source: EIA

Related Analysis

“Oil markets: Relative stability amid geopolitical strife“, Dr Carole Nakhle, Feb 2024

Related Comments

“Could the Red Sea remain a no go route for years?“, Dr Carole Nakhle, Feb 2024

“Overview of Oil markets and the path ahead for OPEC+“, Dr Carole Nakhle, Dec 2023