In this interview given to CNBC, Dr. Carole Nakhle, CEO of Crystol Energy, explains how OPEC+ could proceed with its output policy for the remainder of 2024.

Key takeaways:

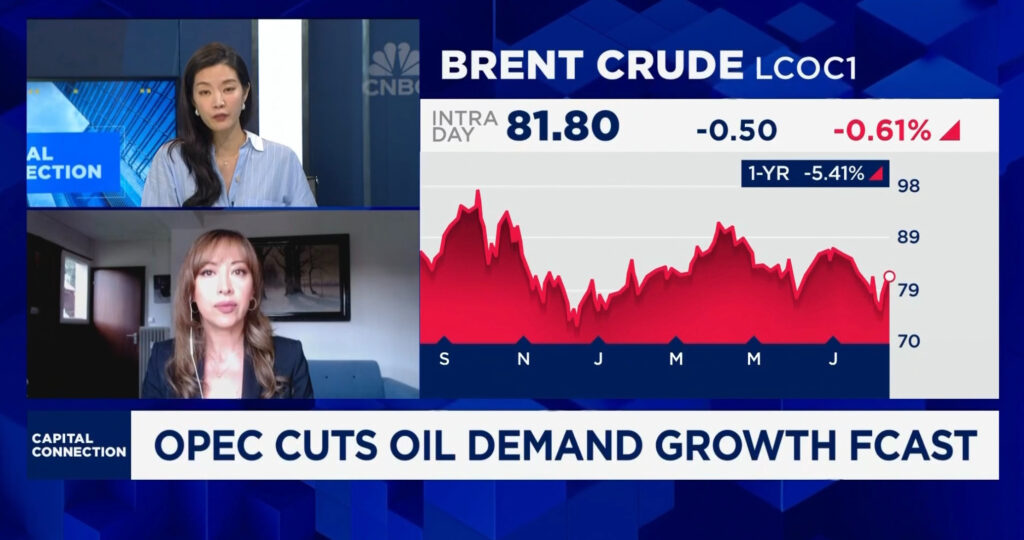

– The most significant headline this week is OPEC’s first downward revision to oil demand forecasts for 2024. Although this revision is minor, it marks a notable shift, especially as OPEC remains more optimistic than other agencies like the IEA, with a forecast still 1 million barrels per day higher.

– OPEC attributes the revision to economic challenges, particularly in China, and sustained high-interest rates. Despite this, OPEC continues to describe demand growth as ‘healthy,’ signaling that the group is likely to proceed with easing some voluntary production cuts starting in Q4. It remains to be seen if further downward revisions will occur, potentially narrowing the gap between OPEC and other forecasting agencies.

– Another key headline is OPEC’s increase in production for July, even amid output restrictions led by Saudi Arabia, Iraq, and Iran.

– For Saudi Arabia, the rise in production partly compensates for lower output in June. Iran, not subject to OPEC quotas, has boosted its exports under the Biden Administration. Iraq, meanwhile, continues its pattern of overproduction. Interestingly, Saudi Arabia’s official reports show higher output, though slightly less than what secondary sources suggest. In contrast, Iraq’s official data does not acknowledge any additional barrels, raising questions about the accuracy of reported figures.

– The recent recovery in oil prices is part of a broader market rebound following a mini-crisis in early August. Concerns about a potential recession in the U.S. have eased, and rising tensions in Ukraine are also contributing factors.

– However, the data remains mixed, and given the significant volatility we’ve seen, it’s important to stay prepared for the possibility of another similar scenario.

Related Analysis

“Oil markets: Relative stability amid geopolitical strife“, Dr Carole Nakhle, Feb 2024

Related Comments

“Reasons for the decline in oil prices“, Dr Carole Nakhle, Aug 2024

“Growth outside OPEC+ robust“, Dr Carole Nakhle, Jul 2024