Dr Carole Nakhle

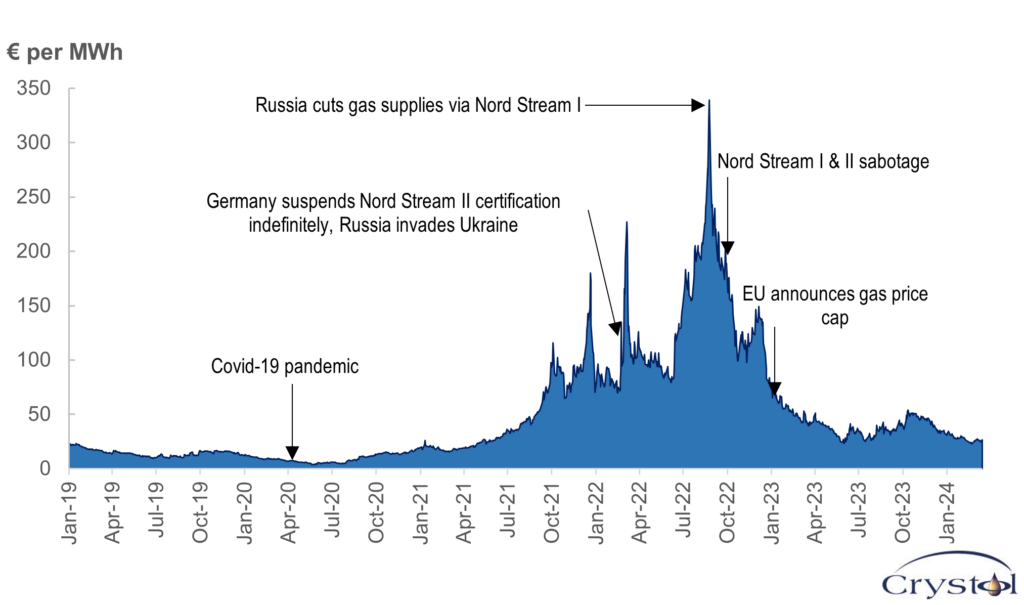

In 2022, Europe witnessed a perilous energy crisis. Natural gas prices soared, hitting a historic high of more than 330 euros per megawatt hour in August 2022. The main culprit was tight gas supplies following Russia’s invasion of Ukraine, coinciding with several disruptions affecting alternatives to natural gas: low wind-generation capacity, nuclear-power outages in France, drought affecting hydropower generation in Norway and curtailed coal transportation in Germany. These problems limited the scope for substitution.

Fast forward to over a year later, and European energy markets seem to have gone from scarcity to plenty. Gas prices have hovered between 22 and 30 euros per megawatt hour since the beginning of this year. The crippling 2022 crisis seems to have been forgotten by many, even though the war in Ukraine is still ongoing – along with rising tensions in the Middle East and Houthi militant attacks on Red Sea shipping, which threaten the liquefied natural gas (LNG) trade.

Several developments have led to this drastic change, chief among them the evolution of the gas trade and its globalization through LNG. This trend is unlikely to be reversed. The European Union has attracted LNG cargoes to fill the gap left by the loss of Russian pipeline gas, resolving a major crisis within a relatively short period.

Since the fallout with Russia, the European gas market has undergone structural shifts in supply, creating opportunities for non-Russian exporters. Whether these opportunities are temporary or long-lasting will largely depend on the EU’s ability to deliver on its ambitious green energy targets, set in 2022 under dire circumstances that have since subsided.

Title Transfer Facility (TTF) gas price

Source: Investing

Russia supplies cut-off

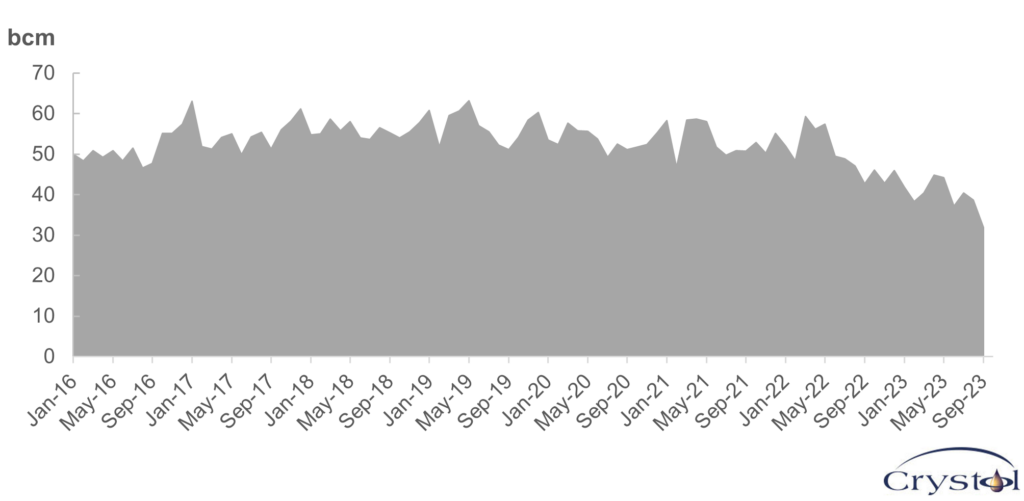

For years, Russia was Europe’s largest gas supplier, accounting for more than 40 percent of the EU’s total gas imports in 2021, mostly via an extensive web of pipelines that were developed over decades. Europe was also Russia’s biggest market, with Germany its largest single customer, absorbing more than half of Russia’s exports to the EU. When Russia started to gradually curtail supplies to Europe in 2021 – and then stopped providing gas altogether to several EU countries following its invasion of Ukraine – gas prices jumped.

Europe saw a significant reduction in natural gas demand, which fell by 7 percent in 2023 to its lowest level since 1995. This came in response to high prices but also subdued economic activity (not only in Europe but also in competing markets, primarily Asia) as well as mild weather. The EU’s gas import needs subsequently declined to their lowest levels in recent years.

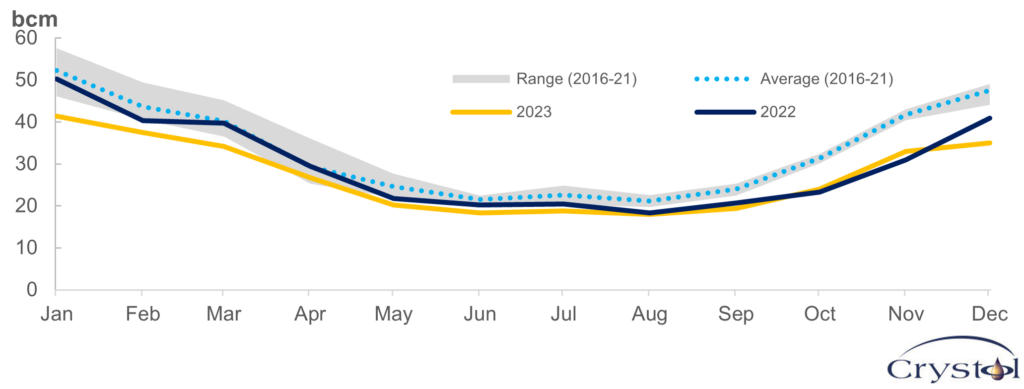

EU gas consumption

Source: Eurostat, ENSTOG

The EU’s policy response

Policy measures introduced across Europe further helped with the demand adjustment. For instance, in the summer of 2022, the EU set a six-month voluntary target to reduce natural gas consumption by 15 percent compared to average 2017-2022 consumption. The EU further introduced mandatory gas storage targets, with member states required to fill sites to 80 percent of capacity by November 1, 2022, and to 90 percent by November 1, 2023. Gas storage plays an important role in balancing gas markets during winter because it is used as a buffer in times of high demand (mainly for heating) and tight supply.

Meanwhile, the increased power generation from renewables and the improving availability of nuclear power helped alleviate some of the pressure on gas demand. In the last quarter of 2023, Europe’s power producers generated more electricity from wind than from coal for the first time. Prolonged maintenance shutdowns in France are now complete and the country’s nuclear power generation recovered in 2023. In 2024 it is expected to boast the most available capacity in at least five years, boosting electricity exports to neighboring countries.

EU gas imports

Source: Eurostat

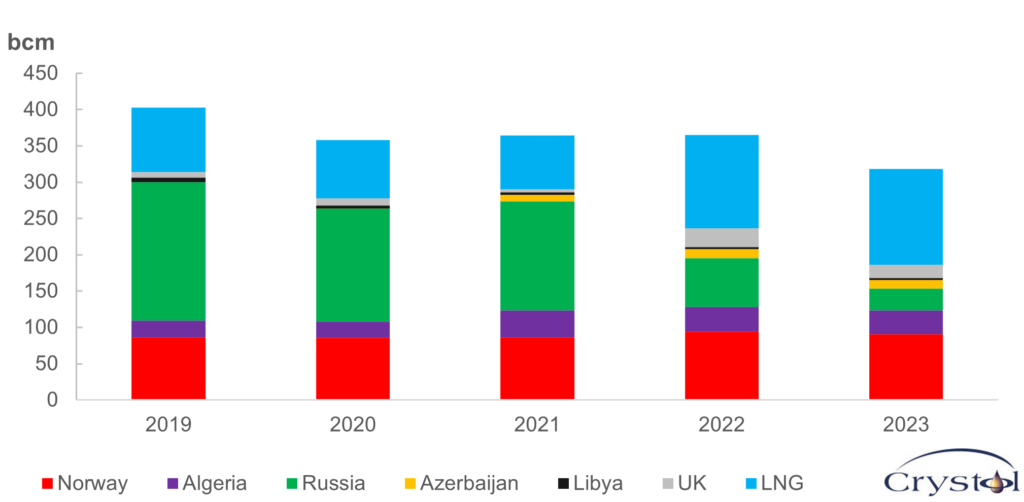

Substituting Russian gas

The EU has yet to sanction Russian gas, which continues to flow to the bloc – unlike oil and coal, which are subject to restrictive sanctions. In 2023, the EU imported 30 billion cubic meters of gas from Russia, equal to the total consumption of Spain, the EU’s fourth-largest gas consumer (after Germany, Italy and France).

Although EU gas demand peaked in 2010 and is today around 19 percent lower than that high, natural gas continues to play a vital role in the European energy system. It is the second-largest fuel for the EU’s primary energy demand, accounting for about 21 percent, after oil (38 percent). Europe is also a major net importing region, competing for gas supplies with Asia, the other sizeable importing region. There, the total gas consumption of China (the world’s largest LNG importer) exceeds that of the EU even though it makes up only 8 percent of the country’s primary energy mix.

While substitutes exist for each usage of gas, these are not always readily available. Green energy is gradually capturing market share from fossil fuels, but to replace gas at scale, the EU needs to significantly expand investment – a process that takes time. Furthermore, because of the intermittency problem related to electricity generation from renewable energy, gas is the typical fuel of choice for generating back-up power.

EU pipeline gas imports by source & LNG imports

Source: ENSTOG

While Europe has seen some fuel sources replaced with others, substitution has mostly taken place between different suppliers of natural gas. The large supply gap created by Russia’s decision to halt most gas deliveries to Europe was largely filled by LNG and Norwegian pipeline supplies. In addition to LNG, the key alternatives to Russian gas are Norway (which sends mostly pipeline gas but also LNG) and pipeline gas deliveries from North Africa. Azerbaijan also delivers gas to Southeast Europe and Italy.

Of these sources, however, LNG – which is transported by tanker and thus more mobile than pipeline gas – remains an indispensable supplement for the EU to replace Russian pipeline gas at current levels of consumption. This is simply because deliveries from Norway, North Africa and Azerbaijan are limited by production and/or pipeline capacity and are likely to stay at current levels, with limited upside potential through the middle of this decade.

The United States has been the biggest beneficiary of the supply shock in Europe. Nearly 70 percent of U.S. LNG exports were destined for Europe in 2022, up from 32 percent in 2021. In 2023, the country still provided nearly half of the EU’s total LNG imports – exceeding supplies from the Middle East, Africa and Russia combined. Ironically, LNG deliveries from Russia to the EU also received a boost in 2022, up by almost 30 percent from 2021 levels, before marginally dropping in 2023.

Before and after the war

Before the war in Ukraine, gas demand in Europe was growing slowly. Between 2011 and 2021, European demand grew at a marginal rate of 0.2 percent per year, compared to 4 percent in Asia. The EU had long enacted several policies to reduce its dependence on fossil fuels, limiting the potential for gas exporters to expand their footprint in the region – unlike in Asia, which offers lucrative and long-term opportunities. Two months after Russia invaded Ukraine, the EU adopted the REPowerEU plan to rapidly reduce dependence on Russian fossil fuels and fast forward the green transition.

Presented in May 2022, it suggested that an earlier EU-wide target of 32 percent from renewable energy by 2030 needed upward revision to accelerate the green transition. The European Commission proposed increasing the target to 45 percent by 2030. As part of the plan, the EU also committed to phasing out Russian gas by 2027 and to generally minimizing the bloc’s reliance on imported fossil fuels, as Europe transitions to a green-dominated energy system.

Scenarios

Likely: Short-term opportunities

The war in Ukraine and the disruption of Russian gas pipeline supplies to Europe have created at least a short-term opportunity for LNG suppliers to fill Europe’s gas consumption gap. The continent has a well-established infrastructure for LNG receiving terminals, with more planned following the war.

However, whether Europe will be a stable long-term customer – let alone a growing one – depends on several factors. These primarily include the alternative gas supply options available from within Europe (including supply from alternative fuels); the evolution of European gas demand, particularly whether ambitious policy targets can be met; and the availability as well as price of alternative energy sources.

Less likely: Long-term growth

The REPowerEU plan implies that there may be little or even no scope to increase imports of LNG over the longer term (beyond 2030). However, the targets in that plan look rather aspirational. For instance, to achieve them, the roll-out of wind and solar power through 2030 will have to exceed four times the historic growth rate for wind and six times the historic rate for solar.

The potential long-term demand for natural gas, and LNG in particular, is therefore linked to the question of how widely Europe will miss its policy targets. This is what many LNG exporters are now trying to figure out.

Facts & Figures

- In its December 2023 economic outlook, the European Central Bank assumes a gas price of 47 euros per MWh for this year.

- Global gas demand grew by an estimated 0.5% in 2023 versus a drop of 1.5% in 2022 (IEA).

- Gas demand in Europe is set to grow by 3% in 2024, but will still be 20% below its 2021 levels (IEA).

- The U.S. is the EU’s biggest supplier of LNG.

- EU policymakers are working to finalize legislation allowing member states to fully ban Russian gas imported via pipeline as well as LNG.

- In January 2024, U.S. President Joe Biden announced a temporary pause on new LNG export project approvals while the administration looks at their impact on climate change. The decision will not affect projects already approved and under construction.

Related Analysis

“Asia’s energy market: The new global epicenter“, Dr Carole Nakhle, Dec 2023

“A rising China is shaping global energy markets“, Dr Carole Nakhle, Nov 2023

Related Comments

“Could the Red Sea Remain a No Go Route for Years?“, Dr Carole Nakhle, Feb 2024

“Impact of geopolitics and elections on global oil markets“, Dr Carole Nakhle, Jan 2024

“2024 oil market expectations“, Dr Carole Nakhle, Jan 2024