Dr Carole Nakhle

In the last two decades, the Asia-Pacific region has emerged as the leading area of global energy consumption. In 2001, it overtook North America as the most significant energy market – a position it has maintained since.

In 2022, it accounted for 46 percent of global energy consumption, equivalent to the consumption of North America, South America, Africa, Europe, Russia and the Commonwealth of Independent States (CIS) in Eurasia combined. Globally, the region currently accounts for 57 percent of the crude-oil trade, 42 percent of the gas trade and 76 percent of the coal trade. Between 2012 and 2022, energy consumption in Asia-Pacific grew at a rate of 2.6 percent annually, the world’s fastest, nearly double the global average of 1.4 percent.

Coal dominates the region’s energy consumption, providing 47 percent of the primary energy mix (followed by oil at 25 percent) and 56 percent of the electricity mix (followed by natural gas at 10 percent). The dominance of coal, which remains the fuel that propels industrialization, is particularly notable in developing Asian economies such as China and India. Coal, widely available in the region, is notorious for its high greenhouse gas emissions compared to oil and gas. In fact, Asia-Pacific is the world’s largest consumer of coal, accounting for a staggering 81 percent of global coal consumption.

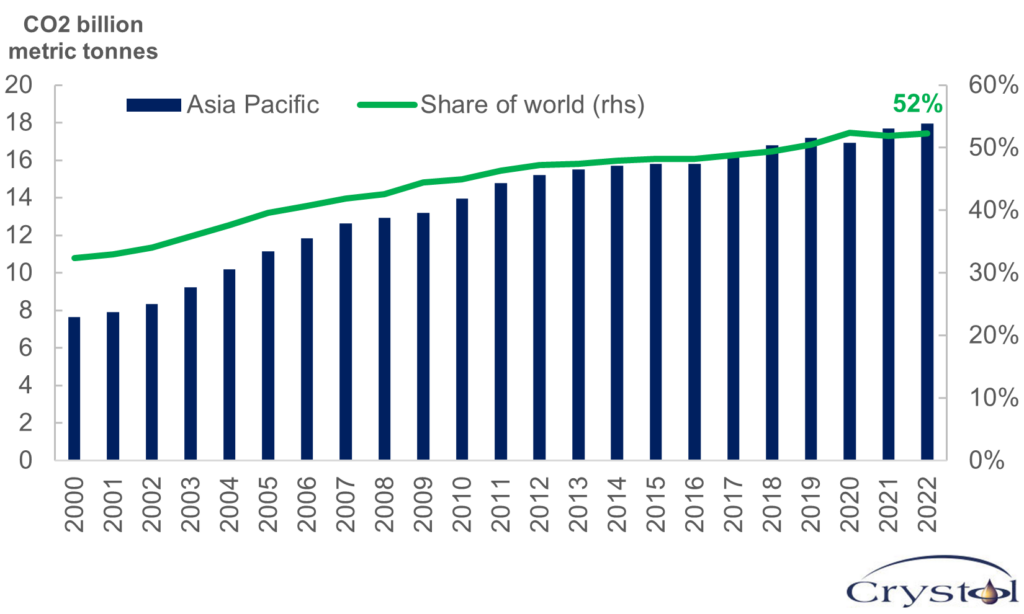

Such a high dependence explains the region’s elevated share of global carbon emissions (more than 52 percent). It also highlights the vital role of the Asia-Pacific region in the worldwide fight against climate change. But this has broader implications for the global energy trade. The area needs to lessen its dependence on coal to reduce its carbon footprint, thereby creating substantial demand for other fuels. China, for example, has pledged to become carbon neutral by 2060 and to reach peak coal consumption by 2025. Pakistan has announced it will not approve new coal power plants, and the Philippines has introduced a moratorium on such stations. The gap left by coal has to be filled by other fuels.

Despite the availability of local reserves, domestic energy production has not been meeting the rapidly growing demand, leaving the region as the world’s largest net energy importer. The International Energy Agency (IEA) expects that 90 percent of oil-demand growth globally will come from Asia-Pacific between 2022 and 2028. The region will also drive the global liquefied natural gas (LNG) trade for the next decade as countries industrialize and pivot from coal. The scale and potential of demand growth in the region, therefore, make it a key target for every established energy exporter, particularly of oil and gas. However, some are poised to benefit more than others from this massive energy market. And for all exporters, betting on Asia is not risk-free.

Asia-Pacific share of carbon dioxide emissions from energy

Source: Energy Institute

The biggest oil market

The Asia-Pacific region is the world’s largest oil market, consuming 35.3 million barrels per day (b/d) and accounting for more than 36 percent of global oil consumption in 2022. It is not just a matter of scale. Whereas Europe is a mature and plateauing market, Asia is among the fastest growing, having expanded at an average rate of 1.8 percent annually between 2012 and 2022 (compared to -0.3 percent per annum in the EU during the same period).

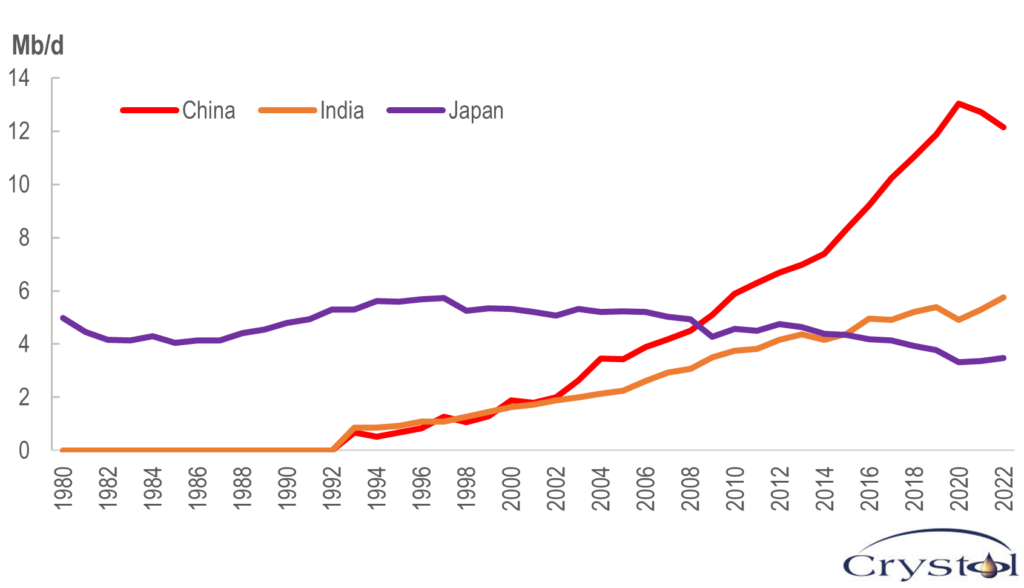

Oil consumption in the region is concentrated among four leading consumers: China (40.5 percent of regional oil consumption), India (14.7 percent), Japan (9.4 percent) and South Korea (8.1 percent). Japan was the region’s biggest oil consumer for decades; however, as the nation fully industrialized and transitioned to less energy-intensive industries, its demand for oil peaked in 1996 at 5.9 million b/d. By 2022, consumption had fallen by almost half to 3.3 million b/d.

In contrast, oil consumption in China and India has risen rapidly. China surpassed Japan as the region’s biggest oil consumer in 2003, and India moved ahead of Japan for the second spot in 2015.

The leading oil importers in Asia-Pacific

Source: Energy Institute

Interestingly, China is also the region’s largest oil producer (4.1 million b/d), producing more than several OPEC members, including the United Arab Emirates, Iran and Kuwait. In the Asia-Pacific, China is followed by India (0.74 million b/d), Indonesia (0.64 million b/d), Malaysia (0.57 million b/d) and Australia (0.42 million b/d).

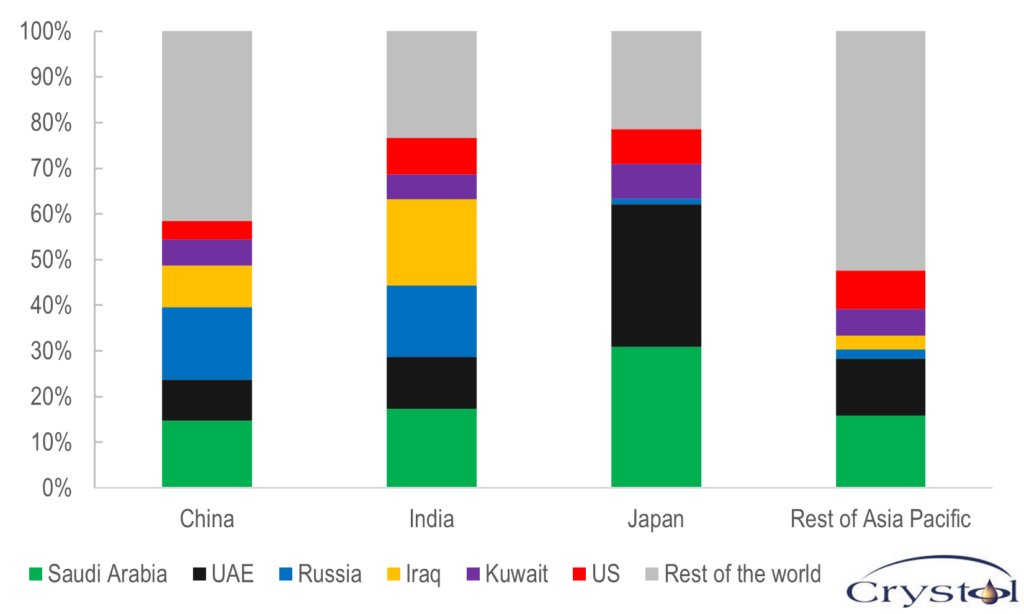

Oil exporters

The evolution of demand centers in Asia has also been accompanied by a change in its oil trading partners. Two decades ago, oil trade with Asia-Pacific was mostly the domain of Middle Eastern producers; they accounted for more than 70 percent of the region’s total oil imports. Over time, however, the reliance on Middle Eastern oil supplies decreased. By 2022, only about half of Asia-Pacific’s oil imports were sourced from the Middle East. The CIS, North America and South America benefited from the change. Between 2002 and 2022, the CIS expanded its market share in Asia-Pacific from 2 percent to 10 percent, while North and South America’s slices of the pie rose from 1 percent each to 8 percent and 4 percent, respectively.

Within the CIS, Russia has led the increase as the country has gradually turned eastward to safeguard its lucrative sector at a time when growth in European oil demand has lost momentum (oil demand peaked in 1979) and given the rising tensions between Russia and the leaders of what used to be its most important energy market. Following Moscow’s invasion of Ukraine and subsequent sanctions imposed by Europe and the G7 on Russian oil, Russia stepped up its trade with Asia. In 2022, it surpassed Saudi Arabia as China’s biggest oil supplier. Russia’s share of India’s oil imports expanded from a modest 2.5 percent in 2021 to 16 percent in 2022, jumping to second place, after Iraq.

In the United States, the shale revolution and the subsequent lifting of the export moratorium in 2015 have allowed American oil companies to begin playing a more significant role in Asia over a relatively short period, sharply increasing exports to the region from 1.6 million barrels in 2016 to 497 million barrels in 2022.

Overall, while Asia-Pacific’s oil supplies are diversified, six countries dominate the region’s sources, especially in its three biggest energy markets (China, India and Japan). These exporters are four OPEC member states (Saudi Arabia, UAE, Iraq and Kuwait), Russia and the U.S. Combined, the six producing countries supplied 59 percent, 76 percent and 79 percent of China, India and Japan’s total oil imports in 2022, respectively.

These countries are focused on deepening their presence in the Asia-Pacific energy market for the coming decades and have gone beyond the mere traditional export-import relationship. Saudi Aramco, for instance, has invested heavily in refineries in China and acquired stakes in local petrochemical companies. Such deals secure Saudi oil supplies to China for years to come. As the CEO of Aramco, Amin Nasser, said at a 2021 event in Beijing: “Ensuring the continuing security of China’s energy needs remains our highest priority – not just for the next five years but for the next 50 and beyond.”

Oil suppliers to Asia-Pacific in 2022

Source: Energy Institute

The world’s largest gas importer

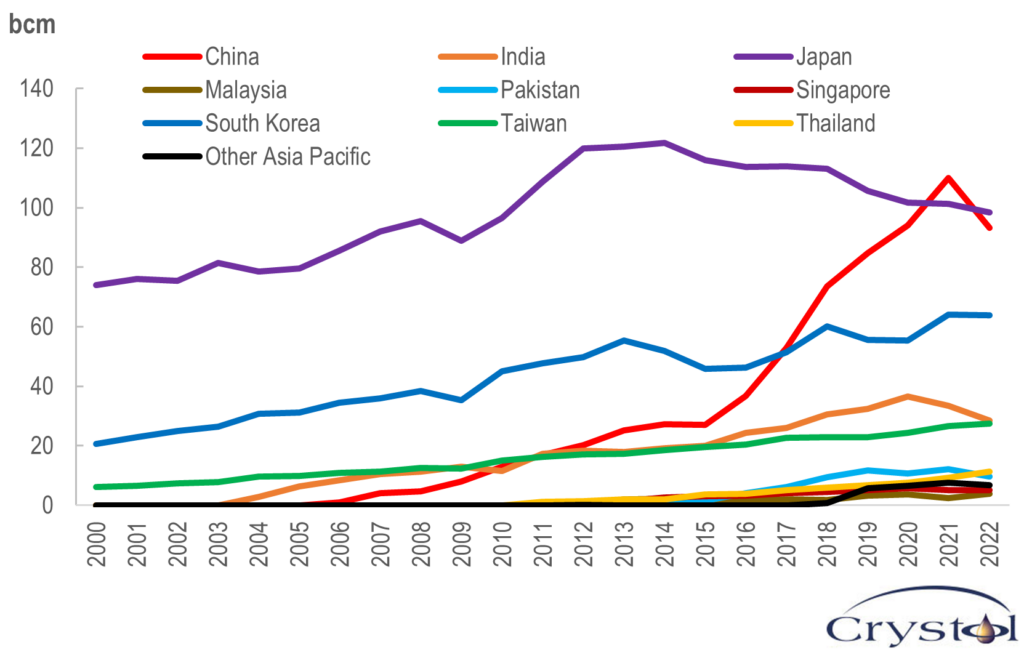

In total consumption, Asia-Pacific is the second-largest gas market (907.1 billion cubic meters [bcm], 23 percent of global gas use) after North America (1099.4 bcm, 27.9 percent). However, the two markets offer fundamentally different opportunities for gas exporters. First, Asia-Pacific was growing at a faster rate (3.2 percent yearly) than North America (2.5 percent) between 2012-2022. Second, while North America is a net exporter, Asia-Pacific is a net importer of gas – the largest in the world. The share of natural gas in the region’s primary energy mix currently stands at 12 percent (compared to 33 percent in North America). However, natural gas has been gaining popularity rapidly as it is a relatively easy substitute for coal, particularly in power generation. Consumption of gas in the region is concentrated in four countries: China (41.4 percent of regional consumption), Japan (11.1 percent), South Korea (6.8 percent) and India (6.4 percent).

LNG imports in Asia-Pacific

Source: Energy Institute

The region is also an important gas producer (17 percent of global gas output in 2022), with China, here too, being the largest producer (222 bcm) followed by Australia (153 bcm), Malaysia (82 bcm) and Indonesia (58 bcm). But again, because consumption exceeds local production, the region remains a net importer of gas, with China, Japan and South Korea being its largest-volume buyers.

Most gas pipeline imports originate from Russia, Central Asia, Myanmar and Indonesia. Russia’s pipeline gas exports are primarily to China via the Power of Siberia 1 pipeline, the first gas pipeline connecting the two countries. It was launched in 2019 and is expected to reach its maximum capacity of 38 bcm per year by 2024. Russia looks to consolidate its position further as a significant supplier to Asia-Pacific by bringing in another 50 bcm pipeline, the Power of Siberia 2, to China, while expanding its LNG trade as well.

Twenty years ago, the trade of LNG was mainly a regional affair, with 71 percent of the commodity provided by Indonesia, Malaysia and Australia and the rest coming from the Middle East, primarily Qatar. Since 2002, however, production has declined in Indonesia and Malaysia, while capacity expansions have allowed Australia and Qatar to cement their position as the two largest LNG exporters to the region – together accounting for 55 percent of Asia-Pacific LNG imports. The U.S. has also swiftly penetrated the market, securing a 7 percent share by 2022, from less than 0.5 percent in 2016.

As is the case with oil, gas exporters are also trying to cement their presence in the Asian market for decades to come. In June 2023, QatarEnergy, the Doha-based state-owned energy company, signed an LNG supply and purchase agreement with China National Petroleum Corporation (CNPC) under which CNPC will purchase 5.44 bcm of LNG annually from Qatar for a period of 27 years – one of the longest known durations for such a contract.

Scenarios

The longer-term prospects

While it is easy to view these dynamics as a zero-sum game, whereby one supplier gains market share at the expense of another, Asia-Pacific continues to grow at a rapid clip, creating a boon for the leading energy exporters, likely securing markets for their oil and gas for many years to come.

That is true for exporters who have scale – primarily sizeable reserves that can support an expansion in production and exports – and have low production costs. Also, geographic proximity will continue to provide an additional advantage. Furthermore, in a more climate-conscious Asia, the lower carbon intensity of the fuels on offer gives some exporters a competitive advantage. Middle Eastern exporters score highly on all these aspects (except geographical proximity) compared to rest of the industry both for oil and gas.

However, betting solely on the Asia-Pacific energy market still carries significant risks for exporters, including the possibility that oil demand peaks in Asia, particularly in a critical country like China, as its economy becomes more service-based and less manufacturing-intensive.

Also, as one market becomes the main attraction to various producers, bargaining power tends to gradually shift to the customer, who will be in a stronger position to negotiate more favorable contracts, thereby toughening the competition between suppliers.

Facts & Figures

- The region sits on 43% of proven global coal reserves (the most extensive in the world); 9% of gas reserves (third-largest in the world after the Middle East and CIS); and 2.6% of oil (after the Middle East, Latin America, North America, CIS, and Africa – but ahead of Europe)

- It produces 21% and 75% of the oil and gas it consumes, respectively.

- Malaysia had a maximum oil output of 7.7 million b/d in 2004, which accounted for 9.6% of global oil output. That shared dropped to 0.6% by 2022.

Related Analysis

“A rising China is reshaping global energy markets“, Dr Carole Nakhle, Nov 2023

“Australia’s LNG success may be at risk“, Dr Carole Nakhle, Aug 2023

Related Comments

“Saudi Arabia always aware of the movements of the Asian oil market“, Dr Carole Nakhle, Jul 2022