Christof Rühl, member of the Advisory Board of Crystol Energy and a Senior Fellow at the Harvard Kennedy School and the Center on Global Energy Policy at Columbia University, discusses the latest global oil and economic developments in this weekly interview to the Gulf Intelligence.

Christof talks about the global economic rebound which has not been as fast as many initially predicted, the way markets have been reacting to the upcoming US presidential elections, as well as whether a change to the US presidency could lead to a fracking ban. He also comments on oil prices, demand and inventories, the increasing pressure oil producers have been facing with their budgets as well as OPEC+’s decision to increase output by 2 million b/d from January 2021.

Will Saudi be able to hold OPEC+ together if they don’t proceed with January output hike?

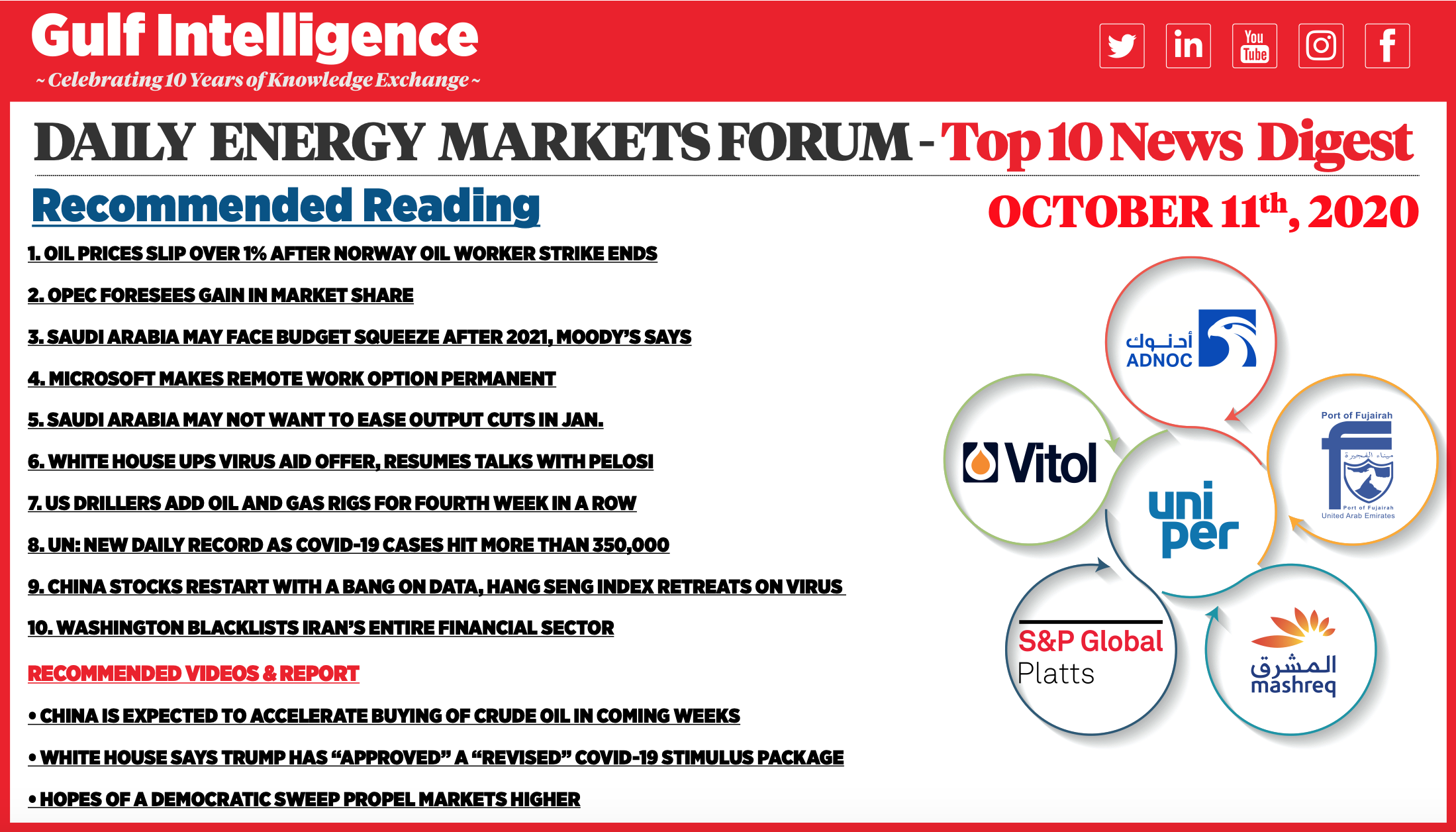

Christof is joined by Mike Muller, Head at Vitol Asia. Sean Evers, Managing Partner at the Gulf Intelligence, moderates the discussion.

Related Analysis

“Oil market outlook: sailing in the dark”, Dr Carole Nakhle, Sep 2020

“Oil Market Outlook: A Quandary of OPEC+”, Dr Carole Nakhle, Aug 2020

“Oil market outlook: A cautious global recovery”, Dr Carole Nakhle, Jul 2020

Related Comments

“Weekly commentary on oil markets and global economy”, Dr Carole Nakhle, Oct 2020